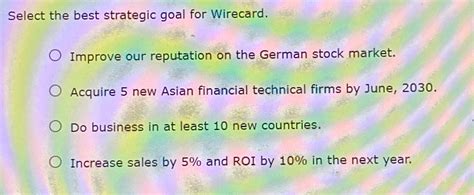

Select The Best Strategic Goal For Wirecard

Breaking News Today

Mar 19, 2025 · 5 min read

Table of Contents

Selecting the Best Strategic Goal for Wirecard: A Post-Scandal Revival

The collapse of Wirecard, once a German payments giant, sent shockwaves through the financial world. Its spectacular downfall, fueled by massive accounting fraud, left a trail of devastation for investors, employees, and the broader financial ecosystem. However, the question remains: could a resurrected Wirecard, stripped of its fraudulent past and operating under stringent ethical oversight, find success? Selecting the right strategic goal is paramount for any potential revival, and this requires a careful examination of the market landscape, the company's remaining assets, and the lessons learned from its catastrophic failure.

Understanding the Wirecard Debacle: A Foundation for Strategic Planning

Before charting a course for a potential Wirecard resurgence, it's crucial to understand the root causes of its demise. The scandal wasn't simply about a few bad apples; it exposed systemic failures in corporate governance, risk management, and auditing practices. The company's aggressive growth strategy, coupled with a lack of transparency and a culture that prioritized rapid expansion over ethical considerations, paved the way for the fraudulent activities to flourish. This understanding informs the crucial aspects of any new strategic direction: transparency, robust governance, and a laser focus on ethical conduct.

Potential Strategic Goals for a Resurrected Wirecard

Several strategic goals could be considered for a reformed Wirecard, each with its own set of challenges and opportunities:

1. Niche Market Focus: Specializing in a Specific Payment Sector

Instead of aiming for broad market dominance, a revitalized Wirecard could focus on a niche market segment. This could involve specializing in a particular industry (e.g., sustainable energy, healthcare, or e-commerce within a specific geographic region) or a specific type of payment processing (e.g., cryptocurrency transactions, micropayments, or B2B payments). This strategy offers several advantages:

- Reduced Competition: Niche markets often have less competition, allowing for faster growth and market share capture.

- Increased Profitability: Specialization can lead to higher profit margins by catering to a specific customer base with specialized needs.

- Enhanced Expertise: Focusing on a particular area allows for the development of deep expertise and competitive advantage.

However, this strategy also carries risks:

- Limited Market Size: Niche markets may be smaller than broader markets, limiting overall growth potential.

- Dependence on a Single Industry: Over-reliance on a single industry makes the company vulnerable to disruptions within that sector.

2. Regaining Trust Through Transparency and Ethical Practices:

Wirecard's biggest hurdle is rebuilding trust. A strategic goal focusing on transparency and ethical conduct is not just a PR exercise; it's fundamental to regaining the confidence of investors, customers, and regulators. This involves:

- Implementing Robust Internal Controls: Implementing rigorous internal controls, auditing processes, and compliance procedures to prevent future fraudulent activities.

- Publicly Reporting Financial Data: Ensuring complete and transparent financial reporting, adhering to the highest accounting standards and undergoing independent audits.

- Investing in Ethical Corporate Culture: Cultivating a corporate culture that prioritizes ethical conduct and values integrity above all else.

This approach is vital for long-term success but may be slower in generating immediate profits.

3. Technological Innovation: Focusing on Cutting-Edge Payment Solutions

Wirecard, before its collapse, had some technological prowess. A revised strategy could leverage this by focusing on innovation in payment technology. This could involve:

- Developing Innovative Payment Solutions: Investing in research and development to create cutting-edge payment solutions, such as biometric authentication, blockchain-based payments, or AI-powered fraud detection systems.

- Strategic Partnerships: Collaborating with fintech startups and technology companies to access cutting-edge technologies and expertise.

- Building a Strong IP Portfolio: Protecting its intellectual property through patents and trademarks to ensure a competitive advantage.

This strategy requires significant investment in R&D and carries a higher risk of failure, but successful innovation could yield substantial rewards.

4. Global Expansion Through Strategic Acquisitions:

While organic growth is important, strategic acquisitions of smaller, well-managed payment processors in underserved markets could accelerate expansion. This approach requires:

- Careful Due Diligence: Rigorous due diligence to avoid repeating past mistakes and ensuring ethical operations of target companies.

- Synergistic Acquisitions: Acquiring companies that complement Wirecard's existing strengths and expand its market reach effectively.

- Integration Expertise: Developing a robust integration strategy to smoothly incorporate acquired companies into the overall business.

This strategy carries significant financial risks, but successful acquisitions could lead to rapid growth and diversification.

Choosing the Best Strategic Goal: A Multifaceted Approach

The ideal strategic goal for a resurrected Wirecard likely isn't a single, isolated strategy but a combination of the approaches mentioned above. A balanced approach that prioritizes:

- Ethical Conduct and Transparency: This is non-negotiable. Without rebuilding trust, no other strategy will succeed.

- Niche Market Focus: Starting with a smaller, more manageable market allows for focused growth and minimizes risk.

- Technological Innovation: Investing in innovative payment technologies provides a competitive edge in the long run.

This combined approach would require a strong leadership team committed to ethical conduct, transparency, and long-term sustainability. A phased approach, focusing initially on rebuilding trust and establishing a solid ethical foundation before expanding aggressively, would be prudent.

Challenges and Mitigation Strategies

Rebuilding Wirecard faces significant challenges:

- Regulatory Scrutiny: The company will face intense regulatory scrutiny, requiring substantial investments in compliance and risk management. Mitigation: Proactive engagement with regulators, transparent communication, and unwavering adherence to all regulations are crucial.

- Reputation Damage: The negative publicity surrounding the scandal will linger, impacting customer trust and investor confidence. Mitigation: A comprehensive public relations strategy focusing on transparency, accountability, and demonstrable ethical conduct is necessary.

- Financial Constraints: Securing funding will be challenging given the company's past failures. Mitigation: A clear, credible business plan demonstrating sustainable profitability and a commitment to ethical operations will be crucial in attracting investors.

Conclusion: A Path to Redemption?

The resurrection of Wirecard is a monumental task, requiring a profound cultural shift and a steadfast commitment to ethical conduct. However, with the right strategic approach—one that prioritizes transparency, ethical practices, niche market focus, and measured technological innovation—a reborn Wirecard might find a path to redemption. The key lies in learning from the past, embracing transparency, and establishing a sustainable, ethical business model. The road ahead is long and arduous, but the possibility of success, albeit challenging, remains a viable objective. The success hinges not just on choosing the "best" strategy, but on consistently executing it with integrity and unwavering commitment to ethical business practices. Only time will tell if Wirecard can successfully navigate this complex landscape and emerge as a credible player in the global payments industry.

Latest Posts

Latest Posts

-

The Age Of Exploration Paved The Way For

Mar 19, 2025

-

Assessment Of A Patient With Hypoglycemia Will Most Likely Reveal

Mar 19, 2025

-

In Which Setting Would Regional Metamorphism Be Most Likely

Mar 19, 2025

-

Elisa Graduated From College With A Double Major

Mar 19, 2025

-

Which Of These Is A Risk Of Speeding

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Select The Best Strategic Goal For Wirecard . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.