What Are The Types Of Essential Records Quizlet

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

What are the Types of Essential Records? A Comprehensive Guide

Quizlet, while a fantastic tool for studying, doesn't inherently categorize "essential records." The types of records considered essential depend heavily on context – are we talking about personal records, business records, government records, or something else entirely? This comprehensive guide delves into various record types, exploring their importance and why maintaining them is crucial. We'll cover personal, financial, medical, legal, and business records, offering a holistic view of essential record-keeping.

Understanding the Importance of Essential Records

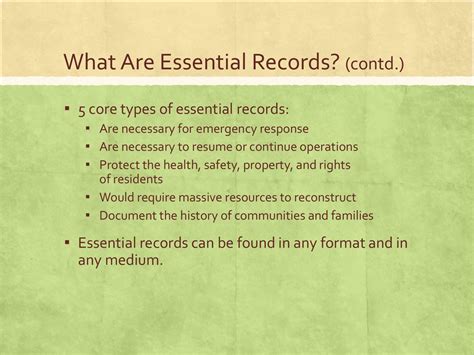

Before diving into specific types, let's establish why maintaining essential records is so vital. Proper record-keeping offers numerous benefits:

- Protection of Rights and Interests: Essential records act as proof of ownership, identity, financial transactions, and legal agreements. They are crucial in resolving disputes, claiming benefits, and defending your rights.

- Financial Security: Accurate financial records are fundamental for tax preparation, budgeting, and financial planning. They help track income, expenses, and assets, safeguarding your financial well-being.

- Legal Compliance: Businesses and individuals alike must maintain records to comply with legal and regulatory requirements. Failure to do so can result in penalties and legal repercussions.

- Historical Perspective: Personal records provide valuable insights into your family history, ancestry, and personal journey. Business records trace a company's evolution and growth.

- Efficient Decision-Making: Access to organized records facilitates informed decision-making in both personal and professional contexts.

Types of Essential Personal Records

Your personal records constitute a vital collection documenting your life and identity. Maintaining these records is crucial for several reasons, including protecting your identity, accessing benefits, and managing your finances effectively. Here are key categories:

1. Identification and Proof of Identity:

- Birth Certificate: This foundational document proves your date and place of birth, establishing your identity.

- Social Security Card (or equivalent): Essential for employment, benefits, and accessing government services.

- Passport or Driver's License: Crucial for travel, identification, and various legal procedures.

- Marriage Certificate (if applicable): Provides legal proof of marriage, impacting numerous legal and financial aspects.

- Divorce Decree (if applicable): Formally documents the dissolution of a marriage.

2. Financial Records:

- Bank Statements: Track your income, expenses, and account balances, essential for budgeting and tax preparation.

- Investment Records: Document your investments, including stocks, bonds, mutual funds, and retirement accounts.

- Tax Returns: Maintain copies of all filed tax returns for future reference and potential audits.

- Loan Documents: Retain copies of loan agreements, payment schedules, and amortization tables.

- Insurance Policies: Keep records of all insurance policies, including details about coverage and premiums.

3. Medical Records:

- Medical History: Maintain a detailed record of your medical history, including diagnoses, treatments, and allergies.

- Vaccination Records: Keep track of vaccinations to ensure you have the necessary protection against diseases.

- Prescription Information: Retain records of prescriptions, including medication names, dosages, and dates.

- Hospital Records: Keep copies of hospital discharge summaries, test results, and other relevant medical documentation.

- Insurance Claim Information: Maintain records of medical insurance claims, payments, and reimbursements.

4. Legal Documents:

- Will: A legally binding document outlining how your assets will be distributed after your death.

- Power of Attorney: Authorizes someone to act on your behalf in legal and financial matters.

- Healthcare Proxy: Designates someone to make healthcare decisions on your behalf if you are unable.

- Living Will: Specifies your wishes regarding end-of-life medical care.

- Deeds and Titles: Document ownership of property, including houses, land, and vehicles.

5. Educational Records:

- Diplomas and Certificates: Proof of educational achievements, essential for employment and further education.

- Transcripts: Detailed records of academic performance, crucial for college applications and job applications.

- Coursework and Project Materials: Relevant for professional development and showcasing skills.

Types of Essential Business Records

Businesses face more stringent record-keeping requirements than individuals. Maintaining accurate and organized business records is not just good practice; it’s often legally mandated. Here are some critical business record categories:

1. Financial Records:

- Income Statements: Show revenue, expenses, and net income over a specific period.

- Balance Sheets: Present a snapshot of a company's assets, liabilities, and equity at a specific point in time.

- Cash Flow Statements: Track the movement of cash in and out of the business.

- Accounts Receivable and Payable: Records of money owed to and by the business.

- Payroll Records: Detailed records of employee wages, deductions, and taxes.

2. Legal and Compliance Records:

- Contracts and Agreements: Keep copies of all contracts with customers, suppliers, and employees.

- Permits and Licenses: Maintain records of all necessary business permits and licenses.

- Insurance Policies: Document business insurance coverage, including liability, property, and workers' compensation.

- Tax Records: Maintain accurate records for tax purposes, including sales tax, income tax, and payroll tax.

- Compliance Documentation: Records demonstrating adherence to industry regulations and standards.

3. Operational Records:

- Inventory Records: Track the stock levels of goods and materials.

- Sales Records: Maintain detailed records of all sales transactions.

- Purchase Orders: Document orders placed with suppliers.

- Shipping and Receiving Records: Track the movement of goods in and out of the business.

- Production Records: Record details of manufacturing processes and output.

4. Customer Records:

- Customer Information: Maintain accurate contact information and purchase history for customers.

- Communication Logs: Document interactions with customers, including emails, phone calls, and other communications.

- Customer Feedback: Collect and analyze customer feedback to improve products and services.

5. Employee Records:

- Employment Applications: Maintain copies of employment applications and resumes.

- Employee Contracts: Keep records of employment contracts and agreements.

- Performance Reviews: Document employee performance evaluations.

- Payroll Records: Maintain detailed payroll records for each employee.

- Training Records: Track employee training and development activities.

Safeguarding Your Essential Records: Best Practices

Regardless of the type of records you're managing, employing proper safeguarding techniques is crucial. This includes:

- Organization: Use a filing system that's easy to navigate and allows for quick retrieval of specific records. Consider both physical and digital filing systems.

- Data Backup: Regularly back up digital records to prevent data loss. Utilize cloud storage, external hard drives, or other backup methods.

- Security: Protect sensitive records from unauthorized access. Use strong passwords, encryption, and physical security measures where appropriate.

- Regular Review and Purging: Periodically review your records and discard obsolete or irrelevant information. Keep only what is essential and legally required.

- Accessibility: Ensure easy access to your records when needed. Maintain a well-organized system that allows you to quickly locate specific documents.

Conclusion: The Ongoing Importance of Record Keeping

Maintaining essential records is a vital aspect of personal and professional life. The specific types of records will vary depending on your individual circumstances and business needs. However, the underlying principle remains consistent: accurate, organized, and well-protected records are fundamental for protecting your rights, managing your finances, complying with legal requirements, and making informed decisions. By understanding the different categories and implementing best practices for record-keeping, you can significantly improve your personal and professional well-being. Remember, proper record-keeping is an ongoing process, requiring consistent effort and attention to detail. The investment in time and effort will pay dividends in the long run.

Latest Posts

Latest Posts

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

-

Did Quizlet Get Rid Of Q Chat

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about What Are The Types Of Essential Records Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.