Refers To A Company's Ability To Generate An Adequate Return.

Breaking News Today

Mar 30, 2025 · 5 min read

Table of Contents

Return on Investment (ROI): A Deep Dive into a Company's Profitability

Return on Investment (ROI) is a fundamental metric that measures the profitability of an investment relative to its cost. For companies, understanding and maximizing ROI is crucial for sustainable growth and attracting investors. This comprehensive guide delves into the intricacies of ROI, exploring its calculation, variations, limitations, and applications in different business contexts.

Understanding Return on Investment (ROI)

At its core, ROI answers a simple yet powerful question: What is the benefit of an investment relative to its cost? It's a ratio expressed as a percentage, showcasing the efficiency of capital allocation. A higher ROI indicates a more profitable investment.

Calculating ROI: The Basic Formula

The most common formula for calculating ROI is straightforward:

ROI = [(Revenue - Cost) / Cost] * 100%

Let's break this down:

- Revenue: This represents the total income generated from the investment.

- Cost: This encompasses all expenses associated with the investment, including initial investment, operating expenses, and any other relevant costs.

Example: A company invests $10,000 in a new marketing campaign. The campaign generates $15,000 in additional revenue.

ROI = [($15,000 - $10,000) / $10,000] * 100% = 50%

This indicates a 50% return on the initial investment.

Beyond the Basic Formula: Considering Time

The basic ROI formula doesn't account for the time value of money. An investment yielding 50% over five years is significantly different from an investment yielding 50% over one year. To address this, more sophisticated methods like Discounted Cash Flow (DCF) analysis are used. DCF incorporates the present value of future cash flows, offering a more accurate reflection of long-term profitability.

Variations of ROI: Tailoring the Metric to Specific Needs

The basic ROI formula is versatile, allowing for adaptations based on specific needs and industry standards. Here are some common variations:

Return on Marketing Investment (ROMI)

This metric specifically focuses on the effectiveness of marketing campaigns. It measures the return generated from marketing expenditures, helping companies optimize their marketing strategies and allocate resources effectively.

ROMI = [(Marketing Revenue - Marketing Cost) / Marketing Cost] * 100%

Return on Equity (ROE)

ROE focuses on the profitability of a company's equity. It measures how efficiently a company is using its shareholders' investments to generate profits.

ROE = (Net Income / Shareholder Equity) * 100%

A high ROE signifies effective utilization of shareholder funds.

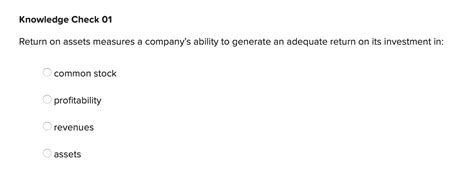

Return on Assets (ROA)

ROA measures how efficiently a company is using its assets to generate profits. It provides insights into the overall operational efficiency of the business.

ROA = (Net Income / Total Assets) * 100%

Return on Capital Employed (ROCE)

ROCE examines the return generated from the capital employed in a business. This includes both equity and debt financing.

ROCE = (Earnings Before Interest and Tax (EBIT) / Capital Employed) * 100%

ROCE provides a holistic view of profitability, considering both equity and debt financing.

Limitations of ROI: What ROI Doesn't Tell You

While ROI is a valuable tool, it's essential to acknowledge its limitations:

-

Ignoring Qualitative Factors: ROI primarily focuses on quantifiable financial results. It often overlooks qualitative factors such as brand building, customer satisfaction, and employee morale, which can contribute significantly to long-term success.

-

Difficulty in Assigning Costs: Accurately assigning costs to specific investments can be challenging, especially in complex projects with multiple contributing factors. Inaccurate cost allocation can lead to misleading ROI figures.

-

Time Horizon: The timeframe considered for ROI calculations significantly impacts the results. A short-term ROI might appear favorable but could mask long-term risks or diminished returns.

-

Inflation: ROI calculations don't inherently account for inflation. An investment yielding a high ROI in nominal terms might have a lower real return after adjusting for inflation.

-

Risk: ROI doesn't explicitly incorporate the level of risk associated with an investment. A high-ROI investment might carry significantly higher risk than a lower-ROI investment.

Applying ROI in Different Business Contexts

ROI's versatility allows for application across various business functions:

Marketing and Advertising: Optimizing Campaigns

Companies use ROI to assess the effectiveness of different marketing channels and campaigns. By tracking the return on marketing investments, businesses can refine their strategies, allocate resources effectively, and maximize the impact of their marketing efforts.

Product Development: Evaluating New Product Launches

ROI plays a crucial role in evaluating the financial viability of new product launches. By forecasting revenue and comparing it to development costs, companies can make informed decisions regarding which products to prioritize.

Capital Budgeting: Prioritizing Investments

ROI analysis is fundamental in capital budgeting decisions. By comparing the ROI of different investment opportunities, companies can allocate capital to the most profitable projects.

Mergers and Acquisitions: Assessing Deal Viability

ROI is a key factor in assessing the financial feasibility of mergers and acquisitions. By evaluating the potential return generated from the acquisition compared to the acquisition cost, companies can make informed decisions on whether to proceed with the deal.

Improving ROI: Strategies for Enhanced Profitability

Several strategies can help businesses improve their ROI:

-

Improving Operational Efficiency: Streamlining processes, reducing waste, and optimizing resource utilization can significantly lower costs and increase profitability.

-

Enhancing Sales and Revenue: Implementing effective sales strategies, expanding market reach, and increasing customer retention can boost revenue generation.

-

Strategic Cost Management: Careful cost control and cost reduction measures are crucial for improving profitability.

-

Investing in Technology: Utilizing technology to automate tasks, improve efficiency, and enhance customer experience can positively impact ROI.

-

Focusing on Customer Retention: Retaining existing customers is often more cost-effective than acquiring new ones.

Conclusion: ROI – A Key to Business Success

Return on Investment (ROI) remains a cornerstone metric for assessing the financial performance of investments and the overall health of a business. While it has limitations, its widespread use underscores its importance in decision-making across various business functions. By understanding ROI calculations, variations, and limitations, along with implementing strategies to enhance profitability, businesses can make informed decisions, optimize resource allocation, and ultimately achieve sustainable growth. The key lies not just in calculating ROI but in using it intelligently to drive strategic improvements and long-term value creation. Remember, a high ROI is not merely an end goal; it’s a reflection of efficient operations, effective strategies, and a well-managed business. Continuous monitoring, analysis, and refinement of ROI-focused strategies are vital for sustained success in the dynamic business environment.

Latest Posts

Latest Posts

-

Which Statement Best Describes The Medical Model

Apr 01, 2025

-

How Do Life Course Theorists View Criminality

Apr 01, 2025

-

Island Species Are Usually Most Closely Related To

Apr 01, 2025

-

What Are The Elements Of A System Of Care Acls

Apr 01, 2025

-

Which Of The Following Is True About Type 1 Diabetes

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Refers To A Company's Ability To Generate An Adequate Return. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.