What Is The Purpose Of Liability Insurance Quizlet

Breaking News Today

Mar 17, 2025 · 6 min read

Table of Contents

What is the Purpose of Liability Insurance? A Comprehensive Guide

Liability insurance is a critical component of risk management for individuals and businesses alike. Understanding its purpose is crucial for making informed decisions about your financial protection. This comprehensive guide delves deep into the intricacies of liability insurance, addressing common questions and misconceptions. We'll explore its purpose, different types, and why it's so vital in today's world.

Defining Liability Insurance: Shielding You From Financial Ruin

At its core, liability insurance protects you from the financial consequences of causing harm to others or their property. It covers the costs associated with legal defense, settlements, and judgments resulting from accidents or incidents for which you are deemed legally responsible. This protection extends beyond simple accidents; it encompasses a wide range of scenarios where your actions or negligence lead to someone else's loss or injury.

Think of it as a financial safety net. Without it, a single accident could lead to devastating financial repercussions, including:

- Medical bills: Covering the medical expenses of the injured party can quickly run into the thousands, or even millions, of dollars.

- Lost wages: If the injured party is unable to work, you could be held responsible for their lost income.

- Property damage: Repairing or replacing damaged property can be incredibly expensive.

- Legal fees: The cost of hiring legal counsel to defend yourself against a lawsuit can be substantial.

- Judgments and settlements: If you are found liable, you could face significant judgments and settlement costs.

Essentially, liability insurance ensures that you are not personally responsible for catastrophic financial burdens resulting from your actions. It protects your assets – your home, car, savings – from being seized to cover damages.

Types of Liability Insurance: Tailoring Coverage to Your Needs

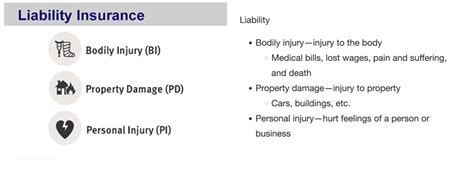

Liability insurance comes in various forms, each designed to address specific risks:

1. Homeowners Insurance: This is a cornerstone of personal liability protection. It covers liability claims arising from incidents occurring on your property, such as a guest tripping and injuring themselves, or your dog biting a neighbor. It often includes coverage for personal liability away from home, such as accidentally damaging someone's property while shopping.

2. Auto Insurance: This is mandatory in most jurisdictions and covers liability claims arising from car accidents. It protects you against claims for bodily injury or property damage caused by your vehicle, regardless of who is at fault. Understanding the difference between liability and collision coverage is critical. Liability covers damages you cause to others; collision covers damage to your own vehicle.

3. Renters Insurance: While you may not own the property, renters insurance provides crucial liability protection for accidents occurring in your rental unit. It also protects your personal belongings from theft or damage.

4. Commercial General Liability (CGL) Insurance: Businesses of all sizes rely on CGL insurance to protect against liability claims arising from their operations. This can include customer injuries on the premises, product defects, or advertising injuries.

5. Professional Liability Insurance (Errors & Omissions Insurance): Professionals like doctors, lawyers, and consultants utilize this type of insurance to protect against claims of negligence or errors in their services.

6. Umbrella Liability Insurance: This provides an additional layer of liability protection, exceeding the limits of your other policies. It acts as a backup, providing coverage for significant claims that exceed the limits of your homeowners, auto, or business insurance policies.

Choosing the right type(s) of liability insurance depends on your specific circumstances, assets, and risk profile. It's always advisable to consult with an insurance professional to determine the appropriate level of coverage.

The Crucial Role of Liability Insurance in Risk Management

Effective risk management involves identifying, assessing, and mitigating potential risks. Liability insurance plays a vital role in this process. By transferring the financial risk of liability claims to an insurance company, you significantly reduce your exposure to potentially devastating financial losses. This allows you to focus on other aspects of your life or business without the constant worry of a potentially catastrophic event.

Here's how liability insurance contributes to effective risk management:

- Financial Protection: It safeguards your assets from being depleted by large liability claims.

- Legal Defense: It covers the costs associated with hiring lawyers to defend you in lawsuits.

- Peace of Mind: It provides a sense of security knowing you're protected from unforeseen events.

- Business Continuity: For businesses, liability insurance ensures continued operation even in the face of liability claims.

Common Misconceptions about Liability Insurance

Several misconceptions surround liability insurance. Understanding these is crucial for making informed decisions:

-

Myth 1: I don't need liability insurance if I'm careful. Accidents happen. Even the most cautious individuals can be involved in incidents leading to liability claims. A single accident can have profound financial consequences.

-

Myth 2: My homeowner's or auto insurance is enough. While these policies provide essential liability coverage, the limits may be insufficient to cover significant claims. An umbrella policy often provides added protection against catastrophic losses.

-

Myth 3: Liability insurance only covers accidents. It also covers legal defense costs, regardless of whether you are found liable. The cost of legal representation can be significant.

-

Myth 4: Liability insurance is too expensive. The cost of liability insurance is relatively small compared to the potential financial devastation of a significant liability claim. Consider it an investment in protecting your future.

Liability Insurance: A Necessary Shield in Today's World

In today's litigious society, liability insurance is no longer a luxury; it's a necessity. The potential for costly lawsuits is ever-present, regardless of your profession or personal lifestyle. Failing to secure adequate liability insurance leaves you vulnerable to financial ruin. Understanding the purpose of liability insurance is the first step towards protecting yourself and your future. It's an investment that provides peace of mind and safeguards against the unpredictable nature of life's events. Don't leave yourself exposed – take the necessary steps to protect your financial well-being through appropriate liability insurance coverage.

Further Considerations and Key Takeaways

- Policy Limits: Understand the limits of your liability coverage. Ensure the limits are sufficient to cover potential claims in your specific situation.

- Deductibles: Be aware of your deductibles. These are the amounts you'll pay out-of-pocket before your insurance coverage kicks in.

- Claims Process: Familiarize yourself with the claims process for your insurance policy. Knowing what to do in the event of an accident is crucial.

- Regular Review: Review your insurance coverage periodically to ensure it's still adequate for your needs. Your circumstances and risk profile may change over time.

- Professional Advice: Consult with an insurance professional to discuss your specific needs and determine the appropriate level of liability insurance coverage.

By understanding the purpose of liability insurance and its various forms, you can make informed decisions about your financial protection. It's a crucial element of risk management, offering a financial safety net that can prevent catastrophic consequences from accidents and unforeseen events. Don't underestimate the importance of this vital protection. Secure adequate liability insurance and safeguard your future.

Latest Posts

Latest Posts

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about What Is The Purpose Of Liability Insurance Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.