When Determining How Medicare Works With Other Insurance Quizlet

Breaking News Today

Mar 23, 2025 · 7 min read

Table of Contents

When Determining How Medicare Works With Other Insurance: A Comprehensive Guide

Navigating the complexities of Medicare can be daunting, especially when you're also dealing with other insurance coverage like employer-sponsored insurance, Medicaid, or a supplemental plan (Medigap). Understanding how these different coverages interact is crucial to maximizing your benefits and minimizing your out-of-pocket expenses. This comprehensive guide will delve into the intricacies of Medicare coordination with other insurance, answering common questions and providing clear explanations.

Understanding the Basics: Medicare & Other Insurances

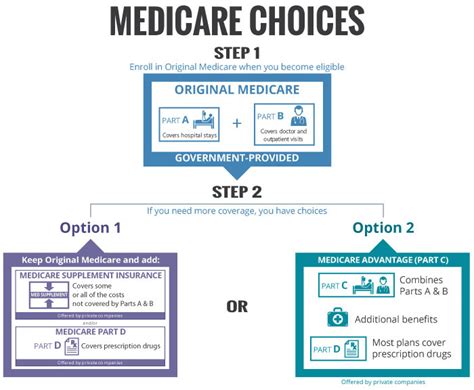

Before we dive into the specifics of how Medicare interacts with other insurances, let's establish a foundational understanding of Medicare itself. Medicare is a federal health insurance program for individuals aged 65 and older, certain younger people with disabilities, and people with End-Stage Renal Disease (ESRD). It consists of four parts:

-

Part A (Hospital Insurance): Covers inpatient hospital care, skilled nursing facilities, hospice, and some home healthcare. Generally, most people don't pay a premium for Part A if they or their spouse worked and paid Medicare taxes for a sufficient period.

-

Part B (Medical Insurance): Covers doctor visits, outpatient care, medical supplies, and preventive services. Part B requires a monthly premium.

-

Part C (Medicare Advantage): Offered by private companies approved by Medicare, Part C combines Part A, Part B, and usually Part D coverage into a single plan. It often includes extra benefits, such as vision, hearing, and dental coverage.

-

Part D (Prescription Drug Insurance): Covers prescription medications. Part D requires a monthly premium and may have a deductible and coverage gap.

When you have other insurance coverage in addition to Medicare, the order in which these insurances pay is crucial. This order is often referred to as "primary" and "secondary" insurance. Generally, your other insurance will be considered primary, meaning it pays first, while Medicare acts as the secondary payer.

Determining Primary and Secondary Insurers: Key Considerations

Several factors determine which insurance is primary and which is secondary:

-

Employment-Based Insurance: If you or your spouse is still actively employed and receiving health insurance coverage through their employer, this will typically be the primary payer. This applies even if you're already eligible for Medicare. Your employer-sponsored insurance will pay first, and Medicare will cover the remaining costs. However, there are exceptions. Some employers might coordinate benefits differently, so it's essential to check your plan documents.

-

Medicaid: Medicaid is a state and federally funded health insurance program for low-income individuals. If you qualify for both Medicare and Medicaid, Medicaid is generally considered the primary insurer, covering your costs before Medicare steps in. This dual coverage is often referred to as "Medi-Medi".

-

Medigap (Medicare Supplement) Insurance: Medigap policies are supplemental insurance plans that help cover some of the out-of-pocket costs associated with Original Medicare (Parts A and B). Medigap policies are always secondary to Medicare. They cannot be primary.

-

TRICARE: For individuals who are eligible for TRICARE (military health insurance), the coordination of benefits with Medicare can be complex and depends on several factors, including your military service status and the type of TRICARE plan you have. It's crucial to contact TRICARE directly to understand how it interacts with your Medicare coverage.

-

VA Health Care: The coordination between VA healthcare and Medicare can also be intricate. Eligibility for VA healthcare is based on several factors, and the priority between VA healthcare and Medicare may vary depending on the services you receive.

How Medicare Works with Other Insurance: Practical Examples

Let's illustrate how this works with some practical scenarios:

Scenario 1: Medicare and Employer-Sponsored Insurance

John is 66 years old and receives health insurance through his employer. He also has Medicare Part A and Part B. In this case, his employer-sponsored insurance is the primary insurer. When he receives medical care, the employer's plan will pay its share first. Any remaining costs will then be covered by Medicare. This often means you'll have lower out-of-pocket costs because the employer plan covers a significant portion of the expenses.

