Which Is An Example Of A Short-term Investment Quizlet

Breaking News Today

Mar 24, 2025 · 6 min read

Table of Contents

Which is an Example of a Short-Term Investment? A Comprehensive Guide

Investing can feel daunting, especially when faced with a myriad of options. Understanding the difference between short-term and long-term investments is crucial for achieving your financial goals. This comprehensive guide will delve into what constitutes a short-term investment, providing clear examples and exploring the benefits and drawbacks associated with them. We'll also examine how short-term investments fit into a broader financial strategy and address frequently asked questions.

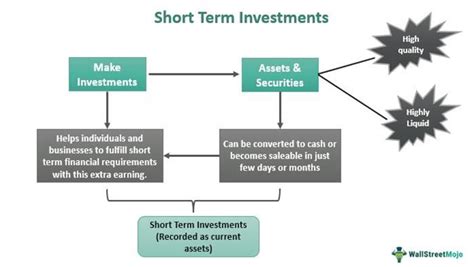

Defining Short-Term Investments

A short-term investment is, simply put, an investment designed to be held for a relatively short period, typically less than one year. The exact timeframe can vary depending on the individual investor's goals and the specific investment vehicle. The primary goal of short-term investing is often capital preservation and liquidity, rather than significant long-term growth. This means investors prioritize easy access to their funds and minimizing the risk of substantial losses.

Key characteristics of short-term investments include:

- Short maturity: The investment's duration is typically less than a year.

- High liquidity: Investors can easily convert the investment back into cash.

- Lower risk: Generally, they carry lower risk compared to long-term investments.

- Lower returns: The potential return on investment (ROI) is usually lower than long-term options.

Examples of Short-Term Investments

Let's explore several common examples of short-term investments, highlighting their features and suitability for different financial situations:

1. High-Yield Savings Accounts (HYSA)

HYSA's are offered by banks and credit unions and provide a higher interest rate than traditional savings accounts. They are incredibly liquid, allowing you to access your funds readily. While the returns might not be spectacular compared to the stock market, they offer a safe haven for your money and protection from inflation (to a certain extent).

Pros:

- High liquidity: Easy access to your funds.

- FDIC insured (in the US): Your deposits are insured up to $250,000 per depositor, per insured bank, for each account ownership category.

- Low risk: Minimal risk of losing your principal.

Cons:

- Lower returns: Interest rates are generally lower than other investment options.

- Interest rate fluctuations: Interest rates can change, impacting your returns.

2. Money Market Accounts (MMA)

Similar to HYSAs, MMAs offer relatively high interest rates and easy access to funds. They often come with check-writing capabilities, providing even greater flexibility. MMAs are typically offered by banks and credit unions and often have a minimum balance requirement.

Pros:

- Liquidity: Easy access to funds.

- Competitive interest rates: Generally offer higher interest rates than regular savings accounts.

- Check-writing capabilities: Allows for convenient payment transactions.

Cons:

- Minimum balance requirements: May require maintaining a minimum balance to avoid fees.

- Interest rate fluctuations: Interest rates are subject to change.

3. Certificates of Deposit (CDs)

CDs are time deposits offered by banks and credit unions. They offer a fixed interest rate for a specific term, ranging from a few months to several years. The catch? You'll usually face penalties for withdrawing your money before the maturity date. Short-term CDs, with maturities of less than a year, are considered short-term investments.

Pros:

- Fixed interest rate: Provides certainty regarding your returns.

- FDIC insured (in the US): Your deposits are insured up to $250,000 per depositor, per insured bank, for each account ownership category.

Cons:

- Limited liquidity: Early withdrawal penalties can significantly impact your returns.

- Lower returns compared to riskier investments: The fixed interest rate might not keep pace with inflation or higher-yielding investments.

4. Treasury Bills (T-Bills)

T-Bills are short-term debt securities issued by the government. They are considered one of the safest investments available, backed by the full faith and credit of the government. T-Bills are sold at a discount and mature at face value, with the difference representing your return.

