Your Response To Risk Behavior Is To

Breaking News Today

Mar 21, 2025 · 7 min read

Table of Contents

Your Response to Risk Behavior: A Comprehensive Guide to Mitigation and Management

Risk. It's an inherent part of life, woven into the fabric of our daily existence. From the seemingly insignificant (will it rain today?) to the profoundly impactful (making major financial decisions), we constantly navigate a landscape of potential gains and losses. Our response to risk behavior, however, is what truly shapes our lives and determines our success or failure. This comprehensive guide will explore various facets of risk response, providing you with a framework for understanding, mitigating, and effectively managing risk in all its forms.

Understanding Your Risk Tolerance

Before diving into specific strategies, it's crucial to understand your own risk tolerance. This is the level of uncertainty you're comfortable with when making decisions. Are you a risk-averse individual, preferring predictable outcomes and minimizing potential losses? Or do you have a higher risk tolerance, embracing uncertainty and potentially larger rewards?

Identifying Your Risk Profile:

-

Risk-Averse: You prioritize security and stability above all else. You meticulously analyze potential downsides before making decisions, often opting for the safer, more conservative choice. This isn't necessarily negative – it's a strategic approach to minimizing losses.

-

Risk-Neutral: You weigh potential gains and losses equally, making decisions based on objective analysis and probabilities. You don't shy away from risk, but you don't actively seek it out either.

-

Risk-Seeking: You're comfortable with uncertainty and actively seek opportunities with higher potential rewards, even if it means accepting greater risk. This approach can lead to significant gains, but also carries a higher potential for losses.

Knowing your risk profile is paramount. It helps guide your decision-making process, ensuring your actions align with your comfort level and overall goals.

Strategies for Responding to Risk

Once you've identified your risk tolerance, you can implement various strategies to effectively manage risk. These strategies fall under four main categories:

1. Risk Avoidance: Eliminating the Threat

This is the most straightforward approach. If a risk is deemed too significant or the potential negative consequences outweigh the potential benefits, the best response is simply to avoid it altogether.

Examples:

- Avoiding risky investments: Choosing low-risk investments like savings accounts or government bonds instead of high-risk ventures like penny stocks.

- Avoiding dangerous activities: Choosing not to engage in activities like extreme sports or reckless driving.

- Avoiding unhealthy habits: Choosing a healthy lifestyle by quitting smoking, avoiding excessive alcohol consumption, and maintaining a balanced diet.

When to Use Risk Avoidance: This strategy is best used when the potential downsides significantly outweigh the potential upsides, or when the risk is simply too high to justify undertaking it.

2. Risk Reduction: Minimizing the Probability or Impact

If avoiding the risk entirely isn't feasible, the next step is to implement strategies to reduce its likelihood or mitigate its potential impact.

Examples:

- Diversification of investments: Spreading investments across multiple asset classes to reduce the overall risk.

- Implementing safety measures: Installing smoke detectors and fire extinguishers to reduce the risk of fire.

- Regular health checkups: Undergoing regular medical examinations to detect and treat potential health problems early.

- Developing robust backup systems: Implementing data backup strategies to protect against data loss.

When to Use Risk Reduction: This strategy is appropriate when the risk can't be avoided entirely but can be lessened through proactive measures.

3. Risk Transfer: Shifting the Responsibility

Sometimes, it's beneficial to transfer the risk to another party. This can be achieved through insurance, contracts, or other legal agreements.

Examples:

- Purchasing insurance: Transferring the financial risk associated with property damage, accidents, or health issues to an insurance company.

- Using surety bonds: Transferring the risk of non-performance on a contract to a surety company.

- Outsourcing tasks: Transferring the risk associated with a particular project or task to a third-party vendor.

When to Use Risk Transfer: This strategy is ideal when the risk is significant, but the cost of transferring it is less than the potential cost of dealing with the consequences.

4. Risk Acceptance: Acknowledging and Monitoring

In some situations, accepting a risk might be the most appropriate course of action. This doesn't mean ignoring the risk; rather, it involves acknowledging its presence and actively monitoring it. This is often the case when the potential benefits outweigh the potential costs, and mitigation strategies are impractical or too costly.

Examples:

- Accepting the risk of market fluctuations: Investors often accept the risk of market fluctuations in exchange for the potential for higher returns.

- Accepting the risk of business failure: Entrepreneurs accept the risk of business failure as part of the process of building a successful company.

- Accepting the risk of minor injuries in sports: Athletes accept the risk of minor injuries as part of participating in their sport.

