Which Of The Following Accounts Is An Asset

Breaking News Today

Mar 24, 2025 · 6 min read

Table of Contents

Which of the Following Accounts is an Asset? A Deep Dive into Accounting Fundamentals

Understanding assets is fundamental to grasping basic accounting principles. This comprehensive guide will delve into the definition of an asset, explore various types of assets, and help you confidently identify assets from a list of accounts. We'll go beyond simple definitions, exploring the nuances and providing practical examples to solidify your understanding.

What is an Asset?

An asset is anything a company owns that has monetary value and is expected to provide future economic benefit. This benefit can manifest in many ways, such as generating revenue, reducing costs, or facilitating efficient operations. Assets are resources controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity. This definition highlights three crucial aspects:

- Control: The entity must have control over the asset.

- Past Events: The asset must have resulted from a past transaction or event.

- Future Economic Benefits: The asset is expected to provide future value.

Types of Assets:

Assets are broadly categorized into two main types: current assets and non-current (long-term) assets.

1. Current Assets: These are assets that are expected to be converted into cash or used up within one year or the company's operating cycle, whichever is longer. Common examples include:

- Cash and Cash Equivalents: This includes money in the bank, petty cash, and highly liquid investments that can be readily converted to cash.

- Accounts Receivable: Money owed to the company by customers for goods or services sold on credit.

- Inventory: Goods held for sale in the ordinary course of business. This includes raw materials, work-in-progress, and finished goods.

- Prepaid Expenses: Expenses paid in advance, such as rent, insurance, or supplies. These represent future benefits.

- Short-Term Investments: Investments with a maturity date of less than one year.

2. Non-Current (Long-Term) Assets: These assets are expected to provide benefits for more than one year or the operating cycle. They are less liquid than current assets. Examples include:

- Property, Plant, and Equipment (PP&E): This includes land, buildings, machinery, equipment, and vehicles used in the business. These assets are depreciated over their useful lives.

- Intangible Assets: These are non-physical assets with value, such as patents, copyrights, trademarks, and goodwill. These assets are amortized over their useful lives.

- Long-Term Investments: Investments with a maturity date of more than one year.

- Deferred Tax Assets: These are potential tax benefits that are expected to be realized in the future.

Identifying Assets: A Practical Approach

Let's move beyond theoretical definitions and apply our knowledge to practical scenarios. When presented with a list of accounts, ask yourself these key questions:

- Does the company own it? If not, it's not an asset.

- Does it have monetary value? If it's worthless, it's not an asset.

- Does it provide future economic benefit? If not, it's not an asset.

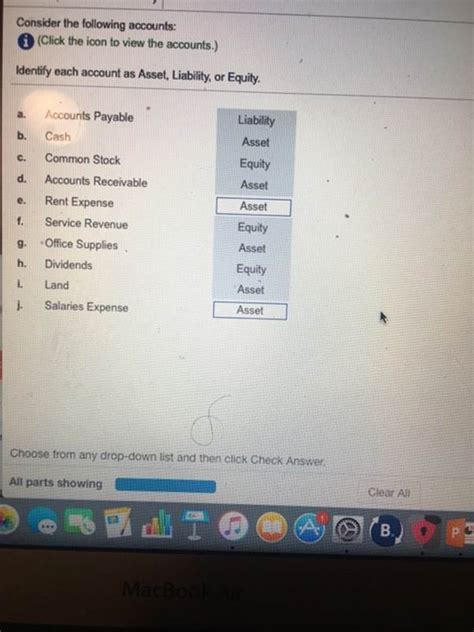

Examples of Accounts and Their Classification:

Let's examine several common accounts and determine whether they represent assets:

- Cash: Asset (Current Asset) - Represents readily available funds.

- Accounts Receivable: Asset (Current Asset) – Money owed to the company by customers.

- Inventory: Asset (Current Asset) - Goods held for sale.