Scenario 2: Medicare and Medicaid (Medi-Medi)

Mary is 70 years old and qualifies for both Medicare and Medicaid due to her low income. Medicaid is considered her primary insurer in this "Medi-Medi" arrangement. Medicaid will cover her healthcare expenses initially, with Medicare serving as the secondary payer only if Medicaid doesn't fully cover the costs. This reduces Mary's out-of-pocket expense significantly.

Scenario 3: Medicare and Medigap

Peter is 68 years old and has Original Medicare (Parts A and B) and a Medigap policy. When he receives medical care, Medicare pays its share first. His Medigap plan then helps cover the remaining costs, including the Medicare deductible and copayments. Medigap plans reduce Peter's financial burden associated with Medicare.

The Importance of Coordination of Benefits (COB)

Understanding Coordination of Benefits (COB) is essential when dealing with multiple insurance plans. COB is a process that ensures that you don't receive duplicate payments for the same medical services. Both your primary and secondary insurers will have COB provisions in their plan documents that outline the procedures and rules for avoiding duplicate payments. If you're dealing with multiple payers, it's vital to provide all your insurance information to each provider to allow the proper application of COB processes.

Common Challenges and Pitfalls

Navigating the interaction between Medicare and other insurance can be challenging. Some common issues include:

-

Incorrect Claim Processing: Claims might be rejected or processed incorrectly due to confusion about the order of payment or incomplete information. It's crucial to keep meticulous records and follow up diligently with both insurers.

-

Delayed Payments: Delays in payments can occur due to administrative issues or disputes between insurance companies. Being proactive in contacting your insurers and following up on claims can help minimize these delays.

-

Understanding Your Responsibility: Even with multiple insurances, you might still have out-of-pocket costs, such as deductibles, copayments, or coinsurance. Understanding your responsibilities and planning accordingly is essential.

-

Lack of Clarity in Plan Documents: Insurance plan documents can be dense and difficult to understand. Take the time to read your plan documents thoroughly or seek assistance from a healthcare professional or insurance expert.

Tips for Effective Navigation

To navigate the complexities of Medicare and other insurances more effectively, consider these strategies:

-

Contact your insurance providers: Reach out to both your primary and secondary insurers to clarify the coordination of benefits and establish a clear understanding of how claims will be processed.

-

Maintain thorough records: Keep detailed records of all medical bills, insurance claims, and payments. This documentation will be essential if disputes arise.

-

Seek professional guidance: If you're struggling to understand how your insurance plans work together, consider consulting with a healthcare professional, insurance agent, or a Medicare counselor.

-

Understand your plan details: Read through all plan documents thoroughly. If something is unclear, contact your insurer to clarify.

-

Be proactive: Don't hesitate to contact your insurers and follow up on claims to ensure that everything is processed correctly and promptly.

Conclusion: Simplifying the Maze of Medicare and Other Insurances

The interaction between Medicare and other insurance plans can be intricate, but understanding the key principles and strategies discussed in this guide can significantly simplify the process. By proactively contacting your insurers, maintaining thorough records, and seeking professional guidance when needed, you can ensure that you receive the maximum benefits from your coverage and minimize your out-of-pocket costs. Remember that the key to successfully navigating this complex landscape lies in thorough preparation, clear communication, and persistent follow-up. Don't hesitate to seek help from qualified professionals if you need assistance in understanding your specific circumstances. Your financial well-being and access to appropriate healthcare depend on effectively coordinating your various insurance plans.

Latest Posts

Latest Posts

-

Which Graph Represents The Following Piecewise Defined Function

Mar 24, 2025

-

How Should Loose Lead Particles Be Removed From Protective Clothing

Mar 24, 2025

-

What Motif Is Addressed In Both Forms Of Poetry

Mar 24, 2025

-

States Have The Most Fragmented Political Culture

Mar 24, 2025

-

More Positive Organizational Outcomes Are Associated With Blank Cultures

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about When Determining How Medicare Works With Other Insurance Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.