Pros:

- Extremely low risk: Backed by the government, making them practically risk-free.

- High liquidity: Easily bought and sold in the secondary market.

Cons:

- Low returns: Returns are typically modest compared to other investment options.

5. Money Market Funds (MMFs)

MMFs invest in a portfolio of short-term debt securities, such as T-Bills, commercial paper, and certificates of deposit. They offer diversification and liquidity, making them a suitable option for short-term investment needs. However, it's important to note that while generally considered low-risk, MMFs are not completely risk-free.

Pros:

- Diversification: Spreads risk across various short-term debt instruments.

- Liquidity: Relatively easy access to funds.

Cons:

- Potential for small losses: While rare, MMFs can experience minor losses in value.

- Fees: May incur management fees.

Short-Term Investments vs. Long-Term Investments: A Comparison

The choice between short-term and long-term investments hinges on your financial goals and risk tolerance.

| Feature | Short-Term Investments | Long-Term Investments |

|---|---|---|

| Time Horizon | Less than one year | More than one year |

| Risk | Generally lower | Generally higher |

| Return | Typically lower | Potentially higher |

| Liquidity | High | Lower |

| Examples | HYSAs, MMAs, CDs, T-Bills, MMFs | Stocks, Bonds, Real Estate, Mutual Funds |

Incorporating Short-Term Investments into Your Financial Strategy

Short-term investments play a vital role in a well-rounded financial strategy. They serve as an emergency fund, providing a readily available source of cash for unexpected expenses. They can also act as a bridge to fund short-term goals, such as a down payment on a car or a vacation. Moreover, they provide a safe place to park funds temporarily before investing them in long-term growth opportunities.

Frequently Asked Questions (FAQs)

Q: Are short-term investments suitable for everyone?

A: While short-term investments are generally accessible to most individuals, their suitability depends on individual financial goals and risk tolerance. Those with low risk tolerance and a need for easy access to funds may find them ideal.

Q: What are the risks associated with short-term investments?

A: While generally considered lower risk, short-term investments are not completely risk-free. Interest rate fluctuations can impact returns, and some investments, like MMFs, carry a small risk of losing principal.

Q: How do I choose the right short-term investment for me?

A: Consider factors like your risk tolerance, liquidity needs, and time horizon. If you need easy access to your funds and prioritize safety, HYSAs or MMAs might be suitable. If you're willing to lock up your money for a specific period for a slightly higher return, a CD could be an option.

Q: Can short-term investments help me build wealth?

A: Short-term investments are not typically designed for significant wealth building. Their primary purpose is capital preservation and liquidity. For wealth building, a diversified portfolio including long-term investments is essential.

Q: Should I invest all my money in short-term investments?

A: No. A balanced approach is usually recommended. Allocate a portion of your savings to short-term investments for emergency funds and short-term goals, while investing the remaining portion in a diversified portfolio of long-term investments for wealth building.

Conclusion

Understanding the nuances of short-term investments empowers you to make informed financial decisions. By carefully considering your risk tolerance, liquidity needs, and financial goals, you can select the most appropriate short-term investment options to safeguard your funds and achieve your short-term financial objectives. Remember to always consult a qualified financial advisor for personalized guidance tailored to your specific circumstances. This comprehensive guide has provided a solid foundation for understanding short-term investments; however, continuous learning and staying informed about market trends are crucial for effective financial management.

Latest Posts

Latest Posts

-

Poverty Is The Sole Cause Of Crime

Mar 26, 2025

-

Which Statement Is True About Adaptable Workers

Mar 26, 2025

-

A Set Of Characters With The Same Design And Shape

Mar 26, 2025

-

The Main Therapeutic Goal Of Rebt Is To

Mar 26, 2025

-

Presence Of Chronic Suprapubic Catheter Icd 10

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Which Is An Example Of A Short-term Investment Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.