Which Is The Best Definition Of Inflation Quizlet

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

Which is the Best Definition of Inflation? A Comprehensive Guide

Inflation. It's a word we hear constantly, whether it's in the news, during economic discussions, or even in casual conversations. But what exactly is inflation, and what's the best way to define it? This comprehensive guide will delve into various definitions of inflation, comparing and contrasting them to ultimately arrive at the most accurate and useful understanding. We’ll also explore the nuances and implications of inflation, making sure to address common misconceptions.

Understanding the Core Concept: What is Inflation?

At its simplest, inflation is a general increase in the prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

However, this simple definition, while accurate, lacks the depth needed for a full understanding. Let's explore some more nuanced definitions and explore their strengths and weaknesses.

Different Definitions, Different Perspectives:

Definition 1: The Increase in the Average Price Level: This definition focuses on the average price of a basket of goods and services. It uses price indices like the Consumer Price Index (CPI) or the Producer Price Index (PPI) to measure the overall change in prices. While widely used, this definition can be misleading if the composition of the basket isn't representative of the average consumer's spending habits. Changes in the basket's composition can artificially inflate or deflate the reported inflation rate.

Definition 2: A Persistent Increase in the General Price Level: This definition adds the crucial element of persistence. A single spike in prices, perhaps due to a temporary supply shock, doesn't necessarily constitute inflation. Inflation implies a sustained and ongoing upward trend in prices. This addresses the issue of temporary fluctuations that can skew the average price level calculations.

Definition 3: A Situation Where Too Much Money Chases Too Few Goods: This is the monetarist perspective on inflation, emphasizing the role of the money supply. An excessive increase in the money supply without a corresponding increase in the production of goods and services leads to higher demand and, consequently, higher prices. This definition highlights the supply-side element of inflation and helps explain why printing excessive amounts of money can be inflationary.

Definition 4: A Decline in the Purchasing Power of Money: This definition directly addresses the impact of inflation on consumers. As prices rise, the amount of goods and services that can be purchased with a given amount of money decreases. This emphasizes the real-world consequences of inflation for individuals and households. This is a strong definition because it directly reflects the felt experience of inflation.

Definition 5: A Self-Perpetuating Cycle of Rising Prices and Wages: This definition emphasizes the feedback loop often associated with inflation. As prices rise, workers demand higher wages to maintain their purchasing power. These higher wages, in turn, increase production costs, leading to further price increases. This is a powerful way of understanding inflationary spirals. This cycle, if unchecked, can lead to runaway inflation (hyperinflation).

Which Definition is Best? A Comparative Analysis

While each definition offers valuable insights, the best definition of inflation combines elements from definitions 2 and 4: Inflation is a persistent increase in the general price level, leading to a decline in the purchasing power of money.

This definition is superior because:

- It emphasizes persistence: It avoids the misinterpretation caused by temporary price fluctuations.

- It highlights the impact on purchasing power: It directly relates the abstract concept of inflation to the tangible experience of consumers.

- It's broad enough to encompass various causes: It doesn't limit itself to a single theoretical framework, like monetarism.

Beyond the Definition: Understanding the Causes and Consequences of Inflation

Understanding the definition is only the first step. To truly grasp the concept of inflation, we need to examine its causes and consequences.

Causes of Inflation:

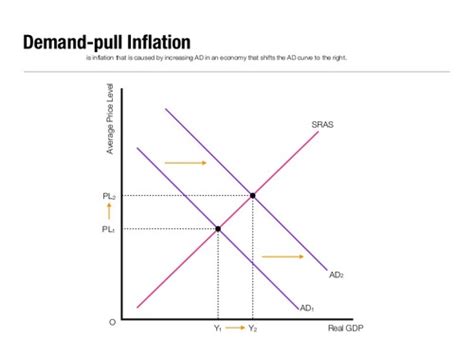

- Demand-Pull Inflation: This occurs when aggregate demand exceeds aggregate supply, leading to increased prices. This can be driven by factors such as increased consumer spending, government spending, or investment.

- Cost-Push Inflation: This occurs when the costs of production, such as wages or raw materials, increase, leading to higher prices. This can be caused by supply shocks, such as oil price increases, or by strong labor unions demanding higher wages.

- Built-in Inflation: This occurs when inflationary expectations become self-fulfilling. If people expect prices to rise, they may demand higher wages, which, in turn, leads to higher prices. This creates a vicious cycle.

- Monetary Inflation: As previously discussed, excessive growth in the money supply without a corresponding increase in output can lead to inflation. Central banks play a crucial role in managing the money supply to control inflation.

Consequences of Inflation:

- Reduced Purchasing Power: The most direct consequence is the erosion of purchasing power. Consumers can buy fewer goods and services with the same amount of money.

- Uncertainty and Instability: High and unpredictable inflation creates uncertainty for businesses and consumers, making it difficult to plan for the future. This can stifle investment and economic growth.

- Distorted Resource Allocation: Inflation can distort resource allocation as businesses struggle to anticipate future prices and adjust their investments accordingly.

- Increased Income Inequality: Inflation disproportionately affects those on fixed incomes, such as retirees, as their purchasing power diminishes faster than those with incomes that can keep pace with inflation.

- Shoe Leather Costs: Inflation encourages people to minimize their cash holdings, leading to increased transactions costs (running around to the bank, etc.).

- Menu Costs: Businesses incur costs in constantly updating their prices to reflect changes in inflation.

Measuring Inflation: Key Indices and Their Limitations

Inflation is typically measured using price indices, such as:

- Consumer Price Index (CPI): This measures the average change in prices paid by urban consumers for a basket of consumer goods and services.

- Producer Price Index (PPI): This measures the average change in prices received by domestic producers for their output.

- GDP Deflator: This is a broader measure of inflation that accounts for changes in the prices of all goods and services produced in an economy.

These indices, while useful, have limitations:

- Substitution Bias: Indices often struggle to account for consumers substituting away from more expensive goods to less expensive ones.

- Quality Bias: Improvements in the quality of goods and services can artificially inflate the price index.

- New Product Bias: Introducing new products can take time to reflect accurately in price indices.

Conclusion: Mastering the Definition and Implications of Inflation

Understanding inflation is crucial for navigating the complexities of the modern economy. While there are several ways to define inflation, the most accurate and useful definition encompasses the persistent increase in the general price level and its corresponding decline in the purchasing power of money. By understanding the causes and consequences of inflation, and the limitations of its measurement, we can better analyze and respond to its effects on our lives and the economy as a whole. It's a dynamic concept, requiring continuous learning and adaptation to stay informed in a constantly evolving economic landscape. Further exploration into specific inflationary periods and their unique contexts will enhance this understanding significantly. Remember to always critically assess sources of information on inflation and to consider multiple perspectives for a comprehensive understanding.

Latest Posts

Latest Posts

-

Typically High Inflation Is A Sign Of

Mar 18, 2025

-

Behaviorism Focuses On Making Psychology An Objective Science By

Mar 18, 2025

-

Debt Is The Most Aggressively Marketed Product

Mar 18, 2025

-

Excessive Eating Caused By Cellular Hunger Is Called

Mar 18, 2025

-

Administrative Civil Or Criminal Sanctions May Be Imposed

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Which Is The Best Definition Of Inflation Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.