When to Use Risk Acceptance: This strategy is suitable when the risk is relatively small, the potential benefits outweigh the potential costs, and mitigation efforts are impractical or too expensive. Continuous monitoring is key here.

Developing a Comprehensive Risk Management Plan

Effective risk management isn't a one-size-fits-all approach. It requires a well-defined plan tailored to your specific circumstances and goals. Here are key steps to creating a comprehensive risk management plan:

-

Identify Potential Risks: Brainstorm all possible risks that could impact your goals. Consider various aspects of your life, including personal finances, health, career, relationships, and more. Be as thorough as possible. Techniques like SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) can be incredibly helpful.

-

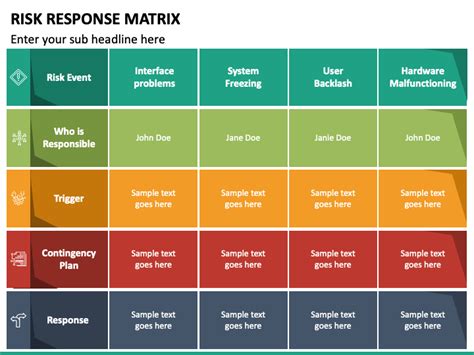

Analyze the Risks: For each identified risk, assess its likelihood and potential impact. This often involves assigning probabilities and quantifying potential losses. Use a risk matrix to visualize this analysis.

-

Evaluate the Risks: Prioritize the risks based on their likelihood and potential impact. Focus your resources on addressing the highest-priority risks first. The Pareto Principle (80/20 rule) often applies here: a small percentage of risks often account for the majority of potential problems.

-

Develop Risk Response Strategies: For each prioritized risk, select the most appropriate response strategy (avoidance, reduction, transfer, or acceptance). Document your chosen strategies and the rationale behind them.

-

Implement the Strategies: Put your chosen strategies into action. This might involve purchasing insurance, implementing safety measures, diversifying investments, or developing contingency plans.

-

Monitor and Review: Regularly monitor the effectiveness of your risk management plan. Review your plan periodically and update it as needed to reflect changing circumstances. Regular updates are crucial for continued effectiveness. This is an iterative process, not a one-time event.

The Importance of Proactive Risk Management

Proactive risk management is significantly more effective than reactive management. By identifying and addressing potential risks before they occur, you can prevent many problems and minimize potential losses. Reactive management, on the other hand, deals with problems only after they've arisen, often leading to more significant costs and disruptions.

Specific Examples of Risk Response in Different Contexts

Let's explore how risk response strategies play out in specific scenarios:

1. Investing:

- Risk: Market downturn leading to investment losses.

- Response: Diversification (risk reduction), investing in low-risk assets (risk reduction), stop-loss orders (risk reduction), thorough research (risk reduction), understanding your risk tolerance (proactive).

2. Health:

- Risk: Developing a chronic illness.

- Response: Maintaining a healthy lifestyle (risk reduction), regular health checkups (risk reduction), health insurance (risk transfer).

3. Business:

- Risk: Competition from a new entrant to the market.

- Response: Innovation and differentiation (risk reduction), building a strong brand reputation (risk reduction), strategic partnerships (risk reduction/transfer).

4. Personal Safety:

- Risk: Home burglary.

- Response: Installing security systems (risk reduction), purchasing home insurance (risk transfer).

5. Relationships:

- Risk: Conflict with a loved one.

- Response: Open communication (risk reduction), conflict resolution skills (risk reduction), seeking professional help (risk reduction/transfer).

Conclusion: Embracing a Proactive Approach

Your response to risk behavior is a defining factor in your success and well-being. By understanding your risk tolerance, developing a comprehensive risk management plan, and adopting a proactive approach, you can navigate life's uncertainties more effectively, minimize potential losses, and maximize your chances of achieving your goals. Remember, risk is inevitable, but the way you respond to it is entirely within your control. A proactive, well-informed approach to risk management is an investment in your future.

Latest Posts

Latest Posts

-

All Of The Following Statements Are True About Color Except

Mar 22, 2025

-

The Nfpa 1901 Standard Now Calls For

Mar 22, 2025

-

Match The Label To The Correct Structure On The Chloroplast

Mar 22, 2025

-

Which Statement Best Describes How Muscles Respond To Weight Training

Mar 22, 2025

-

Which Of The Following Is Associated With Port Security

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Your Response To Risk Behavior Is To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.