What Are The Three Main Sales Forecasting Techniques

Breaking News Today

Mar 21, 2025 · 7 min read

Table of Contents

What are the Three Main Sales Forecasting Techniques?

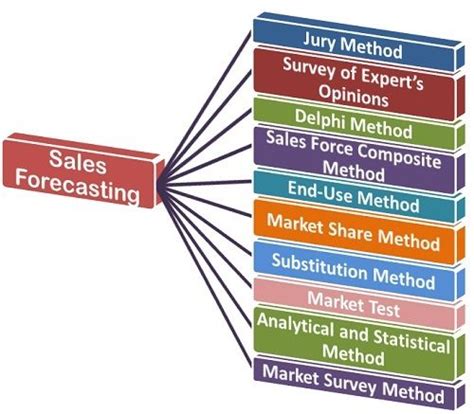

Sales forecasting is the bedrock of any successful business. It's the process of estimating future sales revenue based on historical data, market trends, and other relevant factors. Accurate forecasting allows businesses to make informed decisions regarding inventory management, production planning, budgeting, staffing, and overall strategic planning. While numerous techniques exist, three main sales forecasting methods stand out for their effectiveness and widespread use: qualitative forecasting, time series analysis, and causal forecasting. This article will delve deep into each, exploring their strengths, weaknesses, and best applications.

1. Qualitative Sales Forecasting: The Art of Intuition and Expertise

Qualitative forecasting relies heavily on expert opinion and judgment. It's particularly useful when historical data is scarce or unreliable, such as with new products or in rapidly changing markets. This approach isn't purely guesswork; it leverages the collective knowledge and experience of individuals within the organization and external stakeholders. Several key qualitative methods are employed:

A. Sales Force Composite: The Ground Truth Perspective

This method aggregates sales forecasts from individual salespeople or sales teams. Each salesperson provides their estimate for their territory, leveraging their understanding of customer relationships, market conditions, and potential opportunities. The aggregated data then forms the overall sales forecast.

Strengths:

- Incorporates local market knowledge: Salespeople have firsthand insights into regional trends, customer behavior, and competitive pressures.

- Relatively simple and quick: Data collection is straightforward, making it suitable for quick turnaround forecasts.

Weaknesses:

- Bias and subjectivity: Individual salespeople might be overly optimistic or pessimistic, leading to inaccurate forecasts.

- Lack of statistical rigor: The method relies heavily on subjective judgment, lacking the statistical grounding of other methods.

- Difficult to reconcile conflicting estimates: Managing inconsistencies across different sales teams can be challenging.

B. Market Research: Understanding Customer Behavior

Market research involves collecting data directly from customers and potential customers. This data might be gathered through surveys, focus groups, interviews, or observational studies. The findings inform the sales forecast by providing insights into customer preferences, purchasing intentions, and market size.

Strengths:

- Direct customer input: Provides valuable insights into customer needs and preferences.

- Identifies emerging trends: Can uncover market trends and opportunities that might be missed through other methods.

Weaknesses:

- Expensive and time-consuming: Conducting thorough market research can be costly and take considerable time.

- Sampling bias: The sample chosen might not accurately represent the entire target market.

- Interpretation challenges: Analyzing qualitative data from surveys or focus groups requires careful interpretation.

C. Delphi Method: Harnessing Expert Consensus

The Delphi method involves gathering forecasts from a panel of experts through multiple rounds of questionnaires. The responses are aggregated and anonymized, allowing experts to refine their forecasts based on the collective views. This iterative process aims to achieve a consensus forecast.

Strengths:

- Reduces bias: Anonymity prevents individual biases from unduly influencing the final forecast.

- Combines diverse perspectives: Captures a broader range of viewpoints and expertise.

Weaknesses:

- Time-consuming: Multiple rounds of questionnaires can extend the forecasting process.

- Requires expert participation: Finding and engaging knowledgeable experts can be difficult.

- Difficult to ensure true anonymity: Experts might still try to guess the identity of other participants.

2. Time Series Analysis: Unveiling Patterns in Historical Data

Time series analysis uses historical sales data to identify patterns and trends over time. This approach assumes that past sales performance is a good indicator of future performance. Several key methods exist within time series analysis:

A. Moving Average: Smoothing Out the Noise

The moving average method calculates the average sales over a specific period (e.g., the last 3 months, 6 months, or 1 year). This smooths out short-term fluctuations, revealing underlying trends. The length of the moving average period significantly impacts the forecast’s sensitivity to recent data. A shorter period will be more responsive to recent changes, while a longer period will provide a smoother, less volatile forecast.

Strengths:

- Simple and easy to understand: Relatively straightforward to calculate and interpret.

- Adaptable to various time periods: The length of the averaging period can be adjusted to suit different needs.

Weaknesses:

- Lags behind significant changes: May not accurately reflect sudden shifts in sales patterns.

- Assumes constant trend: Doesn't account for seasonal variations or cyclical fluctuations.

- Equally weights all data points: Doesn’t consider the potential importance of more recent data.

