Short-term Group Disability Income Benefits Are Quizlet

Breaking News Today

Mar 17, 2025 · 6 min read

Table of Contents

Decoding Short-Term Group Disability Income Benefits: A Comprehensive Guide

Understanding short-term group disability income benefits can feel like navigating a maze. This comprehensive guide will illuminate the intricacies of these benefits, addressing common questions and misconceptions often encountered, and providing clarity for both employees and employers. We'll delve into key aspects, ensuring you possess a robust understanding comparable to acing a Quizlet exam on the subject.

What are Short-Term Group Disability Income Benefits?

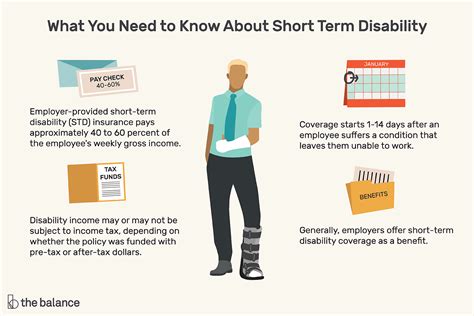

Short-term disability (STD) insurance, often provided as a group benefit by employers, offers financial protection during periods of temporary disability. Unlike long-term disability (LTD) which covers extended absences, STD typically covers a shorter duration, usually ranging from a few weeks to six months. This crucial benefit replaces a portion of your income, allowing you to maintain financial stability while recovering from an illness or injury that prevents you from working. Think of it as a safety net during unforeseen circumstances. The crucial aspect here is that the disability must prevent you from performing your own occupation – not necessarily any occupation.

Key Features of Short-Term Group Disability Income Benefits:

- Eligibility: Eligibility criteria vary depending on the specific policy provided by your employer. Generally, you must have been employed for a certain period (e.g., 90 days) and be actively working at the time of the disability.

- Waiting Period: Most policies include a waiting period before benefits commence. This waiting period, often around 7 days, essentially acts as a deductible, ensuring that minor illnesses don't trigger immediate payouts.

- Benefit Period: As mentioned, the benefit period is typically shorter than LTD, ranging from a few weeks to six months.

- Benefit Amount: The amount of income replaced varies depending on the policy. Common percentages are 60% to 80% of your pre-disability income, often capped at a maximum amount.

- Exclusions: Policies usually exclude certain conditions, such as pre-existing conditions (unless specifically covered), self-inflicted injuries, and injuries sustained while engaging in illegal activities. Carefully review your policy document to fully understand the exclusions.

- Claims Process: Filing a claim typically involves providing medical documentation supporting your inability to work. This might include doctor's notes, medical records, and possibly even evaluations by independent medical examiners.

Common Scenarios Covered by Short-Term Disability:

Short-term disability insurance provides vital support in a wide range of scenarios, including but not limited to:

- Illness: Flu, pneumonia, bronchitis, and other common illnesses can prevent you from working for a period of time.

- Injury: Broken bones, sprains, strains, and other injuries sustained in accidents (whether on or off the job, depending on the policy) can lead to a temporary inability to perform your job duties.

- Surgery: Recovery from surgery often requires time off work, and STD insurance helps cover the resulting lost income.

- Pregnancy and Childbirth: Many policies cover disability related to pregnancy and childbirth, offering crucial financial support during this significant life event. However, the specifics vary considerably, so close examination of the policy is essential.

- Mental Health Conditions: Conditions like depression and anxiety, when severe enough to prevent work, can also be covered.

Understanding the Differences Between Short-Term and Long-Term Disability:

The primary difference lies in the duration of coverage. STD bridges the gap for shorter-term disabilities, typically those lasting less than six months, while LTD covers longer-term disabilities, often lasting several years or even until retirement. Another significant difference is the level of scrutiny during the claims process. LTD claims often face more rigorous reviews due to the prolonged nature and larger financial implications.

How to Maximize Your Short-Term Disability Benefits:

Understanding your policy and adhering to the claims process is crucial to receiving your benefits without issue. Consider these tips:

- Read your policy thoroughly: Don't just skim; meticulously review every clause to understand your coverage, limitations, and the claims procedure.

- Maintain open communication with your employer and insurance provider: Promptly notify your employer and the insurance company of your disability. Provide all required documentation as soon as possible.

- Seek prompt medical attention: Establish a clear record of your injury or illness from the start. Regular doctor visits and adherence to your treatment plan are vital for supporting your claim.

- Keep detailed records: Maintain records of all communication, medical bills, missed work, and any other relevant information. This meticulous documentation can be invaluable during the claims process.

- Understand the appeals process: Familiarize yourself with the process for appealing a denied claim. Know your rights and gather all supporting documentation.

Common Myths and Misconceptions:

Several misconceptions surround STD benefits. Let's clarify some of the most prevalent:

- Myth 1: I don't need STD if I have savings. While savings can provide a temporary buffer, they may not be sufficient for extended periods of disability, particularly if medical expenses are significant. STD acts as a safety net, preserving your savings for other essential needs.

- Myth 2: My employer's health insurance covers lost wages. Health insurance covers medical expenses; it doesn't typically replace lost income due to disability.

- Myth 3: STD is only for serious injuries or illnesses. STD can cover a wide range of illnesses and injuries, including those that might seem minor at first but lead to extended recovery.

- Myth 4: Filing a claim is complicated and time-consuming. While it does require attention and accurate documentation, the process is designed to be manageable. Clear communication with your employer and insurance provider will streamline the process.

Employer's Role in Short-Term Disability Benefits:

Employers play a vital role in providing and administering STD benefits:

- Offering the benefit: Employers choose whether or not to offer STD as part of their employee benefits package.

- Selecting an insurance provider: Employers work with insurance companies to secure coverage for their employees.

- Educating employees: Employers should provide clear and accessible information to employees regarding their STD benefits.

- Administering claims: Employers often have a role in processing claims or facilitating the process between employees and the insurance provider.

The Importance of Understanding Short-Term Disability Benefits:

Understanding your STD benefits is essential for financial preparedness. Unforeseen illnesses or injuries can significantly impact your financial stability. Having a clear grasp of your coverage can reduce stress and anxiety during a challenging time. Don't underestimate the value of this often-overlooked safety net.

Conclusion:

Short-term group disability income benefits are a crucial part of a comprehensive employee benefits package. By understanding the key features, eligibility criteria, and claims process, you can effectively utilize this essential protection when you need it most. Remember, proactive preparation and meticulous record-keeping can significantly streamline the process and ensure you receive the financial support you deserve during a period of temporary disability. This knowledge, far beyond what a simple Quizlet might offer, empowers you to navigate this aspect of your employment with confidence and security.

Latest Posts

Latest Posts

-

True Or False Professional And Technical Communication Is Research Oriented

Mar 18, 2025

-

Which Best Describes The Terrorist Planning Cycle

Mar 18, 2025

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Short-term Group Disability Income Benefits Are Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.