Property And Casualty Insurance Exam Questions And Answers Pdf

Breaking News Today

Mar 15, 2025 · 6 min read

Table of Contents

Property and Casualty Insurance Exam Questions and Answers: A Comprehensive Guide

Finding reliable study materials for the Property and Casualty insurance exam can be challenging. Many resources are either outdated, incomplete, or simply ineffective. This comprehensive guide aims to provide you with a strong foundation of knowledge, covering key concepts and providing example questions and answers to help you ace your exam. Remember, while this guide offers valuable insights, it's crucial to supplement your studies with official study materials and practice exams from your licensing organization.

Understanding the Property and Casualty Insurance Exam

The Property and Casualty (P&C) insurance exam is a crucial step for aspiring insurance professionals. It tests your understanding of various insurance concepts, including property insurance (covering damage to buildings and personal property), casualty insurance (covering liability for injuries or damages caused to others), and the overall insurance industry's operations and regulations. The exam's difficulty varies by state and licensing organization, but generally assesses your knowledge in the following areas:

Key Areas Covered in the Exam:

-

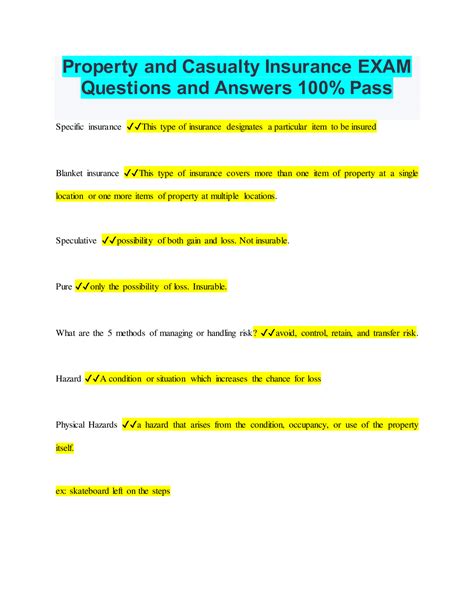

Insurance Principles: This section covers fundamental insurance concepts like risk management, insurance contracts, insurable interest, and the different types of insurance policies (e.g., named perils vs. open perils). Understanding these basics is critical to answering many exam questions.

-

Property Insurance: This section delves into the specifics of property insurance, covering dwelling coverage, personal property coverage, liability coverage, and additional coverages like loss of use. You'll need a thorough understanding of different policy structures and endorsements.

-

Casualty Insurance: This area focuses on liability insurance, including auto insurance, general liability insurance, and umbrella liability insurance. Exam questions often test your understanding of coverage limits, exclusions, and the claims process.

-

Commercial Insurance: Many exams will include questions on commercial insurance, which extends property and casualty coverage to businesses. This may include commercial property, general liability, workers' compensation, and commercial auto insurance.

-

Insurance Regulations and Ethics: A significant portion of the exam will cover state and federal regulations governing the insurance industry, including licensing requirements, unfair trade practices, and ethical considerations.

-

Claims Handling and Adjustments: Understanding the claims process, including investigating claims, determining liability, and processing payments, is essential. Questions may cover different claim scenarios and how to handle various situations.

Sample Property and Casualty Insurance Exam Questions and Answers

The following questions are designed to simulate the types of questions you might encounter on the actual exam. Remember that the specific wording and complexity might differ depending on your jurisdiction. These examples are for illustrative purposes only and should not be considered a substitute for comprehensive study.

Question 1: What is the principle of indemnity in insurance?

Answer: The principle of indemnity aims to restore the insured to their pre-loss financial condition, preventing them from profiting from an insurance claim. It prevents individuals from recovering more than their actual loss.

Question 2: What is the difference between "named perils" and "open perils" in a property insurance policy?

Answer: A named perils policy only covers losses explicitly listed in the policy. An open perils (also known as all-risks) policy covers all losses except those specifically excluded in the policy.

Question 3: Explain the concept of insurable interest.

Answer: Insurable interest means that the policyholder must have a legitimate financial stake in the property or asset being insured. This ensures that the policyholder suffers a direct financial loss if the insured item is damaged or destroyed. For example, you must have an insurable interest in your house to insure it.

Question 4: What is the purpose of an umbrella liability policy?