- Land: Asset (Non-Current Asset) - Property owned by the company.

- Buildings: Asset (Non-Current Asset) - Structures owned and used by the company.

- Equipment: Asset (Non-Current Asset) - Machinery and tools used in operations.

- Vehicles: Asset (Non-Current Asset) - Transportation assets owned by the company.

- Patents: Asset (Non-Current Asset) - Intellectual property rights.

- Copyrights: Asset (Non-Current Asset) - Legal rights to original works.

- Trademarks: Asset (Non-Current Asset) - Brand names and logos.

- Goodwill: Asset (Non-Current Asset) - The value of a company's reputation and customer relationships.

- Accounts Payable: Liability - Money owed to suppliers. This is not an asset.

- Salaries Payable: Liability - Money owed to employees. This is not an asset.

- Loans Payable: Liability - Money borrowed from lenders. This is not an asset.

- Revenue: Equity/Income - Income generated from sales. This is not an asset.

- Expenses: Equity/Expenses - Costs incurred in running the business. This is not an asset.

- Retained Earnings: Equity - Accumulated profits reinvested in the business. This is not an asset.

- Common Stock: Equity - Represents ownership in the company. This is not an asset.

- Prepaid Insurance: Asset (Current Asset) - Insurance premiums paid in advance.

- Depreciation Expense: Expense - Allocation of the cost of an asset over its useful life. This is not an asset.

- Amortization Expense: Expense - Allocation of the cost of an intangible asset over its useful life. This is not an asset.

The Importance of Accurate Asset Identification

Accurate identification of assets is crucial for several reasons:

- Financial Reporting: Assets are a key component of the balance sheet, a crucial financial statement. Incorrect asset reporting can lead to misleading financial information.

- Tax Purposes: The value and type of assets held by a company can impact its tax liability.

- Investment Decisions: Investors rely on accurate financial information, including asset details, to make informed investment decisions.

- Creditworthiness: Lenders assess a company's assets to determine its creditworthiness and ability to repay loans.

- Business Valuation: The value of a company's assets is a key factor in determining its overall worth.

Distinguishing Assets from Other Account Types

It's vital to differentiate assets from other account types, particularly liabilities and equity.

- Liabilities: These are obligations a company owes to others, such as accounts payable, loans payable, and salaries payable. They represent future sacrifices of economic benefits.

- Equity: This represents the owners' stake in the company. It's the residual interest in the assets after deducting liabilities.

Scenario-Based Examples:

Let's consider some scenarios to solidify our understanding:

Scenario 1: A company purchases a new delivery truck for $50,000. The truck is an asset (non-current asset).

Scenario 2: A company sells goods on credit for $10,000. The resulting account receivable is an asset (current asset).

Scenario 3: A company pays $12,000 for rent in advance. The prepaid rent is an asset (current asset).

Scenario 4: A company receives a loan of $200,000. The loan itself is not an asset; it’s a liability (loans payable). However, the cash received from the loan becomes a current asset.

Conclusion:

Identifying assets is a fundamental skill in accounting. By understanding the definition of an asset and the various types of assets, you can confidently analyze financial statements and make informed business decisions. Remember the three key criteria: company ownership, monetary value, and the provision of future economic benefits. Through consistent practice and a thorough understanding of accounting principles, you'll become proficient in differentiating assets from other accounts, ensuring the accuracy of financial reporting and facilitating sound financial management. Always consult with a qualified accountant for specific financial advice related to your business.

Latest Posts

Latest Posts

-

What Was Churchill Hoping To Encourage With This Speech

Mar 28, 2025

-

What Is The Essence Of Qi Review

Mar 28, 2025

-

Which Evasion Aids Can Assist You With Making Contact

Mar 28, 2025

-

What Should You Check Once You Start Your Vehicle

Mar 28, 2025

-

The Variability Of A Statistic Is Described By

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Accounts Is An Asset . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.