What Part Does Interest Play In Deficit Spending

Breaking News Today

Mar 20, 2025 · 6 min read

Table of Contents

What Part Does Interest Play in Deficit Spending?

Governments, like households, sometimes spend more money than they bring in through taxes and other revenue. This difference is called a budget deficit. To cover this deficit, governments borrow money, typically by issuing bonds. A crucial element in understanding the implications of deficit spending is the role of interest payments on that borrowed money. Interest payments significantly impact a nation's finances and its long-term economic health. This article delves into the complex relationship between interest and deficit spending, exploring its multifaceted implications.

The Mechanics of Deficit Spending and Interest Payments

When a government runs a deficit, it needs to finance this shortfall. This is primarily done by borrowing from domestic and international lenders through the issuance of government bonds. These bonds represent a promise to repay the principal amount plus accumulated interest at a future date. The interest rate on these bonds is influenced by various factors, including prevailing market interest rates, the perceived creditworthiness of the government, and inflation expectations.

Interest Rates and the Cost of Borrowing

Higher interest rates translate directly into higher interest payments on the government's debt. This means a larger portion of the government's budget is allocated to servicing its debt rather than funding essential public services like education, healthcare, or infrastructure. This is a critical consideration for policymakers, as it forces difficult choices about resource allocation. A significant increase in interest payments can crowd out other spending, potentially hindering economic growth.

The Accumulation of Debt and Interest Payments

The accumulation of debt over time exacerbates the problem. Each year's deficit adds to the total national debt, increasing the principal amount on which interest payments are calculated. This creates a snowball effect: higher debt leads to higher interest payments, which in turn can lead to even larger deficits in subsequent years, fueling a cycle of debt accumulation. This dynamic is often referred to as the debt trap, and escaping it requires careful fiscal management and potentially painful adjustments.

The Impact of Interest Payments on the Economy

The impact of interest payments on the economy is far-reaching and multifaceted. It extends beyond the simple budgetary constraints imposed on the government. The following sections detail some of the key economic consequences:

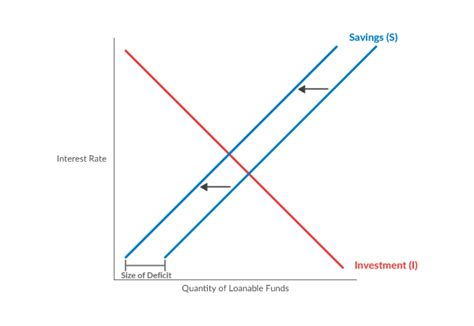

Crowding Out Effect

One significant consequence of high interest payments is the crowding out effect. When the government borrows heavily to finance its deficits, it increases the demand for loanable funds. This increased demand can drive up interest rates, making it more expensive for businesses to invest in capital projects, such as new equipment or expansion. This reduction in private investment can stifle economic growth and limit job creation. The government's borrowing essentially competes with private sector borrowing, pushing out private investment and potentially hindering long-term economic expansion.

Inflationary Pressures

Excessive government borrowing can also contribute to inflationary pressures. If the central bank monetizes the debt—that is, it prints money to finance the government's borrowing—this can lead to an increase in the money supply, which in turn can fuel inflation. While controlled inflation can be beneficial for economic growth, uncontrolled inflation can erode purchasing power, destabilize the economy, and negatively impact individuals' savings. Therefore, maintaining a balance between fiscal and monetary policy is crucial in managing inflationary risks associated with deficit spending.

Intergenerational Equity

The accumulation of debt through deficit spending raises concerns about intergenerational equity. The current generation benefits from the services and programs funded by deficit spending, while future generations inherit the burden of repaying the debt, including the accumulated interest. This raises ethical questions about the fairness of imposing such a financial burden on future generations, who had no say in the decisions that led to the debt accumulation. This intergenerational burden underscores the need for responsible fiscal policy and careful consideration of the long-term consequences of deficit spending.

Factors Influencing Interest Payments on Government Debt

Several factors influence the level of interest payments on government debt, making it a dynamic and complex issue:

Global Interest Rates

Global interest rates significantly impact the cost of borrowing for governments. When global interest rates rise, borrowing becomes more expensive for all nations, including those with high levels of deficit spending. This makes it challenging for countries with already high debt burdens to manage their finances, potentially leading to further deficit expansion or austerity measures. Global economic conditions, central bank policies, and investor sentiment all play a role in shaping global interest rates and, consequently, interest payments on government debt.

Creditworthiness of the Government

The creditworthiness of a government plays a crucial role in determining the interest rate it pays on its debt. Governments perceived as financially responsible and having a low risk of default typically pay lower interest rates. Conversely, governments with a history of fiscal mismanagement and a high risk of default face higher interest rates, increasing the cost of borrowing and potentially leading to a vicious cycle of higher deficits and higher interest payments. Credit rating agencies continuously assess governments' fiscal health, and their ratings significantly influence market perceptions and the interest rates charged on government bonds.

Inflation Expectations

Inflation expectations also influence interest rates. Lenders expect to be compensated for the erosion of the purchasing power of their money due to inflation. Higher inflation expectations lead to higher interest rates to compensate lenders for the anticipated loss in value of their investment. Central banks actively try to manage inflation expectations through monetary policy, as higher-than-expected inflation can increase interest payments on government debt and potentially destabilize the economy.

Managing the Impact of Interest on Deficit Spending

Managing the impact of interest payments on deficit spending requires a multifaceted approach encompassing fiscal discipline, sound monetary policy, and structural reforms.

Fiscal Consolidation

Fiscal consolidation involves reducing government spending and/or increasing taxes to decrease the budget deficit. This reduces the need for borrowing, thus lowering the amount of interest payments. However, fiscal consolidation can be politically challenging and may have negative short-term economic consequences if not implemented carefully. It often involves difficult choices about which public services to cut or which taxes to raise.

Debt Management Strategies

Effective debt management strategies can also help mitigate the impact of interest payments. These strategies may include extending the maturity of the debt, diversifying the sources of borrowing, and actively managing the government's debt portfolio to minimize interest rate risk. These strategies aim to reduce the overall cost of servicing the debt over the long term.

Structural Reforms

Structural reforms aimed at boosting economic growth can help reduce the debt burden over time. By enhancing productivity, competitiveness, and attracting foreign investment, these reforms can increase government revenue and reduce the need for deficit spending. Such reforms often require difficult political decisions and require time to yield significant results.

Conclusion: A Balancing Act

The interplay between interest payments and deficit spending is a crucial aspect of macroeconomic management. High interest payments can severely constrain government finances, limiting resources available for essential public services and potentially hindering economic growth. The accumulation of debt can exacerbate the problem, creating a self-reinforcing cycle of increasing deficits and interest payments. Effective management requires a careful balancing act between stimulating economic growth, maintaining fiscal discipline, and implementing sound monetary policy. Understanding the complexities of this relationship is essential for policymakers, economists, and citizens alike to make informed decisions about the long-term economic health of their nation. The consequences of ignoring the impact of interest on deficit spending can be severe and long-lasting. Responsible fiscal policy, prudent debt management, and structural reforms are vital to mitigating the risks and ensuring sustainable economic growth for current and future generations.

Latest Posts

Latest Posts

-

Once Entrance And Access To The Patient

Mar 21, 2025

-

Which Of The Following Is A Complete Sentence

Mar 21, 2025

-

Name The Three Main Types Of Intaglio Printing

Mar 21, 2025

-

What Is Unique About An Azeotropic Refrigerant Mixture

Mar 21, 2025

-

The Region Of High Hydrogen Ion Concentration Is The

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about What Part Does Interest Play In Deficit Spending . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.