Answer: An umbrella liability policy provides additional liability coverage above and beyond the limits of other liability policies, such as auto or homeowner's insurance. It offers broader protection against significant liability claims.

Question 5: What is the difference between actual cash value (ACV) and replacement cost (RC) in property insurance?

Answer: Actual cash value (ACV) considers the item's current market value, subtracting depreciation. Replacement cost (RC) covers the cost to replace the damaged or destroyed item with a new one of like kind and quality, without deduction for depreciation.

Question 6: What are some common exclusions found in property insurance policies?

Answer: Common exclusions often include acts of war, nuclear events, intentional acts by the insured, and floods (unless specifically added via endorsements). Specific exclusions vary depending on the insurer and policy type.

Question 7: Describe the concept of negligence in liability insurance.

Answer: Negligence is the failure to exercise the reasonable care that a prudent person would exercise in similar circumstances. If someone is found negligent and causes harm to another, they could be held liable for damages. Liability insurance helps cover these costs.

Question 8: What is the difference between bodily injury and property damage in casualty insurance?

Answer: Bodily injury refers to physical harm or death caused to another person. Property damage refers to damage to or destruction of another person's property. Both are common coverage areas within casualty insurance.

Question 9: What is the purpose of a deductible in an insurance policy?

Answer: A deductible is the amount of money the insured must pay out-of-pocket before the insurance company begins to pay benefits. It helps to control costs and reduce the number of small claims.

Question 10: What are some common ethical considerations for insurance professionals?

Answer: Ethical considerations include acting with integrity, transparency, and fairness in dealing with clients and ensuring compliance with all relevant laws and regulations. This includes avoiding conflicts of interest and prioritizing the client's best interests.

Advanced Concepts and Exam Preparation Strategies

Beyond the fundamental concepts, the exam might cover more advanced topics, requiring a deeper understanding of insurance law, underwriting practices, and risk assessment. Effective preparation requires a multi-pronged approach:

Advanced Topics:

-

Underwriting Principles: Understanding how insurers assess risk, determine premiums, and make acceptance/rejection decisions is crucial.

-

Reinsurance: Knowing how insurance companies transfer risk to other insurers (reinsurers) helps to understand the stability and capacity of the insurance market.

-

Insurance Fraud: Familiarity with common insurance fraud schemes and methods of detection is increasingly important.

-

Risk Management Techniques: Understanding different strategies for mitigating and transferring risks is vital for effective insurance planning.

-

Specific Policy Endorsements and Riders: Different policy endorsements modify coverage or add specific protections; understanding their function is key.

Effective Study Strategies:

-

Utilize Official Study Materials: Your licensing organization likely provides study guides, practice exams, and other resources. These are invaluable for preparing for the exam.

-

Create a Study Schedule: Develop a realistic study plan that covers all the key areas, allocating sufficient time to challenging concepts.

-

Practice Regularly: Use practice questions and exams to test your understanding and identify areas needing further review.

-

Join Study Groups: Collaborating with other aspiring insurance professionals can enhance understanding and provide valuable insights.

-

Seek Clarification: If you struggle with specific concepts, don't hesitate to seek clarification from experienced insurance professionals or educators.

-

Review Past Exams (If Available): Analyzing past exams can give you an idea of the question format and topics frequently covered.

-

Understand State-Specific Regulations: Ensure your studies incorporate the specific regulations governing insurance in your state. Regulations can significantly impact exam content.

Conclusion: Mastering the Property and Casualty Insurance Exam

Passing the Property and Casualty insurance exam requires dedicated effort, a systematic study approach, and a thorough understanding of the core concepts. While this guide offers a valuable starting point by providing sample questions and a framework for understanding key concepts, remember that consistent study and the utilization of official resources are critical for success. By employing these strategies and dedicating yourself to comprehensive learning, you’ll significantly improve your chances of passing the exam and embarking on a successful career in the property and casualty insurance industry. Good luck!

Latest Posts

Latest Posts

-

Kaz Wants To Stop Biting His Nails

Mar 21, 2025

-

Letrs Unit 4 Session 8 Check For Understanding

Mar 21, 2025

-

Which Of The Following Is Most Associated With Managerial Accounting

Mar 21, 2025

-

The Planning Steps Of The Planning Control Cycle Are

Mar 21, 2025

-

The Nose Is Located Blank And Blank To The Ears

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about Property And Casualty Insurance Exam Questions And Answers Pdf . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.