What Is The Purpose Of A Disability Income Benefit Quizlet

Breaking News Today

Mar 24, 2025 · 6 min read

Table of Contents

What is the Purpose of a Disability Income Benefit?

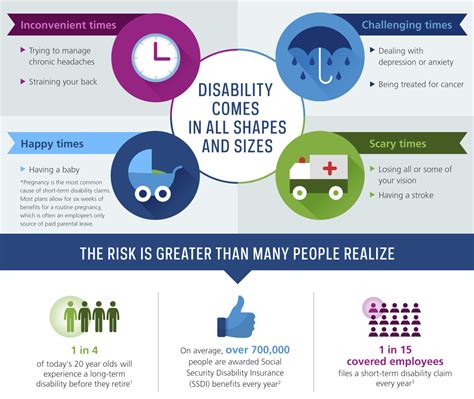

Understanding disability income benefits can be complex, but their core purpose is straightforward: to provide financial support when illness or injury prevents you from working. This article delves deep into the purpose of disability income benefits, exploring various aspects, including the types of benefits available, who qualifies, how they work, and their crucial role in financial security.

The Core Purpose: Maintaining Financial Stability During Disability

The fundamental purpose of a disability income benefit is to replace a portion of your lost income when you're unable to work due to a disabling condition. This loss of income can be devastating, impacting not only your ability to pay bills but also your overall well-being and mental health. Disability benefits act as a crucial safety net, helping individuals and families maintain their standard of living during a difficult time.

Beyond Financial Support: The Broader Impact

While the primary purpose is financial, the impact of disability income benefits extends far beyond mere monetary assistance. They contribute to:

- Reduced financial stress: The anxiety and stress associated with unexpected medical bills and lost income are significantly reduced. This allows individuals to focus on their recovery and rehabilitation, rather than worrying about how to make ends meet.

- Improved health outcomes: Knowing that financial support is available can alleviate the pressure to return to work prematurely, potentially hindering the recovery process. This can lead to better health outcomes in the long run.

- Preservation of assets: Without disability income, many individuals might be forced to deplete their savings or sell assets to cover living expenses. Disability benefits help protect these assets, preserving financial security for the future.

- Enhanced quality of life: Maintaining a reasonable standard of living, even during a period of disability, significantly improves overall quality of life, enabling individuals to focus on their well-being and family.

Types of Disability Income Benefits

Several types of disability income benefits are available, each serving a distinct purpose and catering to different circumstances:

1. Social Security Disability Insurance (SSDI)

SSDI is a federal program providing benefits to individuals who are considered totally and permanently disabled. Eligibility requires meeting specific criteria related to the severity and duration of the disability, work history, and earnings. The purpose of SSDI is to provide long-term financial support to those who are unable to work due to a disabling condition that is expected to last at least 12 months or result in death.

Key Features of SSDI:

- Long-term benefits: Designed to provide ongoing support for eligible individuals.

- Strict eligibility criteria: Rigorous medical evaluation is required to determine disability status.

- Federal funding: Funded through payroll taxes.

2. Supplemental Security Income (SSI)

SSI is another federal program providing financial assistance to individuals with disabilities who have limited income and resources. Unlike SSDI, SSI is needs-based and doesn't require a work history. The primary purpose is to ensure that individuals with limited financial means have access to essential resources to meet their basic needs.

Key Features of SSI:

- Needs-based benefits: Eligibility depends on income and asset levels.

- No work history requirement: Individuals without a significant work history can qualify.

- Federal funding: Also funded through general tax revenue.

3. Private Disability Insurance

Private disability insurance policies, purchased by individuals or provided by employers, offer income replacement in the event of disability. These policies are tailored to individual needs, with varying levels of coverage and benefits. The purpose of private disability insurance is to provide a financial safety net beyond what is offered by government programs.

Key Features of Private Disability Insurance:

- Varied coverage options: Individuals can customize their coverage levels to suit their financial needs.

- Faster claims processing: Generally, claim processing is quicker than with government programs.

- Supplemental income: Can supplement benefits received from government programs.

