In Each Succeeding Payment On An Installment Note The Amount

Breaking News Today

Mar 28, 2025 · 6 min read

Table of Contents

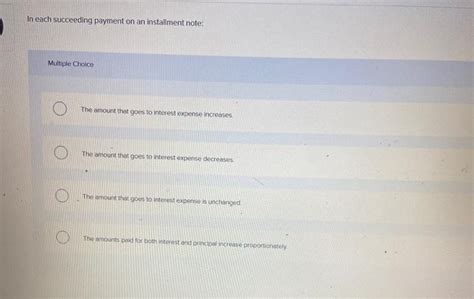

In Each Succeeding Payment on an Installment Note, the Amount: A Comprehensive Guide

Understanding how installment notes work, specifically the allocation of each payment, is crucial for both borrowers and lenders. This comprehensive guide delves deep into the mechanics of installment payments, explaining how the amount applied to principal and interest changes with each successive payment. We will explore the amortization schedule, the impact of interest rates, and the overall implications for financial planning.

Understanding Installment Notes

An installment note is a promissory note where the borrower agrees to repay a loan in a series of fixed payments over a specific period. Each payment typically includes both principal (the original loan amount) and interest (the cost of borrowing). Unlike a lump-sum repayment, an installment note spreads the repayment burden over time, making it more manageable for borrowers.

Key Components of an Installment Note:

- Principal: The initial loan amount borrowed.

- Interest Rate: The annual percentage rate (APR) charged on the loan. This rate determines the cost of borrowing.

- Loan Term: The length of time over which the loan must be repaid (e.g., 12 months, 36 months, 60 months).

- Payment Amount: The fixed amount paid by the borrower at regular intervals (e.g., monthly, quarterly).

- Amortization Schedule: A detailed table showing the breakdown of each payment into principal and interest components for the loan's life.

The Amortization Schedule: Deconstructing Each Payment

The amortization schedule is the heart of understanding how installment payments work. It's a detailed plan that meticulously outlines the allocation of each payment between principal and interest. Initially, a larger portion of the payment goes towards interest, while a smaller portion is applied to reducing the principal balance. As payments progress, this ratio shifts. The interest component diminishes, and the principal component increases with each subsequent payment.

Why the Shift?

The shift is due to the way interest is calculated. Interest is typically calculated on the outstanding principal balance. As you pay down the principal, the base upon which interest is calculated shrinks. Therefore, with each payment, less interest accrues, and more of your payment goes towards reducing the principal balance.

Example Amortization Schedule:

Let's illustrate with a simple example. Assume a loan of $10,000 with a 5% annual interest rate over 3 years (36 months).

| Payment Number | Payment Amount | Interest Paid | Principal Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $299.70 | $41.67 | $258.03 | $9,741.97 |

| 2 | $299.70 | $40.60 | $259.10 | $9,482.87 |

| 3 | $299.70 | $39.52 | $260.18 | $9,222.69 |

| ... | ... | ... | ... | ... |

| 35 | $299.70 | $10.17 | $289.53 | $299.60 |

| 36 | $299.70 | $1.25 | $298.45 | $0.15 |

(Note: This is a simplified example. Actual amortization schedules might vary slightly depending on the calculation method used.)

Observe how the interest paid decreases with each payment, while the principal paid increases. By the final payment, the vast majority of the payment goes toward principal, finally reducing the balance to zero (or a very small remainder due to rounding).

Factors Affecting the Allocation of Payments

Several factors influence the proportion of principal and interest in each installment payment:

1. Interest Rate

A higher interest rate results in a larger interest component in the early payments. This is because a higher rate generates more interest on the outstanding principal. Conversely, a lower interest rate means a smaller interest component, leading to faster principal reduction.

2. Loan Term

A longer loan term (e.g., 60 months) means smaller monthly payments, but a larger overall interest payment. The smaller payments result in a slower reduction of principal, leading to a greater interest component in each payment, especially in the early stages. Shorter loan terms (e.g., 12 months) result in larger monthly payments but less overall interest paid.

3. Payment Frequency

The frequency of payments also matters. More frequent payments (e.g., bi-weekly) result in a faster reduction of the principal balance because interest is calculated more frequently, leading to lower overall interest costs.

Calculating the Allocation Manually (Simple Interest)

While amortization schedules are easily generated using software or online calculators, understanding the basic calculation can be insightful. For simplicity, let's consider a simple interest calculation (though most loans use compound interest).

Simple Interest Calculation:

-

Calculate the interest for the period: Interest = (Principal Balance * Interest Rate) / Number of payments per year.

-

Subtract the interest from the payment amount: Principal Paid = Payment Amount - Interest.

-

Update the principal balance: New Principal Balance = Old Principal Balance - Principal Paid.

Repeat this process for each payment period. Remember, this is a simplified calculation and doesn't reflect the complexities of compound interest used in most loan scenarios.

Importance of Understanding Your Amortization Schedule

Having a clear understanding of your amortization schedule is crucial for several reasons:

-

Financial Planning: It helps you track your progress and manage your finances effectively. You can clearly see how much of your payment goes towards interest and principal, assisting in budgeting and long-term financial planning.

-

Debt Management: Understanding the repayment structure allows you to develop effective debt management strategies. You can evaluate different repayment options and make informed decisions about pre-paying or refinancing your loan.

-

Avoid Unnecessary Costs: Knowing how interest is calculated and applied can help you avoid unnecessary expenses. You can strategically plan to accelerate loan repayment and save on interest.

-

Transparency: An amortization schedule provides transparency in your loan terms. It helps you understand the exact costs and repayment obligations throughout the loan period.

Tools and Resources for Amortization Schedule Calculation

Many online calculators and software applications are available to generate accurate amortization schedules. Simply input the loan amount, interest rate, and loan term, and the tool will generate a detailed schedule. Spreadsheet software like Microsoft Excel or Google Sheets can also be used to create custom amortization schedules, offering greater flexibility and customization.

Conclusion

Understanding the allocation of payments in an installment note is essential for both borrowers and lenders. The amortization schedule provides a clear and concise picture of how each payment is applied to principal and interest, highlighting the gradual shift towards principal repayment over time. Factors like interest rate, loan term, and payment frequency significantly influence this allocation. Utilizing online calculators or spreadsheet software simplifies the process of generating personalized amortization schedules, aiding in effective financial planning and informed decision-making. By mastering the intricacies of installment payments, you gain control over your finances and navigate the complexities of borrowing and lending with greater confidence.

Latest Posts

Latest Posts

-

Functions Of The Large Intestine Include Quizlet

Mar 31, 2025

-

An Interval Of An Ecg Is Quizlet

Mar 31, 2025

-

Which Function Is Shown In The Graph Below

Mar 31, 2025

-

A Guest Tries To Use An Expired Coupon

Mar 31, 2025

-

Common Signs And Symptoms Of A Hypertensive Emergency Include Quizlet

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about In Each Succeeding Payment On An Installment Note The Amount . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.