Which Of These Events Would Be A Result Of Inflation

Breaking News Today

Mar 15, 2025 · 6 min read

Table of Contents

Which of These Events Would Be a Result of Inflation?

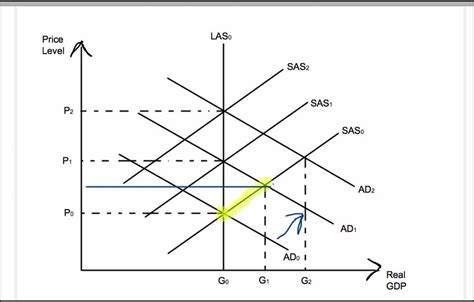

Inflation, the persistent increase in the general price level of goods and services in an economy over a period of time, significantly impacts various aspects of our lives. Understanding its consequences is crucial for individuals, businesses, and policymakers alike. This article delves into the multifaceted effects of inflation, examining which events are likely to result from a sustained inflationary environment.

Defining Inflation and its Measurement

Before exploring the consequences, let's clarify what inflation is and how it's measured. Inflation is typically measured using price indices, most notably the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI tracks the average change in prices paid by urban consumers for a basket of consumer goods and services, while the PPI measures the average change in prices received by domestic producers for their output. A sustained increase in these indices signifies inflation. The rate of inflation is usually expressed as a percentage change over a specific period, often annually.

Several factors contribute to inflation, including increased demand, rising production costs (including wages and raw materials), government policies (like excessive money printing), and supply chain disruptions. Understanding these drivers helps in predicting the likely consequences.

Events Likely to Result from Inflation

The consequences of inflation are far-reaching and interconnected. Here's an in-depth look at several events that are highly probable outcomes of a sustained inflationary period:

1. Increased Prices of Goods and Services

This is the most immediate and obvious consequence of inflation. As the general price level rises, consumers pay more for everything from groceries and gasoline to housing and healthcare. This erosion of purchasing power affects all segments of society, but disproportionately impacts low-income households who spend a larger portion of their income on essential goods and services.

Keywords: Inflation, price increases, purchasing power, consumer goods, essential goods, cost of living, inflation rate, price index.

2. Reduced Purchasing Power

With higher prices, the purchasing power of money decreases. This means that the same amount of money can buy fewer goods and services than before. Consumers need to spend more to maintain their previous consumption levels. This reduction in purchasing power can lead to a decline in living standards, especially if wages don't keep pace with inflation.

Keywords: Purchasing power, real wages, inflation, erosion of purchasing power, cost of living, disposable income, economic hardship.

3. Increased Interest Rates

Central banks often respond to inflation by raising interest rates. Higher interest rates make borrowing more expensive, discouraging spending and investment. This is a monetary policy tool aimed at cooling down the economy and controlling inflation by reducing aggregate demand. However, higher interest rates can also negatively impact economic growth.

Keywords: Interest rates, monetary policy, central bank, inflation control, economic growth, borrowing costs, investment, recession.

4. Wage-Price Spiral

Inflation can trigger a wage-price spiral, a self-perpetuating cycle where rising prices lead to demands for higher wages, which in turn further push up prices. Workers demand higher wages to maintain their real income in the face of rising inflation, but these wage increases can lead to businesses raising prices to cover their increased labor costs, thus perpetuating the cycle.

Keywords: Wage-price spiral, inflation, wages, prices, labor costs, cost-push inflation, economic instability.

5. Increased Savings Rate (Initially)

In the initial stages of inflation, some individuals may increase their savings rate to protect themselves from the declining purchasing power of money. They may choose to save more rather than spend, anticipating further price increases. However, this effect is often temporary and may be countered by other factors, like the need to cover rising living expenses.

Keywords: Savings rate, inflation, precautionary savings, consumer behavior, economic uncertainty, investment.

6. Increased Investment in Inflation-Hedged Assets

Investors often seek to protect their wealth during inflationary periods by investing in assets that tend to hold their value or even appreciate in the face of rising prices. These include commodities like gold, real estate, and certain types of stocks. This increased demand drives up the prices of these assets, creating another ripple effect throughout the economy.

Keywords: Inflation hedge, gold, real estate, commodities, stocks, investment strategy, portfolio diversification, inflation protection.

7. Currency Depreciation

In the case of persistent inflation, a country's currency may depreciate against other currencies. This is because higher inflation erodes the purchasing power of the currency, making imports more expensive and exports relatively cheaper. A weaker currency can affect trade balances and overall economic stability.

Keywords: Currency depreciation, exchange rates, inflation, trade balance, imports, exports, international trade, economic competitiveness.

8. Menu Costs

Businesses face "menu costs" – the costs associated with changing prices. During inflationary periods, businesses frequently have to update their price lists, menus, and other pricing information, which can be time-consuming and expensive. These costs, while seemingly small individually, can accumulate and impact profitability.

Keywords: Menu costs, inflation, price adjustments, business costs, pricing strategies, economic efficiency, administrative costs.

9. Shoe-Leather Costs

Another cost associated with inflation is "shoe-leather costs," the time and effort people spend trying to minimize the effects of inflation. This might include frequent trips to the bank to withdraw cash or searching for the best deals to avoid paying inflated prices. These efforts divert time and resources from other productive activities.

Keywords: Shoe-leather costs, inflation, transaction costs, opportunity costs, time costs, economic efficiency, money management.

10. Uncertainty and Reduced Investment

High and unpredictable inflation creates uncertainty among businesses and investors. This uncertainty makes them hesitant to invest in long-term projects, fearing that unexpected price changes could negatively impact their returns. Reduced investment can hinder economic growth and job creation.

Keywords: Uncertainty, investment, inflation, economic growth, business confidence, risk aversion, long-term planning, economic stability.

11. Social Unrest

Persistent high inflation can lead to social unrest and political instability. If people feel their living standards are declining rapidly and the government is not addressing the issue effectively, this can create widespread discontent, leading to protests, strikes, and even civil unrest.

Keywords: Social unrest, political instability, inflation, inequality, poverty, public dissatisfaction, government response, economic crisis.

12. Distorted Resource Allocation

Inflation can distort resource allocation within an economy. When prices don't accurately reflect the relative scarcity of goods and services, businesses may make suboptimal investment decisions, leading to inefficient resource use. This can reduce overall economic efficiency and productivity.

Keywords: Resource allocation, inflation, market signals, price distortions, economic efficiency, investment decisions, market failures.

Conclusion: Navigating the Inflationary Landscape

Inflation's impact is complex and multifaceted. While some consequences are immediate and readily observable, others are more subtle and long-term. Understanding these potential consequences is vital for individuals, businesses, and governments to make informed decisions and develop strategies to mitigate the negative impacts of inflation. Whether it's adjusting investment strategies, managing personal finances, or implementing appropriate monetary and fiscal policies, navigating the inflationary landscape requires a comprehensive understanding of its far-reaching effects. The events listed above highlight only some of the significant consequences of sustained inflation; its impact varies depending on the severity and duration of the inflationary period, as well as the specific economic context.

Latest Posts

Latest Posts

-

How Many Feet From A Helicopter Lifting Depositing Quizlet

Mar 18, 2025

-

What Is The Best Definition Of Marginal Revenue Quizlet

Mar 18, 2025

-

The Superficial Temporal Artery Can Be Palpated Quizlet

Mar 18, 2025

-

Rn Comprehensive Online Practice 2023 B With Ngn Quizlet

Mar 18, 2025

-

Administrative Civil Or Criminal Sanctions Cui Quizlet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Which Of These Events Would Be A Result Of Inflation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.