Under A Graded Premium Whole Life Policy

Breaking News Today

Mar 30, 2025 · 8 min read

Table of Contents

Decoding the Graded Premium Whole Life Policy: A Comprehensive Guide

Whole life insurance offers lifelong coverage, but the premiums can be hefty. A graded premium whole life policy provides a solution by offering lower initial premiums that gradually increase over a set period. This structure makes it more accessible to individuals who might find traditional whole life insurance unaffordable. However, understanding the nuances of this type of policy is crucial before making a commitment. This in-depth guide will explore the ins and outs of graded premium whole life policies, helping you determine if it's the right fit for your financial needs.

What is a Graded Premium Whole Life Insurance Policy?

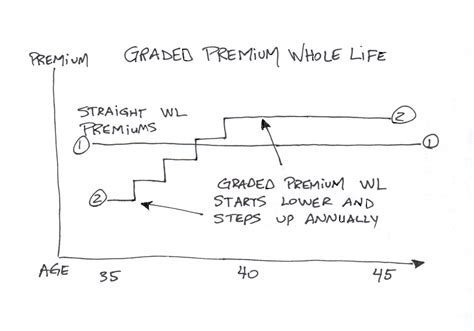

A graded premium whole life insurance policy is a type of permanent life insurance that offers lifelong coverage, similar to a traditional whole life policy. The key differentiator lies in the premium structure. Instead of paying a fixed, level premium throughout your life, you start with lower premiums that gradually increase over a specified period, typically 5 to 10 years. After this initial period, the premiums level off and remain consistent for the remainder of your life.

How Does it Differ from Traditional Whole Life Insurance?

The primary difference between graded premium and traditional whole life insurance is the premium payment schedule. Traditional whole life policies require level premiums, meaning the payment amount remains the same each year from the policy's inception until the insured's death. Graded premium policies, on the other hand, feature lower initial premiums that increase incrementally until they reach a level premium. This makes them more attractive to younger individuals or those on a tighter budget who may not be able to afford the higher initial premiums associated with traditional whole life policies.

Here's a table summarizing the key differences:

| Feature | Graded Premium Whole Life | Traditional Whole Life |

|---|---|---|

| Premium Payments | Gradually increasing, then levels off | Level throughout policy life |

| Initial Cost | Lower | Higher |

| Long-Term Cost | Potentially higher overall | Lower overall |

| Cash Value Growth | Slower initially | Faster initially |

Advantages of Graded Premium Whole Life Insurance

-

Affordability: The most significant advantage is the lower initial premiums. This makes whole life insurance more accessible to individuals who might not be able to afford the higher premiums of traditional policies. This is particularly beneficial for younger people starting their careers or families.

-

Permanent Coverage: Like traditional whole life insurance, a graded premium policy offers lifelong coverage, ensuring your beneficiaries receive a death benefit regardless of when you pass away. This provides peace of mind and long-term financial security for loved ones.

-

Cash Value Accumulation: These policies build cash value over time, which grows tax-deferred. This cash value can be borrowed against or withdrawn (subject to tax implications and potential surrender charges). It can serve as a valuable source of funds for future needs, such as retirement or education expenses.

-

Fixed Premiums (Eventually): After the initial grading period, the premiums become level, providing predictability and stability in your budget. You know exactly what to expect each year, avoiding the uncertainty of fluctuating premiums.

Disadvantages of Graded Premium Whole Life Insurance

-

Higher Overall Cost: Although the initial premiums are lower, the gradual increase means you could potentially pay more in total premiums over the life of the policy compared to a traditional whole life policy. The overall cost depends on the length of the grading period and the rate of premium increases.

-

Slower Cash Value Growth: Due to the lower initial premiums, the cash value accumulation typically grows more slowly in the early years compared to traditional whole life policies. This is because a smaller portion of each initial premium contributes to the cash value.

-

Potential for Higher Premiums Than Expected: While premiums eventually level off, unexpected life events or changes in health could influence the ultimate premium cost. It is important to understand the terms and conditions fully before signing a contract.

Understanding the Premium Structure

The grading period is a crucial aspect of a graded premium whole life policy. This is the timeframe during which premiums gradually increase. The length of this period varies among insurance providers and specific policy options. It is typically between 5 and 10 years. After this period, the premiums become level and fixed for the remainder of your life.

The rate of premium increase also varies. Some policies might increase premiums incrementally each year during the grading period, while others might have a steeper increase in the early years, followed by smaller increases later on. It is imperative to carefully review the policy documents to understand the exact schedule of premium increases.

