Interest Rates Are Expressed As A Percentage Of Quizlet

Breaking News Today

Mar 17, 2025 · 6 min read

Table of Contents

Interest Rates: A Deep Dive into the Percentage Puzzle (Quizlet-Style Explained)

Interest rates are a fundamental concept in finance, impacting everything from borrowing money for a house to the growth of your savings. Understanding how they're expressed and calculated as a percentage is crucial for navigating the financial world. This comprehensive guide breaks down the complexities of interest rates, using a Quizlet-inspired approach to make learning engaging and effective.

What are Interest Rates?

Simply put, an interest rate is the cost of borrowing money or the reward for lending money. It's expressed as a percentage of the principal amount (the original amount borrowed or lent). Think of it as the "rental fee" for using someone else's money.

- Borrowers pay interest rates to lenders for the privilege of using their funds.

- Lenders receive interest rates as compensation for the risk of lending their money and the opportunity cost (the return they could have earned elsewhere).

How are Interest Rates Expressed as a Percentage?

Interest rates are almost always expressed as an annual percentage rate (APR). This means the rate is calculated over a year. However, the actual interest paid or earned can vary depending on the loan or investment's terms (e.g., monthly, quarterly, or daily compounding).

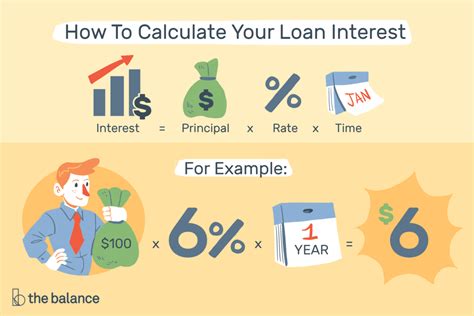

Let's break down the key components:

- Principal: The original amount borrowed or invested.

- Interest Rate: The percentage charged or earned per year.

- Time: The length of the loan or investment period.

- Interest: The total amount paid or earned over the time period.

Example:

Imagine you borrow $1,000 at an annual interest rate of 5%. After one year, the interest accrued would be:

$1,000 (Principal) x 0.05 (Interest Rate) = $50 (Interest)

Types of Interest Rates:

Several different types of interest rates exist, each with its own characteristics and applications:

1. Nominal Interest Rate: The Stated Rate

This is the stated interest rate without considering the effects of compounding. It's the number you see advertised, but it doesn't represent the actual effective cost or return. For instance, a loan might advertise a 10% nominal interest rate, but the effective interest rate could be higher due to compounding.

2. Effective Interest Rate (Annual Percentage Yield - APY): The Real Deal

The effective interest rate, or APY, accounts for compounding. Compounding means earning interest on interest. If interest is compounded more frequently (e.g., monthly or daily), the effective interest rate will be higher than the nominal interest rate.

Example:

A loan with a 10% nominal interest rate compounded monthly will have a higher effective interest rate than the same loan compounded annually. The more frequent the compounding, the greater the difference between nominal and effective rates.

3. Real Interest Rate: Adjusting for Inflation

The real interest rate adjusts the nominal interest rate for inflation. Inflation erodes the purchasing power of money. A real interest rate reflects the actual increase in purchasing power earned or paid.

Calculating Real Interest Rate:

Real Interest Rate ≈ Nominal Interest Rate - Inflation Rate

Example:

If the nominal interest rate is 5% and inflation is 2%, the real interest rate is approximately 3%.

4. Fixed Interest Rate: Stability Over Time

A fixed interest rate remains constant throughout the loan or investment term. This provides predictability and stability for both borrowers and lenders. Mortgages and some bonds often use fixed interest rates.

5. Variable Interest Rate: Fluctuations Based on Market Conditions

A variable interest rate fluctuates over time, typically based on a benchmark interest rate like the prime rate or LIBOR. These rates can be advantageous when market rates are low, but they also carry risk if rates rise. Credit cards and some adjustable-rate mortgages utilize variable interest rates.

