Why Might Loans Obtained From Families And Friends Be Problematic

Breaking News Today

Mar 17, 2025 · 6 min read

Table of Contents

Why Might Loans Obtained from Families and Friends Be Problematic?

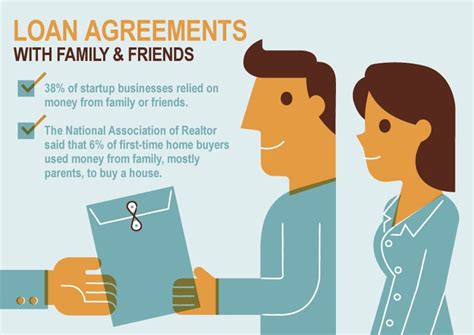

Borrowing money can be a stressful experience, but it’s often made even more complicated when the lender is a family member or friend. While it might seem like a convenient and potentially less formal option compared to traditional financial institutions, loans obtained from loved ones can lead to a range of problems that can severely strain relationships and create lasting financial difficulties. This article delves into the potential pitfalls of borrowing from family and friends, offering insights into why it's often a less-than-ideal solution and exploring alternative options.

The Emotional Tightrope: Navigating Relationships and Finances

One of the most significant challenges when borrowing from family or friends is the inherent emotional entanglement. Money, as we all know, is a sensitive subject, and mixing it with personal relationships can create a minefield of potential issues. Even with the best of intentions, a loan can quickly transform a close bond into a strained and uncomfortable one.

Damage to Relationships

The biggest risk is the potential damage to relationships. If repayments are missed, or if disagreements arise regarding terms, the emotional fallout can be devastating. The casual nature of the loan can easily lead to misunderstandings, with differing expectations about repayment schedules, interest rates (or lack thereof), and overall communication. What starts as a seemingly simple favor can escalate into resentment, anger, and ultimately, the fracturing of a cherished relationship.

Unrealistic Expectations

Family and friends may have unrealistic expectations about the loan's repayment. They may underestimate the borrower's financial challenges or overestimate their capacity to repay. This can lead to pressure, stress, and further damage to the relationship. Conversely, the borrower might underestimate the lender’s financial needs, placing undue strain on the lender’s own resources. Open and honest communication about financial realities, both for the borrower and the lender, is crucial but often lacking in these situations.

Blurred Lines and Resentment

The informal nature of these loans often leads to blurred lines regarding repayment schedules and interest. The lack of a formal written agreement can create confusion and resentment down the line. One party may feel taken advantage of, while the other may feel unjustly pressured. This ambiguity can fuel conflicts and erode trust, leaving irreparable damage to the relationship.

The Financial Fallout: Unexpected Consequences

Beyond the emotional toll, borrowing from family and friends carries significant financial risks for both the borrower and the lender. These risks often outweigh the perceived benefits of convenience and informality.

Lack of Legal Protection

Unlike loans from banks or credit unions, loans from family and friends generally lack the legal protections afforded by formal contracts. This means that recovering the money if the borrower defaults can be incredibly difficult and costly. The lender has limited legal recourse, often resorting to strained conversations and potentially damaging confrontations instead of a legally sound process.

Impact on Credit Score

While loans from family and friends don't directly impact credit scores, the financial strain caused by missed payments or the accumulation of debt can indirectly affect creditworthiness. If the borrower's financial situation deteriorates significantly due to the loan, it could lead to missed payments on other credit accounts, ultimately harming their credit score.

Financial Strain on the Lender

Lending money, even to loved ones, carries financial risk. The lender may experience financial hardship if the borrower defaults on the loan. This can significantly impact the lender's own financial stability, especially if a large sum of money is involved. It’s crucial for lenders to consider their own financial position before extending a loan, ensuring they can afford to lose the money if necessary.

Potential for Conflicts of Interest

The personal nature of the loan can also create conflicts of interest. For example, the lender might pressure the borrower to make decisions that benefit the lender rather than the borrower’s best interests. This can range from influencing investment choices to imposing unreasonable repayment terms. This dynamic can easily compromise the borrower’s autonomy and exacerbate existing financial troubles.

Avoiding the Pitfalls: Strategies for Responsible Borrowing and Lending

While borrowing from family and friends can be tempting, it’s essential to carefully weigh the risks and consider alternative options. Here are some strategies to help navigate these situations responsibly:

Formalizing the Agreement

If you decide to borrow from a family member or friend, create a formal written agreement outlining all terms and conditions. This should include the loan amount, interest rate (even if it's 0%), repayment schedule, and consequences of default. This formality protects both parties and minimizes misunderstandings. Having a clear and legally sound agreement can prevent future conflicts and disputes.

Setting Realistic Expectations

Be honest and transparent about your financial situation and repayment capabilities. Manage expectations by clearly explaining any potential delays or challenges you might face in repaying the loan. Open communication is key to building and maintaining trust and avoiding misunderstandings. For lenders, it's crucial to establish a realistic repayment plan that accounts for potential unforeseen circumstances on the borrower's side.

Exploring Alternative Financing Options

Before turning to family or friends, explore other financing options, such as personal loans from banks or credit unions, or online lenders. These options offer better legal protection and structured repayment plans. While the interest rates might be higher, the clarity and legal safeguards are often worth the extra cost.

Seeking Professional Financial Advice

If you're facing significant financial difficulties, consider seeking advice from a qualified financial advisor. They can help you create a budget, manage debt, and explore solutions to your financial challenges. Similarly, lenders can seek professional advice to assess the risk associated with the loan and make informed decisions.

Prioritizing Open and Honest Communication

Consistent and open communication is paramount throughout the loan process. Regular updates about the borrower's financial situation and transparent discussions about any potential challenges can prevent misunderstandings and maintain a healthy relationship. This ongoing dialogue is crucial for both parties to manage expectations and address concerns promptly.

The Bottom Line: Weighing the Risks and Rewards

Borrowing from family and friends can appear appealing due to its convenience and informal nature. However, the potential risks to relationships and finances often outweigh these perceived advantages. The emotional toll, lack of legal protection, and potential for financial strain make it a risky proposition. Prioritizing open communication, formalizing agreements, and exploring alternative financing options are crucial for minimizing the potential negative consequences. Ultimately, a thoughtful and responsible approach is essential to protect both the relationship and the financial well-being of all involved. Remember, sometimes the most convenient option isn't always the best one, especially when it comes to borrowing money. The long-term impact on your relationships and financial health should always be the primary consideration.

Latest Posts

Latest Posts

-

If An Individual Is Heterozygous For A Particular Trait

Mar 18, 2025

-

If You Add More Enzyme The Reaction Will

Mar 18, 2025

-

The Purpose Of A Hazcom Program Is To Ensure That

Mar 18, 2025

-

Describe The Continuous Nature Of The Physical Fitness Concept

Mar 18, 2025

-

High Levels Of Cholesterol Can First Lead Directly To

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Why Might Loans Obtained From Families And Friends Be Problematic . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.