Example: A policy with a 10-year grading period might start with an annual premium of $500. This premium could increase by $50 each year during the grading period, ultimately reaching a level premium of $1000 after 10 years. This simplified illustration helps to explain the underlying principle.

Who Should Consider a Graded Premium Whole Life Policy?

Graded premium whole life insurance is a good option for certain individuals, but not for everyone. Consider this type of policy if:

-

You need permanent life insurance coverage but have limited funds currently. The lower initial premiums make it accessible to individuals who might not be able to afford traditional whole life insurance immediately.

-

You anticipate your income increasing over time. The increasing premiums align with the expectation of a rising income, making it easier to manage premium payments as your earning potential grows.

-

You prefer predictable long-term financial planning. Although the early years involve increasing premiums, the stability of level premiums after the grading period provides financial certainty.

Who Should Avoid a Graded Premium Whole Life Policy?

This policy might not be suitable for:

-

Individuals who need maximum cash value growth quickly. The slower cash value growth in the early years makes this policy less attractive for individuals seeking rapid cash value accumulation.

-

Those on a strictly fixed income and unable to adapt to incremental increases. The unpredictable increase in premium might cause problems for some individuals with fixed income, potentially leading to difficulty maintaining payments.

-

Individuals who prioritize the lowest possible cost regardless of coverage duration. While this is a good option to provide lifetime coverage, overall costs might not be the lowest compared to other policy types.

Comparing Graded Premium to Other Whole Life Options

Graded premium whole life is not the only type of permanent life insurance. Understanding the differences between other options will help you make an informed decision:

-

Traditional Whole Life: Offers level premiums throughout the policy's duration. It typically has higher initial premiums but lower overall costs over time, and faster cash value growth.

-

Single Premium Whole Life: Requires a single, lump-sum payment. It offers immediate high cash value growth and level death benefit. However, it demands a significant upfront investment.

-

Modified Whole Life: Features lower premiums during the initial years (often 5-10 years), then transitions to a level premium. Similar to graded premium but the transition might be more abrupt.

Choosing the Right Policy: Key Factors to Consider

When considering a graded premium whole life policy, several crucial aspects require careful consideration:

-

The Length of the Grading Period: Longer grading periods mean lower initial premiums but higher overall costs. Carefully evaluate your financial situation and how your income is projected to change over this period.

-

The Rate of Premium Increase: Understand the precise schedule of premium increases during the grading period. A gradual and predictable increase is generally preferred to avoid financial strain.

-

Cash Value Growth Potential: Compare the projected cash value growth of graded premium with other whole life options. Ensure that the potential growth aligns with your long-term financial goals.

-

Death Benefit: Ensure the death benefit adequately meets the needs of your beneficiaries. Consider factors like inflation and potential future expenses.

-

Riders and Additional Features: Explore available riders and additional features that may enhance your coverage or benefits. Common riders include accidental death benefit, long-term care riders, and disability waiver of premiums.

Finding the Right Insurer and Policy

Choosing the right insurer and policy requires research and careful comparison. Obtain quotes from multiple insurers to compare premium structures, grading periods, cash value growth potential, and additional features. Discuss your specific financial goals and needs with an insurance professional. An independent insurance agent can provide objective advice and help you choose the policy that best suits your circumstances.

Conclusion

Graded premium whole life insurance offers a compelling compromise between affordability and permanent coverage. While the lower initial premiums are a significant advantage, it's essential to weigh the potential for higher overall costs and slower initial cash value growth. Understanding the intricacies of the premium structure, the grading period, and the long-term cost implications are critical before making a decision. Thorough research, comparison shopping, and professional consultation will empower you to make an informed choice that aligns with your financial objectives and provides the lifelong security you seek. Remember to carefully review policy documents and seek clarification on any aspects that remain unclear. Making an informed decision is essential for securing your financial future and providing for your loved ones.

Latest Posts

Latest Posts

-

Which Statement Is True About The Factors Affecting Physical Fitness

Apr 01, 2025

-

Economic Efficiency In A Competitive Market Is Achieved When

Apr 01, 2025

-

What Does Catherine Tell Nick About Gatsby

Apr 01, 2025

-

Ap Human Geography Unit 6 Practice Test

Apr 01, 2025

-

Which Diagram Best Represents A Polar Molecule

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Under A Graded Premium Whole Life Policy . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.