What Is The Standard Deduction Used For Quizlet

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

What is the Standard Deduction Used For? A Comprehensive Guide

The standard deduction is a crucial element of the US tax system, offering taxpayers a way to reduce their taxable income. Understanding its purpose and application is vital for accurate tax filing. This comprehensive guide will explore the standard deduction, detailing its uses, eligibility, and implications for various taxpayer situations. We'll go beyond the basics to provide a nuanced understanding, answering common questions and clarifying potential misconceptions.

What is the Standard Deduction?

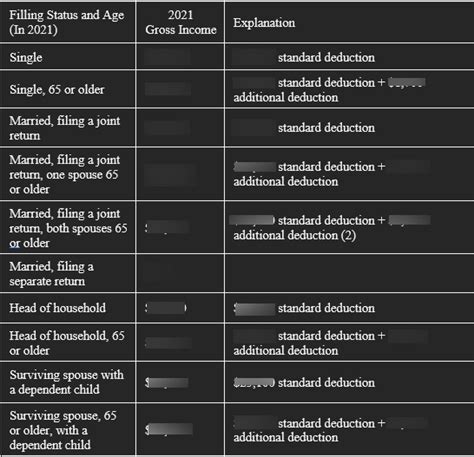

The standard deduction is a flat amount that reduces your taxable income. It's a government-provided allowance designed to lessen the tax burden on individuals and families. Instead of itemizing deductions (like charitable contributions, medical expenses, or home mortgage interest), taxpayers can opt for the standard deduction, often simplifying the tax filing process. The amount varies depending on your filing status (single, married filing jointly, head of household, etc.) and your age (those 65 and older receive an additional amount).

Key takeaway: The standard deduction lowers your taxable income, resulting in a lower tax liability.

Who is Eligible for the Standard Deduction?

Almost all US taxpayers are eligible for the standard deduction. There are minimal exceptions, primarily revolving around filing statuses and specific situations. For instance, individuals who are claimed as dependents on someone else's return may have limitations on their standard deduction amount.

Filing Status and Standard Deduction:

- Single: The standard deduction is a specific amount for single filers.

- Married Filing Jointly: Couples filing jointly receive a higher standard deduction amount.

- Married Filing Separately: Each spouse receives a standard deduction amount, but it's generally lower than the amount for those filing jointly.

- Head of Household: This filing status offers a standard deduction amount that falls between the single and married filing jointly amounts.

- Qualifying Widow(er) with Dependent Child: This status, available for a limited time after the death of a spouse, offers a higher standard deduction.

Age and Standard Deduction: Taxpayers who are age 65 or older, or who are blind, receive an additional standard deduction amount. This additional amount applies regardless of filing status.

How is the Standard Deduction Used?

The standard deduction is a straightforward element of tax preparation. You simply subtract the applicable standard deduction amount from your gross income to arrive at your adjusted gross income (AGI). Your AGI then forms the basis for calculating your tax liability.

Simplified Example:

Let's say John is single, under 65, and has a gross income of $60,000. The standard deduction for single filers is $13,850 (this amount is subject to change, always consult the current IRS guidelines). John's AGI would be $60,000 - $13,850 = $46,150. His tax liability would then be calculated based on this adjusted gross income.

Standard Deduction vs. Itemized Deductions: Making the Right Choice

Taxpayers have the option of choosing between the standard deduction and itemizing deductions. Itemizing involves listing specific deductions, such as those for charitable contributions, state and local taxes (SALT), medical expenses exceeding a certain percentage of your AGI, and mortgage interest.

Choosing the Right Option:

You should itemize only if the total of your itemized deductions exceeds your standard deduction amount. If your itemized deductions are less than your standard deduction, you'll pay less tax by using the standard deduction. It's crucial to calculate both to make the most informed decision.

