What Is The Definition Of Freezing Your Credit Everfi

Breaking News Today

Mar 21, 2025 · 7 min read

Table of Contents

What is the Definition of Freezing Your Credit (EverFi)? A Comprehensive Guide

Freezing your credit, a crucial aspect of financial security often discussed in EverFi's financial literacy programs, is a powerful tool to protect yourself from identity theft and fraud. This comprehensive guide will delve deep into the definition of a credit freeze, explaining its benefits, drawbacks, and how it differs from a credit lock. We'll also cover when you might want to consider freezing your credit and how to navigate the process.

Understanding Credit Freezes: A Definition

A credit freeze, also known as a security freeze, is a request you make to the three major credit bureaus—Equifax, Experian, and TransUnion—to restrict access to your credit reports. When your credit is frozen, these bureaus will not release your credit report information to potential creditors, landlords, or other entities that conduct credit checks. This effectively prevents them from opening new accounts in your name, even if a thief has obtained your personal information. Think of it as locking a door to protect your valuables. It's a preventative measure, not a reactive one.

Unlike a credit lock, which is offered by credit bureaus or private companies, a credit freeze is a legally mandated service available directly and for free from the three major credit bureaus. This is a significant difference that impacts your control and security.

Why Freeze Your Credit? The Benefits of a Credit Freeze

The primary benefit of a credit freeze is the significant reduction in your risk of identity theft and fraudulent credit accounts. This is particularly important in today's digital age where data breaches are commonplace. A thief needs your credit report to open fraudulent accounts. A freeze prevents them from accessing that crucial information.

Here’s a breakdown of the key benefits:

- Identity Theft Prevention: This is the most compelling reason. A frozen credit report makes it significantly harder for identity thieves to open fraudulent accounts in your name.

- Fraudulent Loan Applications: It prevents unauthorized loans, credit cards, and other lines of credit from being opened.

- Protection Against Medical Identity Theft: Medical identity theft can lead to significant financial burdens and damage your credit. A credit freeze offers a layer of protection.

- Reduced Risk of Utility Fraud: Dishonest individuals can use your information to set up utility services in your name, leaving you with unexpected bills.

- Peace of Mind: Knowing your credit is protected provides a significant sense of security and peace of mind.

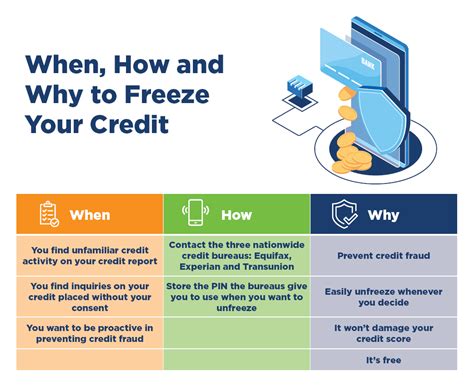

When Should You Consider Freezing Your Credit?

While freezing your credit offers substantial benefits, it's essential to understand when it's most appropriate. Consider a credit freeze if:

- You are a victim of identity theft: If you suspect your information has been compromised, immediately freeze your credit to prevent further damage.

- You haven't recently applied for credit: If you're not actively seeking new credit accounts (mortgage, loan, credit card), a freeze adds a protective layer.

- You have concerns about your data security: In the event of a data breach at a company where you're a customer, proactive freezing is a smart move.

- You're leaving your personal information vulnerable: If you've lost your wallet, had your mail stolen, or are dealing with a situation that increases your risk of identity theft, freezing your credit is a prudent step.

- You're planning a long period of inactivity: If you are travelling extensively or will have limited access to your mail and financial accounts, a credit freeze provides a solid security measure.

The Drawbacks of Freezing Your Credit

While credit freezes offer substantial protection, they aren't without some potential drawbacks:

- Temporary Inconvenience: If you need to apply for credit, you will have to temporarily lift the freeze. This requires contacting each credit bureau individually, potentially delaying your application process.

