Mrs Duarte Is Enrolled In Original Medicare Quizlet

Breaking News Today

Mar 23, 2025 · 6 min read

Table of Contents

Decoding Medicare: A Comprehensive Guide to Mrs. Duarte's Enrollment in Original Medicare

Understanding Medicare can be a daunting task, even for seasoned professionals. This comprehensive guide aims to demystify the complexities of Original Medicare enrollment, using Mrs. Duarte's hypothetical situation as a case study. We'll explore the intricacies of Part A and Part B, eligibility criteria, enrollment periods, and potential pitfalls to avoid. By the end, you'll have a much clearer understanding of navigating the Original Medicare system, effectively preparing you to assist others or manage your own enrollment.

What is Original Medicare?

Original Medicare, also known as Traditional Medicare, consists of two parts:

- Part A: Hospital Insurance: This covers inpatient hospital care, skilled nursing facility care, hospice care, and some types of home healthcare. Funding for Part A primarily comes from payroll taxes paid during your working years. Most people don't pay a monthly premium for Part A if they or their spouse have worked and paid Medicare taxes for at least 10 years.

- Part B: Medical Insurance: This covers doctor's visits, outpatient care, medical supplies, and preventative services. Most people pay a monthly premium for Part B, the amount of which depends on their income.

Mrs. Duarte's Enrollment Scenario: A Step-by-Step Analysis

Let's imagine Mrs. Duarte, a 65-year-old retiree, is considering enrolling in Original Medicare. To help her navigate this process successfully, we will break it down into key steps:

1. Determining Eligibility for Original Medicare

Eligibility for Original Medicare hinges on several factors:

- Age: Generally, individuals become eligible for Medicare at age 65.

- Work History: As mentioned earlier, having worked and paid Medicare taxes for at least 10 years generally qualifies you for Part A without paying a monthly premium.

- Disability: Individuals under 65 with certain disabilities or End-Stage Renal Disease (ESRD) may also qualify.

Mrs. Duarte's Case: Assuming Mrs. Duarte is 65 and meets the work history requirements, she's likely eligible for both Part A and Part B.

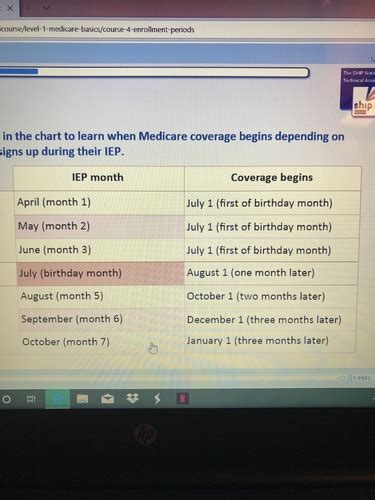

2. Understanding the Initial Enrollment Period (IEP)

The Initial Enrollment Period (IEP) is a seven-month window centered around your 65th birthday. This period is crucial for avoiding potential penalties. It includes:

- Three months before your birth month.

- The month of your birth month.

- Three months after your birth month.

Mrs. Duarte's IEP: If Mrs. Duarte's birthday is in June, her IEP would span from March to September. Enrolling within this timeframe is critical for avoiding potential late-enrollment penalties.

3. The Importance of Timely Enrollment

Failing to enroll in Medicare during the IEP can result in penalties:

- Part B Penalty: A higher monthly premium for Part B for as long as you have Part B coverage. The penalty is calculated based on how long you were without Part B coverage.

- Part A Penalty: While less common, if you aren’t eligible for premium-free Part A and decide to delay enrollment, there may be a penalty on your monthly premium amount.

Mrs. Duarte's Strategy: It's vital for Mrs. Duarte to enroll during her IEP to avoid these potential penalties.

4. Navigating the Medicare Enrollment Process

The enrollment process itself is relatively straightforward:

- Online Application: The Social Security Administration (SSA) website provides a convenient online application portal.

- Phone Application: Contacting the SSA directly via phone allows for assistance with the application process.

- Mail Application: Paper applications are also available for those who prefer a more traditional approach.

Mrs. Duarte's Choice: Based on her comfort level with technology, Mrs. Duarte can choose the method that best suits her needs.