Who Qualifies for Disability Income Benefits?

Qualification criteria vary depending on the type of benefit. However, generally, individuals must demonstrate:

- A significant medical impairment: The condition must be severe enough to prevent them from performing their previous work or any other substantial gainful activity (SGA).

- Meeting duration requirements: Most programs require the disability to be expected to last at least 12 months or result in death.

- Meeting work history requirements (for SSDI): Individuals applying for SSDI need to meet specific work credits requirements based on their age and earnings history.

- Limited income and resources (for SSI): Eligibility for SSI is based on both income and asset levels, which must fall below certain thresholds.

The process of demonstrating eligibility can be challenging, often requiring extensive medical documentation and evidence of inability to work. Seeking legal assistance from a disability attorney can be highly beneficial in navigating this complex process.

How Disability Income Benefits Work

The process of applying for and receiving disability benefits generally involves:

- Application: Completing the necessary application forms and providing detailed medical information.

- Medical evaluation: A thorough review of medical records and potentially a medical examination by a government doctor.

- Review process: The application is reviewed to determine eligibility based on medical evidence and work history.

- Approval or denial: If approved, benefits are disbursed regularly. If denied, an appeals process is available.

The Importance of Disability Income Benefits in Financial Planning

Incorporating disability income protection into a comprehensive financial plan is crucial for several reasons:

- Protection against unforeseen events: Disability can strike anyone at any time, regardless of age or health status. Having disability insurance provides a much-needed safety net.

- Maintaining financial stability: It helps prevent the depletion of savings and ensures continued financial security for you and your family.

- Peace of mind: Knowing you have this protection removes a significant source of financial stress and anxiety.

Beyond the Basics: Addressing Key Considerations

While the core purpose of disability income benefits is clear – to provide financial support during disability – several nuances and considerations are vital for a comprehensive understanding:

-

Benefit Amounts: The amount of benefit received varies depending on the program, income history, and policy details (for private insurance). It typically replaces a percentage of pre-disability income, aiming to alleviate but not necessarily fully replace lost earnings. This necessitates careful planning and budgeting even with benefits received.

-

Waiting Periods: Most programs have waiting periods before benefits commence. This period might range from a few months to a year, necessitating careful financial planning during this waiting period.

-

Appeals Process: Denial of benefits is not uncommon. Understanding the appeals process, which can be intricate and lengthy, is crucial for those whose initial claims are rejected. Seeking legal counsel is often advised during this process.

-

Coordination with other benefits: Disability benefits might interact with other benefits such as workers’ compensation or veterans' benefits. Careful coordination is necessary to avoid duplicate benefits or inefficiencies.

-

Return-to-work incentives: Some programs offer incentives for gradual return-to-work, recognizing the importance of rehabilitation and vocational support.

Conclusion: A Vital Safety Net for Unforeseen Circumstances

The purpose of disability income benefits is paramount: to provide a financial safety net during a period of significant vulnerability. These benefits, whether provided by the government or through private insurance, play a crucial role in maintaining financial stability, improving health outcomes, and ensuring overall well-being for individuals facing disability. Understanding the various types of benefits available, eligibility criteria, and the application process is crucial for anyone seeking this essential protection. Proper financial planning, which includes considering disability income protection, is a critical element of responsible financial management, ensuring a more secure future regardless of unforeseen circumstances. The multifaceted nature of these benefits, including their potential impact on financial stress, health, and family well-being, underscores their critical role in society.

Latest Posts

Latest Posts

-

Which Topics Relate Directly To The Themes Developed In Frankenstein

Mar 25, 2025

-

Which Undefined Terms Are Needed To Define Parallel Lines

Mar 25, 2025

-

Match Each Health Screening To The Correct Disease

Mar 25, 2025

-

The Financial Responsibility Law Requires You To Have

Mar 25, 2025

-

What Additional Assessment And Stabilization Activities Should Be Completed

Mar 25, 2025

Related Post

Thank you for visiting our website which covers about What Is The Purpose Of A Disability Income Benefit Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.