The Revenue Recognition Principle States That Revenue:

Breaking News Today

Mar 16, 2025 · 8 min read

Table of Contents

The Revenue Recognition Principle: A Comprehensive Guide

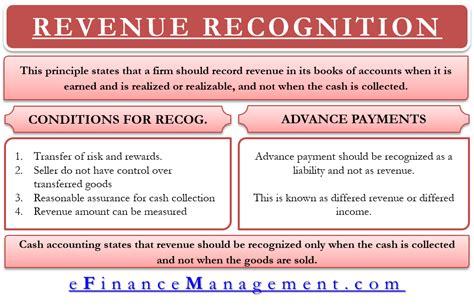

The revenue recognition principle is a cornerstone of accrual accounting, dictating when and how revenue is recognized in a company's financial statements. It ensures that revenue is recorded in the period it's earned, regardless of when cash changes hands. Understanding this principle is crucial for accurately reflecting a company's financial performance and providing reliable information to investors, creditors, and other stakeholders. This comprehensive guide will delve into the intricacies of the revenue recognition principle, exploring its key aspects, underlying concepts, and practical implications.

What is the Revenue Recognition Principle?

The revenue recognition principle, simply stated, dictates that revenue should be recognized when it is earned, not necessarily when cash is received. This means that the crucial point is the transfer of goods or services to a customer, rather than the receipt of payment. This seemingly straightforward principle, however, requires careful consideration of several factors to ensure accurate and consistent application.

Key Aspects of the Revenue Recognition Principle:

-

Earning Process: The core of the principle lies in identifying the earning process. This involves determining the point at which the company has substantially completed its performance obligations. This point varies based on the nature of the transaction. For example, a retailer recognizes revenue when goods are sold and delivered to a customer. A consulting firm, on the other hand, might recognize revenue over time as services are performed.

-

Performance Obligations: The principle focuses on identifying the performance obligations within a contract. A performance obligation is a promise in a contract to transfer goods or services to a customer. A single contract might involve multiple performance obligations, each requiring separate revenue recognition. For example, a software company selling a software license and providing ongoing support would have two distinct performance obligations.

-

Measurement: Once the performance obligation is satisfied, revenue is measured at the fair value of the consideration received or receivable. This often involves accounting for discounts, returns, and other related factors.

-

Collectability: While revenue is recognized when earned, there needs to be reasonable assurance that the revenue is collectible. This involves assessing the creditworthiness of the customer and considering potential risks of non-payment. Significant uncertainties about collectability might delay or even prevent revenue recognition.

Historical Context and Evolution of Revenue Recognition

Before the widespread adoption of the current revenue recognition standard (IFRS 15 and ASC 606), the guidance surrounding revenue recognition was fragmented and varied across different industries. This lack of standardization resulted in inconsistencies in financial reporting, making comparisons between companies difficult.

The development of the new standards aimed to address these inconsistencies by establishing a single, comprehensive framework for revenue recognition. This framework focused on a principles-based approach, allowing for greater flexibility while maintaining comparability. The movement towards convergence between International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP) was a key driver in this evolution, culminating in the similar standards.

IFRS 15 and ASC 606: The Current Standards

The current revenue recognition standard, essentially harmonized globally, simplifies the guidance by focusing on five steps. Both IFRS 15 (International Financial Reporting Standards) and ASC 606 (US Generally Accepted Accounting Principles) use this five-step model:

-

Identify the Contract(s) with a Customer: This involves determining whether a legally enforceable agreement exists. It also considers whether the contract has commercial substance and the customer's acceptance of the goods or services.

-

Identify the Performance Obligations in the Contract: This crucial step involves pinpointing the distinct promises made to the customer within the contract. Each promise represents a performance obligation requiring separate recognition. Careful consideration of the customer's needs is critical in this step.

-

Determine the Transaction Price: The transaction price is the amount the company expects to receive in exchange for transferring the promised goods or services. It considers various factors such as variable considerations (e.g., discounts, rebates, performance bonuses), time value of money, and non-cash considerations.

-

Allocate the Transaction Price to the Performance Obligations: If multiple performance obligations exist, the transaction price is allocated proportionally based on the relative stand-alone selling prices of each obligation. The stand-alone selling price is the price at which the company would sell the good or service separately.

-

Recognize Revenue When (or as) the Entity Satisfies a Performance Obligation: This is the final step, where revenue is recognized when (or as) the entity satisfies a performance obligation. This timing depends on whether the performance obligation is satisfied at a point in time or over time.