B. Exponential Smoothing: Weighting Recent Data

Exponential smoothing assigns exponentially decreasing weights to older data points, giving more emphasis to recent sales figures. This method is more responsive to changes in sales patterns than the simple moving average. Different variations exist, including single exponential smoothing, double exponential smoothing (for trends), and triple exponential smoothing (for trends and seasonality).

Strengths:

- Responsive to changes: Better captures recent sales trends compared to moving averages.

- Relatively simple to implement: Easier to compute than more complex time series models.

Weaknesses:

- Parameter sensitivity: The choice of smoothing parameter significantly impacts the forecast accuracy.

- Assumes consistent patterns: May not accurately predict sudden or unexpected changes.

C. ARIMA Models: Capturing Complex Patterns

Autoregressive Integrated Moving Average (ARIMA) models are sophisticated statistical models capable of capturing complex patterns in time series data. They consider autocorrelations within the data, accounting for past sales values and their impact on future sales. The specific ARIMA model (specified by parameters p, d, and q) is selected based on the characteristics of the data.

Strengths:

- Handles complex patterns: Can accurately model data with trends, seasonality, and cyclical fluctuations.

- Statistically robust: Provides measures of forecast accuracy and uncertainty.

Weaknesses:

- Complex to implement: Requires statistical expertise and specialized software.

- Data requirements: Needs a relatively long and consistent historical sales dataset.

- Overfitting risk: Overly complex models may overfit the data, leading to inaccurate forecasts.

3. Causal Forecasting: Identifying Underlying Drivers

Causal forecasting identifies the factors that influence sales and uses statistical models to quantify these relationships. This approach goes beyond simply analyzing historical sales data; it seeks to understand the underlying drivers of sales performance. Regression analysis is a commonly used technique within causal forecasting.

A. Regression Analysis: Quantifying Relationships

Regression analysis uses statistical methods to model the relationship between sales (dependent variable) and other relevant factors (independent variables). These independent variables can include things like advertising expenditure, price changes, economic indicators (GDP, consumer confidence), competitor actions, and seasonal factors. The model generates an equation that can be used to predict future sales based on anticipated values of the independent variables.

Strengths:

- Explains sales drivers: Provides insights into the factors influencing sales performance.

- Predictive power: Can generate accurate forecasts when the relationships between variables are well-understood.

Weaknesses:

- Data requirements: Requires a large dataset with reliable measurements of both dependent and independent variables.

- Model complexity: Developing and validating a robust regression model can be challenging.

- Causality vs. Correlation: It's important to be cautious about interpreting correlations as causal relationships. Spurious correlations can lead to inaccurate forecasts.

B. Econometric Modeling: Macroeconomic Influence

Econometric modeling extends regression analysis by incorporating macroeconomic factors and their impact on sales. These models might include factors like interest rates, inflation, unemployment rates, and exchange rates. This is particularly useful for businesses operating in sectors sensitive to broader economic conditions.

Strengths:

- Captures macroeconomic effects: Provides a more complete picture of sales drivers by considering macroeconomic factors.

- Useful for long-term forecasts: Suitable for forecasting over longer time horizons.

Weaknesses:

- Data availability: Requires access to reliable macroeconomic data.

- Model complexity: Can be significantly more complex than simple regression models.

- Forecasting macroeconomic variables: Accurately forecasting macroeconomic variables themselves can be challenging.

Choosing the Right Forecasting Technique

The best sales forecasting technique depends on several factors, including:

- Data availability: The amount and quality of historical sales data.

- Forecast horizon: The length of time the forecast needs to cover.

- Resources available: The budget, time, and expertise available for forecasting.

- Industry and market characteristics: The stability and predictability of the market.

- Level of detail required: The level of granularity needed in the forecast (e.g., overall revenue, sales by product, sales by region).

Often, a combination of methods provides the most accurate and robust forecast. For instance, a company might use qualitative methods to identify potential new market opportunities and then combine this information with time series analysis of historical sales data to generate a comprehensive forecast.

Conclusion: Refining Your Forecasting Process

Accurate sales forecasting is crucial for business success. By understanding the strengths and weaknesses of qualitative forecasting, time series analysis, and causal forecasting, businesses can select the most appropriate methods and build a robust forecasting process. Remember that forecasting is an iterative process; regularly review and refine your methods based on performance and emerging market conditions to ensure continued accuracy and effectiveness. The key lies in understanding your data, utilizing the right tools, and constantly seeking improvement to stay ahead of the curve.

Latest Posts

Latest Posts

-

Prevention Of The Spread Of Infections Begins And Ends With

Mar 28, 2025

-

The Entry To Establish A Petty Cash Fund Includes

Mar 28, 2025

-

What Can A Budget Help You Do Everfi

Mar 28, 2025

-

Which Event Marks The Beginning Of A Supernova

Mar 28, 2025

-

Ap Lit Unit 3 Progress Check Mcq

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about What Are The Three Main Sales Forecasting Techniques . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.