Which Of The Following Illustrates An Opportunity Cost

Breaking News Today

Mar 14, 2025 · 6 min read

Table of Contents

Which of the Following Illustrates an Opportunity Cost? Understanding the True Cost of Choices

Opportunity cost. A seemingly simple concept, yet one that forms the bedrock of economic decision-making. It's the silent, often unseen, cost of choosing one option over another. It's not about money directly spent, but about the potential benefits forgone. This article dives deep into the concept of opportunity cost, exploring its nuances, providing examples, and helping you discern when and how it applies. We'll dissect several scenarios to clearly illustrate what constitutes an opportunity cost and what doesn't.

Defining Opportunity Cost: More Than Just Money

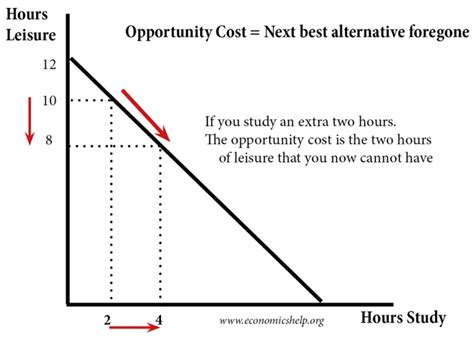

The most straightforward definition of opportunity cost is the value of the next best alternative forgone when making a decision. It's the potential benefit that you give up when choosing one alternative over another. This is crucial because resources – whether time, money, or raw materials – are always scarce. When you allocate resources to one use, you automatically limit their availability for other uses.

Why Understanding Opportunity Cost is Crucial

Grasping opportunity cost goes beyond simple accounting. It's integral to:

- Rational Decision-Making: By considering the opportunity cost, you can make more informed choices that maximize your overall benefit. A decision that appears financially attractive might be a poor choice when the opportunity cost is high.

- Resource Allocation: Businesses and individuals utilize opportunity cost analysis to efficiently allocate scarce resources to their most profitable or fulfilling uses.

- Economic Modeling: Opportunity cost is a fundamental concept in various economic models, such as production possibility frontiers (PPFs) and cost-benefit analyses.

- Personal Finance: Understanding opportunity cost allows for better investment decisions, career choices, and time management.

Examples that DO Illustrate Opportunity Cost

Let's explore several scenarios that clearly demonstrate opportunity cost:

1. The College Decision:

Imagine you're deciding between attending college and starting a job immediately after high school. Let's assume the potential yearly salary from the job is $30,000. The opportunity cost of attending college is not just the tuition fees, but also the lost wages you would have earned had you started working instead. This lost income represents a significant opportunity cost, even if you eventually earn a higher salary with a college degree.

Opportunity Cost: The potential $30,000 yearly income forgone by choosing college.

2. Investing in Stocks vs. Bonds:

Suppose you have $10,000 to invest. You're considering investing it in stocks or bonds. If you invest in stocks, you have a chance of higher returns, but also a higher risk of losing money. If you invest in bonds, you'll likely have lower returns, but also lower risk. If you choose stocks, the opportunity cost is the potential return you could have earned from investing in bonds. Conversely, if you choose bonds, the opportunity cost is the potential higher return you could have gained from stocks.

Opportunity Cost: The potential return from the investment you didn't choose.

3. Time Management: Work vs. Leisure:

Consider the choice between working an extra hour to earn an additional $25 and spending that hour relaxing. The opportunity cost of relaxing is the $25 you could have earned. Conversely, the opportunity cost of working is the relaxation and leisure you sacrificed. This highlights that opportunity cost isn't just about money; it encompasses the value of your time.

Opportunity Cost: The value of the forgone leisure time or the potential earnings, depending on the choice made.

4. Government Spending Priorities:

Governments face significant opportunity cost challenges. If they allocate a large budget towards defense spending, the opportunity cost might be reduced investment in education or healthcare. The decision involves weighing the benefits of enhanced security against the potential benefits of a better-educated workforce or improved public health.

Opportunity Cost: The potential benefits from the public services that receive less funding due to the increased defense spending.

5. Business Expansion Decisions:

A company considering expanding its operations into a new market must consider the opportunity cost. Investing resources (money, time, personnel) in the new market means those resources are unavailable for other projects, such as research and development, marketing in existing markets, or paying down debt. The opportunity cost is the potential profits or improvements that could have resulted from alternative uses of those resources.

Opportunity Cost: The potential profits or improvements forgone by choosing to expand into the new market.

Examples that DO NOT Illustrate Opportunity Cost

It's equally important to understand scenarios where opportunity cost is not directly applicable:

1. Sunk Costs:

Sunk costs are expenses that have already been incurred and cannot be recovered. For example, if you've already paid for a non-refundable concert ticket and decide not to go, the money spent on the ticket is a sunk cost. It's not an opportunity cost because you cannot reclaim it. The opportunity cost is what you could have done with that time instead of attending the concert (or not attending, as the case may be).

2. Irrelevant Alternatives:

Opportunity cost relates only to feasible alternatives. If considering buying a car, the opportunity cost is not owning a private jet. It's comparing the cost and benefits of different realistic car choices or the benefits of not buying a car at all and using alternative transportation methods.

3. Free Goods:

If something is genuinely free, it doesn't involve an opportunity cost. For instance, picking up a free pen from a promotional event doesn't have a direct opportunity cost unless you had to spend time acquiring it, which could have been spent productively elsewhere.

Calculating and Applying Opportunity Cost

While not always quantifiable precisely, understanding the process of calculating opportunity cost is vital. It generally involves:

- Identifying Alternatives: List all feasible options available.

- Ranking Alternatives: Rank the options based on their desirability or potential benefits.

- Determining the Next Best Alternative: Identify the option you would have chosen if your initial choice wasn't available.

- Assessing the Value: Estimate the value of the benefits you would have received from the next best alternative. This value represents your opportunity cost.

Often, this involves a comparative analysis of potential returns, profits, or benefits from each option. The difference between the chosen option's value and the next best alternative's value signifies the opportunity cost.

Opportunity Cost in Different Contexts

The concept of opportunity cost spans various fields:

- Personal Finance: Choosing between saving for retirement or investing in a new house involves comparing potential returns and risks.

- Business Decisions: A company deciding whether to launch a new product or improve an existing one must weigh the potential profits and the resources required.

- Government Policy: Decisions about public spending (infrastructure, healthcare, education) always involve trade-offs and opportunity costs.

- Environmental Economics: Protecting a natural habitat versus developing it for economic gain requires considering the ecological and economic opportunity costs.

Conclusion: Embracing the Inevitability of Choice

Opportunity cost is an intrinsic part of decision-making. Every choice involves forgoing something else. By acknowledging and analyzing opportunity costs, we can make more informed and rational choices, maximizing our overall well-being, whether as individuals, businesses, or governments. Learning to accurately assess and weigh opportunity costs is a skill that pays dividends in all aspects of life. It's not about avoiding choices, but about making the best choices informed by a realistic understanding of their true cost – the opportunity cost.

Latest Posts

Latest Posts

-

Draw A Scatter Diagram That Might Represent Each Relation

May 09, 2025

-

You Are Providing Care For Mrs Bove

May 09, 2025

-

Display All The Comments In This Worksheet At Once

May 09, 2025

-

Dendrite Is To Axon As Is To

May 09, 2025

-

The Change In An Objects Position Is Called

May 09, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Illustrates An Opportunity Cost . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.