The Impact of the Standard Deduction on Tax Liability

The standard deduction directly reduces your taxable income, leading to a lower tax liability. This is particularly beneficial for taxpayers with lower incomes, as it can significantly reduce or even eliminate their tax burden. For higher-income taxpayers, the standard deduction may still be advantageous, depending on the amount of their itemized deductions.

Standard Deduction and Tax Credits: Key Differences

It's important to differentiate between the standard deduction and tax credits. While the standard deduction reduces your taxable income, tax credits directly reduce the amount of tax you owe. Tax credits are generally more valuable than deductions because they directly decrease your tax liability, dollar for dollar.

Standard Deduction and Different Filing Statuses: A Deeper Dive

The standard deduction amount varies significantly based on filing status. Understanding these variations is crucial for accurate tax calculation.

- Single: The standard deduction for single filers is designed for individuals who are not married and do not qualify for other filing statuses.

- Married Filing Jointly: This status offers the highest standard deduction amount, reflecting the combined income and expenses of a married couple. Both spouses benefit from this higher deduction.

- Married Filing Separately: This status results in a lower standard deduction than filing jointly. It’s generally only used in specific situations, such as when one spouse needs to protect themselves from the other’s tax liabilities.

- Head of Household: This status is for unmarried individuals who maintain a household for a qualifying person (such as a child or dependent parent). It provides a standard deduction amount higher than that for single filers but lower than that for those filing jointly.

- Qualifying Widow(er) with Dependent Child: This status is available for a limited number of years after the death of a spouse and requires the presence of a dependent child. It allows for a higher standard deduction, providing some financial relief during a difficult time.

Standard Deduction Changes Over Time: Staying Informed

The standard deduction amount is not static; it's adjusted annually to account for inflation. It's crucial to consult the latest IRS guidelines to ensure accuracy when filing your taxes. Tax laws and regulations are subject to change, and staying updated on these changes is vital for accurate tax preparation.

Common Misconceptions about the Standard Deduction

Several misconceptions surround the standard deduction. It's essential to clarify these to ensure a complete understanding.

-

Myth 1: The standard deduction is only for low-income taxpayers. Reality: The standard deduction benefits taxpayers across all income levels. It simplifies tax filing for many, regardless of their income bracket.

-

Myth 2: The standard deduction applies only to those with dependents. Reality: The standard deduction is available to all eligible taxpayers, with or without dependents. However, the amount might vary based on filing status, which can be influenced by dependents.

-

Myth 3: Itemizing is always better than the standard deduction. Reality: Itemizing is only advantageous if the total amount of your itemized deductions exceeds your standard deduction. Carefully calculate both to make an informed decision.

Utilizing the Standard Deduction Effectively: Tips and Strategies

While the standard deduction is relatively straightforward, strategic planning can maximize its benefits.

- Accurate Record Keeping: Maintain detailed records of your income and expenses. This will assist in determining whether itemizing or using the standard deduction is more advantageous.

- Understanding Filing Status: Choose the appropriate filing status to ensure you receive the correct standard deduction amount. Your filing status can significantly impact your tax liability.

- Staying Informed: Keep abreast of any changes in tax laws and regulations, as these can influence the standard deduction amount and eligibility criteria.

Conclusion: Mastering the Standard Deduction for Optimal Tax Planning

The standard deduction is a cornerstone of the US tax system, providing a simple and effective way for taxpayers to reduce their tax liability. Understanding its purpose, application, and nuances is vital for accurate tax filing and effective tax planning. By carefully considering your individual circumstances, understanding the differences between the standard deduction and itemizing, and staying informed about tax law changes, you can optimize your tax strategy and ensure you're taking full advantage of this important tax provision. Remember to always consult current IRS guidelines for the most up-to-date information.

Latest Posts

Latest Posts

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

-

These Cards Will Get You Drunk Quizlet

Mar 18, 2025

-

Did Quizlet Get Rid Of Q Chat

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about What Is The Standard Deduction Used For Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.