What Was The Result Of John Overdrawing His Checking Account

Breaking News Today

Mar 16, 2025 · 6 min read

Table of Contents

What Was the Result of John Overdrawing His Checking Account? A Comprehensive Look at Overdraft Fees and Their Consequences

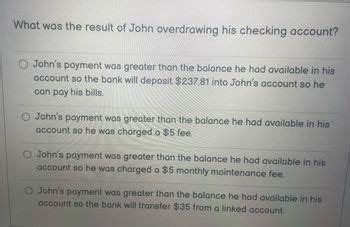

John, like many others, found himself in a predicament: his checking account was overdrawn. This seemingly simple act has far-reaching consequences, impacting not only his finances but also his credit score and overall financial well-being. This article delves deep into the repercussions of overdrawing a checking account, using John's situation as a case study to illustrate the potential outcomes. We’ll explore the various fees involved, the impact on credit, and strategies to avoid similar situations in the future.

Understanding Overdrafts: More Than Just a Negative Balance

An overdraft occurs when you spend more money than you have available in your checking account. This can happen through various means: writing a check for more than your balance, using your debit card for a purchase that exceeds your funds, or even through automated payments. While banks offer overdraft protection in some cases, it often comes with significant costs.

In John’s case, he inadvertently overdrew his account by $150 due to a series of unexpected expenses and a missed bill payment. This seemingly small amount triggered a chain reaction that significantly impacted his financial standing.

The Immediate Consequences: Overdraft Fees

The most immediate consequence of overdrawing is the overdraft fee. These fees vary widely between banks, ranging from $25 to $35 per occurrence, and can accumulate quickly with multiple overdrafts. Some banks even charge a fee for each individual transaction that results in an overdraft. John’s bank charged a $35 overdraft fee for his $150 overdraft.

Beyond the initial fee, John’s bank also implemented returned item fees. This occurs when a transaction, such as a check or automated payment, is rejected due to insufficient funds. This resulted in an additional $20 fee. These fees quickly add up, making a seemingly small overdraft a substantial financial burden.

The Ripple Effect: Long-Term Impacts of Overdrafts

The financial consequences of overdrafts extend far beyond the immediate fees. The impact can be significant and long-lasting.

Damage to Credit Score: A Silent Killer

Many people are unaware that overdrafts can negatively affect their credit score. While overdrafts themselves don’t directly appear on credit reports, their consequences often do. If John’s bank reported his overdraft to the credit bureaus, it could lower his credit score. This could have several adverse effects:

- Higher Interest Rates: Lenders view individuals with lower credit scores as higher risk. Consequently, John could face higher interest rates on loans, credit cards, and mortgages, increasing his borrowing costs significantly.

- Loan Application Rejection: A poor credit score can make it difficult, or even impossible, to secure loans for important purchases like a car or a house. Lenders are less likely to approve loan applications from individuals with a history of overdrafts and related negative marks on their credit report.

- Difficulty Renting an Apartment: Some landlords conduct credit checks as part of the application process. John's poor credit score could hinder his chances of securing suitable rental housing.

- Increased Insurance Premiums: In some cases, insurance companies use credit scores to determine premiums. A lower credit score could lead to higher premiums for car insurance, homeowner's insurance, or even renters insurance.

Negative Impact on Financial Habits

Repeated overdrafts can create a vicious cycle of debt. John, faced with paying off the overdraft fees, might struggle to manage his budget effectively, leading to further overdrafts in the future. This can become a significant financial burden, and can spiral into a cycle of debt difficult to break.

Damaged Bank Relationship

Frequent overdrafts can damage John’s relationship with his bank. The bank might view him as a high-risk customer, potentially leading to account closures or limitations on services. This could include the inability to open new accounts or access certain financial products.

Avoiding Overdrafts: Proactive Strategies for Financial Wellness

Preventing overdrafts requires proactive financial management. Here are several strategies that John, and anyone else, can implement to avoid similar situations:

Budgeting and Financial Planning

Creating a Realistic Budget: The cornerstone of avoiding overdrafts is a well-defined budget. John needs to track his income and expenses meticulously to understand his spending habits and identify areas for potential savings. Using budgeting apps or spreadsheets can help streamline this process.

Emergency Fund: Building an emergency fund is crucial. This fund should ideally cover 3-6 months of living expenses. Having this financial safety net can help cushion the blow of unexpected expenses, preventing the need to overdraw an account.

Prioritizing Bill Payments: Setting up automatic payments for essential bills can prevent late payments and associated fees. John should ensure his accounts have sufficient funds to cover these recurring expenses.

Monitoring Account Balances Regularly

Online Banking and Mobile Apps: John should leverage online banking and mobile banking apps to monitor his account balance regularly. Daily checks can prevent overdrafts by providing immediate awareness of spending patterns and potential shortfalls.

Account Alerts: Most banks offer email or text alerts that notify customers of low balances, impending overdrafts, and completed transactions. Setting up these alerts can provide timely warnings, giving John the chance to take corrective action before an overdraft occurs.

Overdraft Protection Options

While overdraft fees are often high, some banks offer overdraft protection services. These services can prevent overdrafts by transferring funds from a linked savings or credit card account. However, it's crucial to understand the associated fees, which can still be substantial.

Seeking Financial Advice

If John is struggling to manage his finances effectively, seeking professional financial advice is beneficial. A financial advisor can provide personalized guidance on budgeting, debt management, and financial planning, helping him build a strong financial foundation.

The Aftermath: Recouping from an Overdraft

Even after the immediate impact of an overdraft, the consequences can linger. John needs to take proactive steps to recover and prevent future occurrences.

Paying Off Overdraft Fees and Negative Balance

The first step is to pay off the overdraft fees and the negative balance as quickly as possible. This will prevent further fees and help John regain control of his finances.

Building a Positive Credit History

Improving his credit score requires time and consistent effort. John should pay all bills on time and maintain a low credit utilization ratio (the amount of credit used compared to the total credit available). Monitoring his credit report regularly for errors is also crucial.

Developing Healthy Financial Habits

Long-term financial well-being requires adopting healthy financial habits. John needs to consistently follow a budget, track his spending, and save regularly. Regularly reviewing his financial status will help him maintain control and avoid similar situations in the future.

Conclusion: Learning from John's Experience

John’s experience highlights the significant consequences of overdrawing a checking account. The overdraft fees, the potential impact on his credit score, and the overall strain on his financial well-being underscore the importance of proactive financial management. By implementing the strategies outlined above, John, and others facing similar situations, can avoid future overdrafts and build a stronger financial future. Remember, financial responsibility is key to long-term financial stability and peace of mind. Preventing overdrafts is not just about avoiding fees; it's about building a secure financial future.

Latest Posts

Latest Posts

-

Topic 1 Assessment Form A Answer Key

Mar 16, 2025

-

Which Best Describes A Birds Role As It Eats Seeds

Mar 16, 2025

-

What Is The Dose For Emergency Volume Expander

Mar 16, 2025

-

Match Each Term To Its Correct Definition

Mar 16, 2025

-

A 29 Year Old Male With Head Injury

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about What Was The Result Of John Overdrawing His Checking Account . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.