- Potential for Delay: While the process is typically straightforward, there can be minor delays in getting your credit unfrozen, especially during peak times or with technical issues.

- Not a Complete Solution: A credit freeze won't prevent all types of fraud. For example, it won't stop someone from using your information for other illicit activities, such as opening bank accounts or filing fraudulent tax returns.

Credit Freeze vs. Credit Lock: Understanding the Key Differences

Many people confuse credit freezes with credit locks. While both limit access to your credit report, there are crucial differences:

| Feature | Credit Freeze | Credit Lock |

|---|---|---|

| Provider | Credit Bureaus (Equifax, Experian, TransUnion) | Credit Bureaus or Private Companies |

| Cost | Typically Free | Often involves a subscription fee |

| Security | Stronger, legally mandated security | Less stringent security, potentially vulnerable to company issues |

| Control | You have complete control over your freeze | Company can potentially unlock without your explicit instructions |

| Regulation | Federally regulated under the FACT Act | Less heavily regulated |

As you can see, a credit freeze provides a more robust and secure solution compared to a credit lock.

How to Freeze Your Credit: A Step-by-Step Guide

Freezing your credit is a straightforward process. Each credit bureau has its own website, but the process is generally similar:

- Visit each credit bureau's website: Go to the websites of Equifax, Experian, and TransUnion.

- Locate the credit freeze section: Look for options like "Security Freeze" or "Credit Freeze."

- Create an account (if needed): You'll likely need to create an account or log in to an existing one. Use a strong password.

- Follow the instructions to initiate the freeze: You will need to provide personal information to verify your identity.

- Receive a PIN or password: Each bureau will give you a PIN or password to use when you want to lift the freeze. Keep this information safe and secure.

- Confirm the freeze: After you submit your request, you should receive confirmation that your credit has been frozen.

How to Lift Your Credit Freeze: A Temporary Pause

When you need to apply for credit, you will need to temporarily lift, or "thaw," your freeze. The process is usually similar to initiating the freeze:

- Log in to each credit bureau's website: Use your account credentials.

- Find the credit freeze management section: This will allow you to temporarily lift the freeze.

- Provide your PIN or password: Enter the PIN or password provided during the freeze process.

- Specify the duration: You may be able to specify how long the freeze is lifted, from a few hours to a specific date.

- Confirm the lift: You'll get a confirmation that your freeze is temporarily lifted.

Maintaining Your Credit Freeze: A Long-Term Strategy

Once you've frozen your credit, it's a good practice to:

- Keep your PINs and passwords secure: Store this information safely, separate from any other personal documents.

- Monitor your credit reports regularly: Even with a freeze, it's important to check your credit reports for any suspicious activity. You can do this through annualcreditreport.com, which is a free government-sponsored service.

- Update your contact information: Keep your contact information updated with the credit bureaus to ensure they can reach you if there are any issues.

- Educate your family: Inform your family and close friends about the credit freeze to avoid any confusion if they try to access your credit report on your behalf.

Freezing Your Credit: A Proactive Step for Financial Security

Freezing your credit is a proactive and powerful tool to protect yourself from identity theft and financial fraud. While there are minor inconveniences, the benefits significantly outweigh the drawbacks, particularly in today’s increasingly digital and interconnected world. By understanding the definition of a credit freeze, the steps involved, and the key differences compared to credit locks, you can confidently take control of your financial security and protect your future. Remember to regularly monitor your credit reports and maintain secure access to your freeze information. This is a critical step in building a strong foundation for your financial well-being.

Latest Posts

Latest Posts

-

To Avoid A Spin While In A Skid You Should

Mar 28, 2025

-

The Designated Length Of A Ladder Is

Mar 28, 2025

-

What Are Two Advantages Of Selling Digital Products

Mar 28, 2025

-

One Shortfall Of The Act Is That

Mar 28, 2025

-

Identify The Parts Of The Fibrous Layer

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about What Is The Definition Of Freezing Your Credit Everfi . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.