5. Understanding Medicare Part A and Part B Coverage in Detail

- Part A Coverage: Covers inpatient hospital stays, skilled nursing facility care (limited duration), home healthcare (under certain conditions), and hospice care. There's a deductible and co-insurance involved.

- Part B Coverage: Covers doctor visits, outpatient services, medical equipment, preventative services, and some mental health services. There's a monthly premium, an annual deductible, and a 20% coinsurance after the deductible is met.

6. Considering Supplemental Coverage (Medigap) and Medicare Advantage

Original Medicare doesn't cover everything. Many people choose to supplement their coverage with:

- Medigap (Medicare Supplement Insurance): These private insurance policies help pay some of the expenses not covered by Original Medicare, such as co-pays, deductibles, and coinsurance. This is usually an additional monthly payment.

- Medicare Advantage (Part C): These are private insurance plans that offer comprehensive coverage. They often include prescription drug coverage (Part D). Each plan has its own costs and benefits.

Mrs. Duarte's Decision: Depending on her financial situation and healthcare needs, Mrs. Duarte might consider either Medigap or Medicare Advantage to bridge the gaps in Original Medicare coverage. She'll need to carefully evaluate her options and compare costs and benefits.

7. The Importance of Regular Review and Updates

Medicare rules and regulations are subject to change. It's important to review your coverage annually to ensure it still meets your needs and to account for any changes in your personal circumstances or potential updated Medicare benefits.

Mrs. Duarte's Ongoing Management: Mrs. Duarte should review her Medicare coverage yearly, ensuring her plan aligns with her current healthcare needs.

8. Addressing Potential Challenges and Common Questions

- Understanding the terminology: The jargon surrounding Medicare can be confusing. Learning the key terms is the first step towards understanding the system better.

- Choosing the right supplemental plan: Navigating the choices between Medigap and Medicare Advantage can be tricky. Careful consideration of individual circumstances and health needs is essential.

- Navigating the appeals process: If Mrs. Duarte receives a claim denial from Medicare, she should thoroughly understand the appeals process and how to dispute the decision.

Mrs. Duarte's Resources: The Medicare website, the SSA website, and local senior centers are excellent resources for navigating challenges and answering specific questions. Consider reaching out to a qualified healthcare advisor for personalized guidance.

9. Staying Informed About Medicare Changes

Medicare undergoes updates each year, affecting premiums, coverage, and enrollment guidelines. Staying informed through official channels, such as the official Medicare website and the Social Security Administration, is essential for keeping coverage current and avoiding potential setbacks.

Mrs. Duarte's Proactive Approach: By monitoring changes annually, Mrs. Duarte ensures her plan continues to align with her evolving needs and the current Medicare system.

10. Planning for the Future: Long-Term Care Considerations

While Original Medicare covers certain aspects of healthcare, it doesn't comprehensively cover long-term care needs such as assisted living or nursing homes. Mrs. Duarte should consider exploring long-term care insurance or planning for potential long-term care costs.

Mrs. Duarte’s Long-Term Strategy: Preparing for the potential financial costs associated with long-term care is a crucial part of overall Medicare planning and a responsible step for securing her future well-being.

This detailed analysis of Mrs. Duarte's enrollment in Original Medicare provides a comprehensive understanding of the process. Remember, seeking professional guidance from a Medicare specialist or a qualified healthcare advisor can significantly aid in navigating this complex system. While this guide provides valuable information, it's not a substitute for individualized professional advice. Always consult reliable official sources for the most accurate and up-to-date information regarding your specific circumstances and needs. Understanding Medicare is a journey, not a destination, and continuous learning is key to making informed decisions that ensure your financial well-being and healthcare access.

Latest Posts

Latest Posts

-

Select All That Are True Of Glands

Mar 24, 2025

-

Chapter Summaries Of The Things They Carried

Mar 24, 2025

-

Soil Pollution Can Result In Dangerous Levels Of Silver

Mar 24, 2025

-

Which Statement Is True Of Ph Buffers

Mar 24, 2025

-

Reducing Speed Increases A Drivers Total Stopping Distance

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about Mrs Duarte Is Enrolled In Original Medicare Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.