Factors Affecting Interest Rates:

Several key factors influence interest rates:

1. Inflation: The Erosion of Purchasing Power

High inflation generally leads to higher interest rates as lenders demand higher returns to compensate for the diminished value of money.

2. Economic Growth: The Engine of the Economy

Strong economic growth usually results in higher interest rates as demand for loans increases.

3. Monetary Policy: The Central Bank's Influence

Central banks (like the Federal Reserve in the US) control interest rates through monetary policy tools such as setting reserve requirements and the federal funds rate. These actions aim to manage inflation and stimulate or slow economic activity.

4. Government Debt: The National Borrowing

High levels of government debt can put upward pressure on interest rates as the government competes with other borrowers for funds.

5. Risk: The Uncertainty Factor

The risk associated with a loan or investment significantly impacts the interest rate. Higher-risk investments typically offer higher interest rates to compensate for the increased chance of loss. This is why corporate bonds typically offer higher yields than government bonds.

6. Supply and Demand: The Balancing Act

The supply and demand for loanable funds influence interest rates. Increased demand pushes rates up, while increased supply pushes rates down.

Interest Rate Calculations: Beyond the Basics

While simple interest calculations are straightforward, many financial products use more complex methods:

1. Simple Interest: The Straightforward Approach

Simple interest is calculated only on the principal amount. It's the easiest to understand but generally offers lower returns than compound interest.

Formula: Simple Interest = Principal x Interest Rate x Time

2. Compound Interest: The Power of Compounding

Compound interest calculates interest on both the principal and accumulated interest. The more frequent the compounding, the faster the balance grows.

Formula: A = P (1 + r/n)^(nt)

Where:

- A = the future value of the investment/loan, including interest

- P = the principal investment amount (the initial deposit or loan amount)

- r = the annual interest rate (decimal)

- n = the number of times that interest is compounded per year

- t = the number of years the money is invested or borrowed for

Interest Rates and Your Financial Decisions:

Understanding interest rates is crucial for making informed financial decisions:

- Borrowing: Lower interest rates mean lower monthly payments and less total interest paid over the life of a loan. Shop around for the best interest rates when borrowing.

- Saving and Investing: Higher interest rates mean greater returns on savings accounts, certificates of deposit (CDs), and other investments.

- Mortgages: Interest rates significantly affect monthly mortgage payments and the total cost of owning a home.

- Credit Cards: High interest rates on credit card debt can quickly lead to overwhelming debt. Aim to keep credit card balances low and pay them off promptly.

Quizlet-Style Review:

Here's a quick Quizlet-style review to solidify your understanding:

Term: Interest Rate Definition: The cost of borrowing money or the reward for lending money, expressed as a percentage.

Term: APR Definition: Annual Percentage Rate; the annualized interest rate.

Term: Nominal Interest Rate Definition: The stated interest rate without considering compounding.

Term: Effective Interest Rate (APY) Definition: The actual annual interest rate, considering compounding.

Term: Real Interest Rate Definition: The nominal interest rate adjusted for inflation.

Term: Fixed Interest Rate Definition: An interest rate that remains constant over time.

Term: Variable Interest Rate Definition: An interest rate that fluctuates over time.

Term: Simple Interest Definition: Interest calculated only on the principal amount.

Term: Compound Interest Definition: Interest calculated on both the principal and accumulated interest.

Conclusion:

Interest rates are a critical aspect of personal finance and the broader economy. Understanding how they are expressed as percentages, the various types of interest rates, and the factors influencing them empowers you to make informed financial decisions, whether you're borrowing money, saving for the future, or investing your funds. By mastering this fundamental concept, you pave the way for greater financial literacy and success. Remember to always consider the effective interest rate, not just the nominal rate, for a true picture of costs and returns.

Latest Posts

Latest Posts

-

True Or False Professional And Technical Communication Is Research Oriented

Mar 18, 2025

-

Which Best Describes The Terrorist Planning Cycle

Mar 18, 2025

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Interest Rates Are Expressed As A Percentage Of Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.