Which Of The Following Statements Best Represents The Accounting Equation

Breaking News Today

Mar 24, 2025 · 6 min read

Table of Contents

- Which Of The Following Statements Best Represents The Accounting Equation

- Table of Contents

- Which of the Following Statements Best Represents the Accounting Equation?

- Understanding the Accounting Equation

- Different Representations of the Accounting Equation

- Which Statement Best Represents the Accounting Equation?

- Implications of the Accounting Equation for Financial Reporting and Decision-Making

- Financial Reporting

- Decision-Making

- Illustrative Example

- Advanced Considerations

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Which of the Following Statements Best Represents the Accounting Equation?

The accounting equation is a fundamental concept in accounting, representing the relationship between a company's assets, liabilities, and equity. Understanding this equation is crucial for anyone involved in financial management, accounting, or business analysis. This article will delve deep into the accounting equation, exploring its various representations and clarifying which statement best encapsulates its core meaning. We will also discuss the implications of this equation for financial reporting and decision-making.

Understanding the Accounting Equation

The accounting equation, also known as the balance sheet equation, states that a company's assets are always equal to the sum of its liabilities and equity. This fundamental principle forms the basis of double-entry bookkeeping, ensuring that every transaction affects at least two accounts, maintaining the balance of the equation.

The equation is typically represented as:

Assets = Liabilities + Equity

Let's break down each component:

-

Assets: These are resources controlled by the company as a result of past events and from which future economic benefits are expected to flow to the entity. Examples include cash, accounts receivable, inventory, property, plant, and equipment (PP&E), and investments. Assets represent what a company owns.

-

Liabilities: These are present obligations of the entity arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. Examples include accounts payable, salaries payable, loans payable, and bonds payable. Liabilities represent what a company owes.

-

Equity: This represents the residual interest in the assets of the entity after deducting all its liabilities. For a company, equity is often referred to as shareholder's equity or owner's equity. It reflects the owners' stake in the business. Equity can be increased through investments by owners or retained earnings (profits that are not distributed as dividends).

Different Representations of the Accounting Equation

While the standard representation (Assets = Liabilities + Equity) is the most common, the equation can be rearranged to highlight different aspects. These rearrangements are equally valid and often helpful in understanding specific financial situations. For example:

-

Assets - Liabilities = Equity: This version emphasizes the calculation of equity. It shows that equity is the difference between what a company owns (assets) and what it owes (liabilities). This is particularly useful when analyzing a company's net worth.

-

Assets - Equity = Liabilities: This representation highlights the calculation of liabilities. It shows that liabilities are the difference between a company's assets and its equity. This perspective can be helpful in understanding the financing structure of a business.

-

Equity = Assets - Liabilities: This is a direct rearrangement of the standard equation, explicitly defining equity. This form is useful for quickly determining the value of the owner's stake in the company.

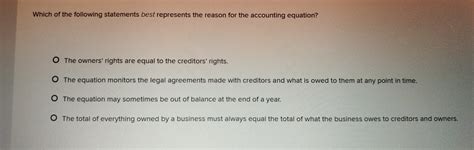

Which Statement Best Represents the Accounting Equation?

The best representation of the accounting equation depends on the context. However, the most fundamental and universally accepted representation is:

Assets = Liabilities + Equity

This statement concisely captures the core principle: the total resources controlled by a company (assets) must always equal the combined claims against those resources by creditors (liabilities) and owners (equity). This equation is the foundation upon which all financial statements are built and provides a crucial framework for understanding a company's financial position.

While other rearrangements of the equation are useful for specific analyses, the standard form provides the most comprehensive and easily understood representation of the basic accounting relationship.

Implications of the Accounting Equation for Financial Reporting and Decision-Making

The accounting equation is not just a theoretical concept; it has significant practical implications for financial reporting and decision-making.

Financial Reporting

-

Balance Sheet Preparation: The accounting equation is the cornerstone of the balance sheet, a key financial statement showing a company's financial position at a specific point in time. The equation ensures that the balance sheet always balances, with total assets equaling total liabilities and equity.

-

Ensuring Accuracy: The equation helps to identify potential errors in accounting records. If the equation doesn't balance, it indicates a mistake somewhere in the accounting process, requiring further investigation and correction. This is crucial for maintaining the integrity of financial reports.

-

Financial Statement Analysis: Analysts use the accounting equation to assess a company's financial health and stability. By examining the relative proportions of assets, liabilities, and equity, they can gain insights into a company's leverage, liquidity, and solvency.

Decision-Making

-

Investment Decisions: Investors use the accounting equation to evaluate the financial strength and risk profile of companies before investing. A company with a higher equity-to-liability ratio, for instance, might be considered less risky.

-

Credit Decisions: Lenders use the equation to assess a borrower's creditworthiness. A company with a higher proportion of assets compared to liabilities is generally viewed as a safer borrower.

-

Internal Management Decisions: Managers use the equation to monitor the financial performance of their companies and make informed decisions regarding resource allocation, investment opportunities, and cost control. Analyzing changes in assets, liabilities, and equity over time can provide valuable insights into a company's operational efficiency and financial health.

Illustrative Example

Let's consider a simple example: a small business with the following:

- Cash: $10,000

- Accounts Receivable: $5,000

- Inventory: $3,000

- Equipment: $20,000

- Accounts Payable: $8,000

- Owner's Equity: $20,000

Applying the accounting equation:

Assets: $10,000 + $5,000 + $3,000 + $20,000 = $38,000 Liabilities: $8,000 Equity: $30,000

The equation balances: $38,000 (Assets) = $8,000 (Liabilities) + $30,000 (Equity)

This simple example demonstrates how the accounting equation works in practice and how it ensures that the financial records of a business are consistent and accurate.

Advanced Considerations

The accounting equation also applies to more complex accounting scenarios, including:

-

Transactions Affecting Multiple Accounts: Many transactions impact more than one account. For example, purchasing equipment on credit increases both an asset (equipment) and a liability (accounts payable). The equation remains balanced as the increase in assets is offset by an equal increase in liabilities.

-

Adjusting Entries: At the end of an accounting period, adjusting entries are made to ensure that financial statements accurately reflect the company's financial position. These entries, while complex, still adhere to the fundamental principle of the accounting equation.

-

Consolidated Financial Statements: For companies with subsidiaries, consolidated financial statements combine the financial data of all entities. Even in this complex scenario, the accounting equation still holds true at the consolidated level.

Conclusion

The accounting equation, represented most effectively as Assets = Liabilities + Equity, is a fundamental principle of accounting. Its understanding is essential for anyone involved in financial management, accounting, or business analysis. The equation not only provides a framework for preparing financial statements but also plays a crucial role in financial analysis and decision-making. By comprehending the equation and its various applications, individuals can gain valuable insights into the financial health and stability of businesses, facilitating better informed financial decisions. Understanding the relationship between assets, liabilities, and equity is not just about balancing numbers; it’s about understanding the true financial picture of a company.

Latest Posts

Latest Posts

-

Which Of The Following Does Not Relate To System Design

Mar 27, 2025

-

A Is Placed On A Tank To Protect The Valves

Mar 27, 2025

-

Which Business Opportunity Involves Higher Start Up Costs

Mar 27, 2025

-

Which Of The Following Is Not An Ingredient In Paella

Mar 27, 2025

-

Are Like Pieces Of A Puzzle An Unauthorized Recipient

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Statements Best Represents The Accounting Equation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.