What Is Not A Common Feature Of A Financial Institution

Breaking News Today

Mar 21, 2025 · 5 min read

Table of Contents

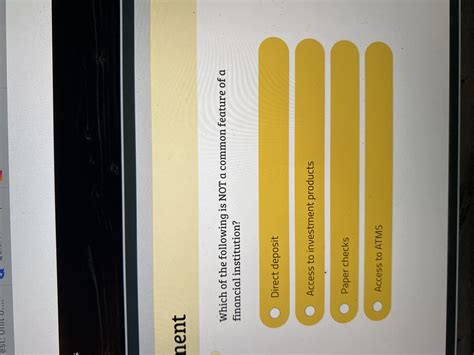

What is NOT a Common Feature of a Financial Institution?

Financial institutions are cornerstones of the modern economy, facilitating transactions, managing investments, and providing essential financial services. However, while certain features are universally expected, others are decidedly uncommon – or even completely absent. Understanding what isn't typically found in a financial institution can be just as crucial as understanding what is, allowing for better financial decision-making and a sharper awareness of potential risks.

Uncommon Activities: Beyond the Traditional Scope

Traditional financial institutions primarily focus on a few core activities: accepting deposits, providing loans, facilitating payments, and offering investment products. Anything outside these core functions is generally uncommon, and sometimes even a red flag.

1. Direct Involvement in Non-Financial Businesses

A hallmark of a reputable financial institution is its focus on finance. You won't typically find them directly involved in operating restaurants, manufacturing goods, or engaging in activities outside their core competency. While some might have investment arms involved in various sectors, direct operational control of non-financial businesses is highly unusual. This separation is crucial for mitigating risks and ensuring the institution's stability. Diversification, yes; direct operational management of unrelated businesses, no.

2. Lack of Regulatory Compliance and Transparency

Transparency and regulatory compliance are non-negotiable for legitimate financial institutions. A glaring absence of these is a major warning sign. Look for readily available information about their licensing, audits, and adherence to relevant financial regulations. A lack of transparency, coupled with an inability to readily provide documentation of compliance, is a clear indication of potential problems. This includes avoiding questions about their financial health or operational processes.

3. Guaranteed Unsustainable Returns

Any institution promising exceptionally high and guaranteed returns on investments should raise serious concerns. Legitimate financial institutions understand and openly acknowledge the inherent risks in investment strategies. Guaranteed high returns, especially those significantly exceeding market averages, are virtually always unsustainable and often indicative of a scam. Remember: High returns almost always come with higher risk.

4. High-Pressure Sales Tactics and Aggressive Solicitation

Reputable financial institutions prioritize building client trust and understanding. Aggressive, high-pressure sales tactics, misleading information, or persistent unsolicited calls are major red flags. A legitimate institution will provide you with the information you need to make informed decisions, not pressure you into actions you're not comfortable with.

5. Complex and Unclear Fee Structures

Hidden fees or overly complicated fee structures are common indicators of potentially predatory practices. A trustworthy financial institution will provide clear and concise information about all applicable fees and charges. Hidden fees, ambiguous terms, or excessive charges are indicative of a lack of transparency and potential exploitation. Always carefully review fee schedules and ask clarifying questions.

Unusual Characteristics: Diverging from Standard Practices

Certain characteristics, while not entirely absent, are significantly less common in reputable financial institutions:

6. Minimal or No Customer Support

Easy access to reliable customer support is vital. A lack of readily available contact information, unhelpful staff, or long wait times for assistance are significant drawbacks. A reputable institution prioritizes client satisfaction and provides multiple avenues for communication and support.

7. Outdated Technology and Infrastructure

In today's digital age, reliance on outdated technology and lack of online accessibility can hinder efficiency and security. While some smaller institutions might lag behind, the complete absence of modern technological infrastructure and security measures raises concerns about their capability and commitment to safeguarding client information.

8. Lack of Security Measures and Data Protection

Strong security measures are paramount. An institution's failure to implement robust security protocols to protect client data, including encryption and fraud prevention mechanisms, is a serious red flag. Data breaches and security vulnerabilities are a significant risk.

9. Absence of Independent Audits and Reviews

Regular independent audits provide assurance of financial health and operational transparency. A lack of publicly available audit reports or evidence of independent reviews raises questions about the institution's accountability and financial stability.

10. Negative or Missing Online Reviews and Reputation

Online reviews and reputation are increasingly important for assessing the credibility and trustworthiness of any business, including financial institutions. A significant absence of online reviews or a preponderance of negative feedback should raise concerns.

Distinguishing Legitimate Institutions from Potentially Risky Ones

The features listed above help differentiate between established, reputable financial institutions and those that might pose significant risks. While not every financial institution will have every single "common" feature in perfect execution, the absence of several of the uncommon features discussed above should warrant serious scrutiny.

Due Diligence: Your First Line of Defense

Before engaging with any financial institution, conduct thorough due diligence. This includes:

- Checking regulatory licenses and registrations: Ensure they operate legally and are compliant with relevant regulations.

- Reading reviews and testimonials: Gain insight from other customers' experiences.

- Examining fee schedules and terms and conditions: Understand all associated costs and potential risks.

- Verifying their security measures: Assess their data protection and fraud prevention mechanisms.

- Contacting customer service: Gauge the responsiveness and helpfulness of their support team.

Understanding the Risks

Engaging with a financial institution that lacks the hallmarks of trustworthiness can expose you to significant risks, including:

- Financial loss: Fraud, scams, and investment failures can lead to substantial financial losses.

- Identity theft: Poor security practices can expose your personal and financial information to theft.

- Legal issues: Dealing with an unlicensed or unregulated institution can leave you vulnerable to legal ramifications.

- Reputational damage: Association with a disreputable institution can damage your own financial reputation.

Conclusion: Prioritizing Safety and Security

Choosing a financial institution is a crucial decision with long-term implications. By understanding what is not a common feature of a reputable financial institution, you can better protect yourself from potential risks and make more informed choices. Always prioritize safety, security, transparency, and regulatory compliance when selecting a financial partner. Remember that due diligence and critical thinking are your most valuable tools in navigating the complex world of finance. Don't hesitate to seek professional financial advice if needed; it's always better to be safe than sorry when it comes to your financial well-being. By remaining vigilant and informed, you can ensure a secure and successful financial future.

Latest Posts

Latest Posts

-

Which Of The Following Is Not A Period Cost

Mar 27, 2025

-

Hay 13 6 Chicas Y 20 12 Chicos

Mar 27, 2025

-

Se Sugiere Buscar Una Casa En Un Barrio Seguro Safe

Mar 27, 2025

-

What Are The Key Clauses In Ap Government

Mar 27, 2025

-

Which Of The Following Best Describes An Inside Attacker

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about What Is Not A Common Feature Of A Financial Institution . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.