Examples of Revenue Recognition Applications

To further clarify the application of the revenue recognition principle, let’s examine some examples:

Example 1: Sale of Goods: A retailer sells a television set for $1,000 cash. Revenue is recognized when the television is delivered to the customer and the retailer has fulfilled its obligation under the contract. The fact that cash is received simultaneously doesn’t alter the timing of revenue recognition.

Example 2: Service Revenue Over Time: A consulting firm provides services to a client for $10,000 over a six-month period. Revenue is recognized ratably over the six months as the services are performed, reflecting the value of the services provided in each period. Even if the entire $10,000 is paid upfront, revenue is still recognized over time.

Example 3: Long-Term Construction Contract: A construction company undertakes a large building project with multiple performance obligations (design, construction, inspections) spread over several years. The contract price will be allocated to each performance obligation, and revenue for each obligation is recognized as it is completed. This may involve more complex calculations involving progress towards the completion of each obligation.

Example 4: Software Licenses with Support: A software company sells a software license for $500 and provides ongoing support for $100 per month. This represents two separate performance obligations. The license revenue is recognized upon delivery and the support revenue is recognized each month as the support services are provided.

Example 5: Variable Consideration: A company sells products with a volume discount. The revenue recognition depends on the company's best estimate of the likely discount based on historical data and other factors. This requires considering the probability of customers qualifying for discounts and estimating the impact on the final revenue recognition.

Challenges in Applying the Revenue Recognition Principle

Despite the clear five-step model, implementing the revenue recognition principle can pose challenges:

-

Identifying Performance Obligations: Determining the boundaries of distinct performance obligations requires careful consideration of the contract and the customer's perspective. This can be particularly complex in contracts with intricate terms and conditions.

-

Determining Transaction Price: Accurately estimating the transaction price, especially when variable considerations are involved, can be difficult. Companies need to make realistic judgments based on available information and historical experience.

-

Allocating the Transaction Price: If multiple performance obligations exist, allocating the transaction price requires determining the relative stand-alone selling prices, which may not always be readily available.

-

Estimating Collectability: Assessing the likelihood of collecting payments necessitates careful credit risk assessment and forecasting.

-

Accounting for Complex Transactions: Many real-world business transactions are significantly more complex than the simple examples presented above. They may involve multiple parties, different currencies, variable payments, and other factors making accurate revenue recognition challenging.

The Importance of Proper Revenue Recognition

Accurate and timely revenue recognition is paramount for several reasons:

-

Financial Reporting Accuracy: Proper application of the principle ensures that a company’s financial statements accurately reflect its financial performance. This provides reliable information to users of the financial statements.

-

Investor Confidence: Accurate revenue recognition builds investor confidence by providing a clear and transparent picture of the company's financial health. Misstatements can erode investor trust and negatively impact the company's valuation.

-

Lender Relations: Banks and other lenders rely on accurate financial statements to assess creditworthiness. Inaccurate revenue recognition can harm a company's ability to secure financing.

-

Regulatory Compliance: Compliance with revenue recognition standards is crucial for avoiding penalties and legal repercussions. Regulators closely scrutinize revenue recognition practices as they are critical to financial statement integrity.

-

Internal Control: Effective internal controls are necessary to ensure that revenue is recognized in accordance with the relevant standards. Robust processes and policies for revenue recognition help mitigate the risk of errors or fraud.

Conclusion

The revenue recognition principle is a fundamental concept in accrual accounting. Understanding and correctly applying this principle is essential for producing accurate and reliable financial statements. While the five-step model provides a framework, careful consideration and judgment are necessary to address the complexity inherent in various business transactions. The benefits of proper revenue recognition extend far beyond mere compliance, fostering trust, transparency, and sound financial decision-making. The consistent evolution and refining of standards like IFRS 15 and ASC 606 underscore the ongoing importance of keeping abreast of best practices and ensuring accurate financial reporting. Continuous professional development and staying informed on the latest updates in accounting standards are crucial for accountants and financial professionals to maintain their expertise in this vital area.

Latest Posts

Latest Posts

-

True Or False Professional And Technical Communication Is Research Oriented

Mar 18, 2025

-

Which Best Describes The Terrorist Planning Cycle

Mar 18, 2025

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Revenue Recognition Principle States That Revenue: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.