Which Scenario Is An Example Of Cost Push Inflation

Breaking News Today

Mar 15, 2025 · 7 min read

Table of Contents

Which Scenario is an Example of Cost-Push Inflation? Understanding the Drivers of Rising Prices

Cost-push inflation, a significant economic phenomenon, occurs when the overall price level in an economy rises due to increases in the cost of producing goods and services. Unlike demand-pull inflation, which stems from excessive demand exceeding supply, cost-push inflation is driven by factors within the production process. Understanding these factors is crucial for policymakers and businesses alike. This article will delve into various scenarios, analyzing which ones represent classic examples of cost-push inflation and exploring the underlying mechanisms at play.

Understanding Cost-Push Inflation: A Deep Dive

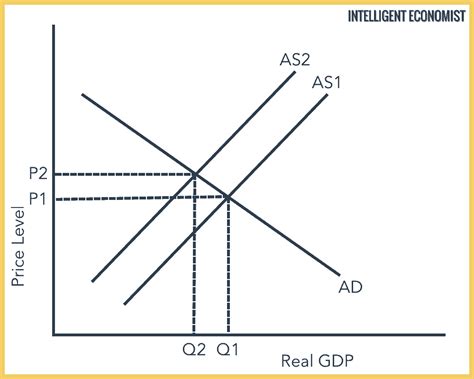

Cost-push inflation is characterized by a reduction in aggregate supply, the total supply of goods and services available in an economy at a given price level. This reduction can be triggered by a multitude of factors, leading to a leftward shift of the aggregate supply curve. Consequently, businesses respond by raising prices to maintain profitability, resulting in a higher overall price level. This differs from demand-pull inflation, where increased demand leads to higher prices.

Key factors contributing to cost-push inflation include:

- Increased wages: A significant rise in wages, often driven by strong labor unions or labor shortages, increases the cost of production. Businesses pass these increased labor costs onto consumers through higher prices.

- Rising raw material prices: Fluctuations in commodity markets, such as oil, metals, or agricultural products, can significantly impact the cost of inputs for many industries. A surge in these prices directly translates to higher production costs and subsequently, higher consumer prices.

- Supply chain disruptions: Events like natural disasters, pandemics, or geopolitical instability can disrupt global supply chains, leading to shortages and increased prices for essential goods and components.

- Increased taxes and regulations: Government policies such as increased taxes on businesses or stricter environmental regulations can raise production costs, forcing companies to increase prices to maintain profit margins.

- Technological advancements: While often beneficial in the long run, the initial investment and implementation costs associated with new technologies can temporarily increase production expenses, contributing to short-term inflationary pressures.

Scenarios Illustrating Cost-Push Inflation

Let's examine various scenarios to illustrate how cost-push inflation manifests:

Scenario 1: The Oil Price Shock

Imagine a global oil crisis. A major oil-producing country experiences a sudden political upheaval, disrupting oil exports significantly. This immediately impacts the price of oil, causing it to skyrocket. Numerous industries rely heavily on oil – transportation, manufacturing, plastics, and many more. The increased cost of oil directly translates into higher transportation costs for goods, increased manufacturing costs for various products, and higher energy bills for consumers. Businesses across the board pass these increased costs onto consumers, leading to widespread inflation. This is a textbook example of cost-push inflation triggered by rising raw material prices.

Scenario 2: The Minimum Wage Hike

Suppose a country implements a substantial increase in the minimum wage. While intended to improve the living standards of low-wage earners, this can have inflationary consequences. Businesses, particularly those employing a large number of minimum-wage workers, such as restaurants and retail stores, face immediate increased labor costs. To maintain profit margins, they raise prices on their goods and services, resulting in inflation. This exemplifies cost-push inflation driven by increased wages. The magnitude of the inflationary impact depends on the size of the wage increase, the proportion of minimum-wage workers in the economy, and the elasticity of demand for goods and services affected.

Scenario 3: The Pandemic Supply Chain Crisis

The COVID-19 pandemic dramatically illustrated the fragility of global supply chains. Lockdowns, factory closures, and port congestion led to significant shortages of various goods, from semiconductors to building materials. The reduced supply coupled with relatively stable or even increased demand resulted in a sharp increase in prices for many products. This highlights cost-push inflation fueled by supply chain disruptions. The lack of readily available goods and components forced businesses to increase prices to meet the constrained supply, impacting consumers directly.

Scenario 4: Increased Environmental Regulations

A government introduces stricter environmental regulations aimed at reducing carbon emissions. Companies, particularly those in energy-intensive industries, face increased compliance costs – investing in cleaner technologies, upgrading equipment, and implementing new processes. These additional expenses increase the cost of production, and companies pass these on to consumers through higher prices, leading to inflation. This illustrates cost-push inflation stemming from increased taxes and regulations. The extent of inflationary pressure depends on the stringency of the regulations and the adaptability of industries to the new standards.

Scenario 5: A Major Natural Disaster

A devastating earthquake destroys a significant portion of a country's agricultural infrastructure, including farms and processing plants. This dramatically reduces the supply of agricultural products, impacting food prices. The shortage of food staples, coupled with consistent or increased demand, results in higher food prices, contributing to overall inflation. This scenario highlights cost-push inflation caused by supply chain disruptions and reduced aggregate supply directly impacting essential goods.

Distinguishing Cost-Push from Demand-Pull Inflation

It's crucial to differentiate between cost-push and demand-pull inflation. While both lead to rising prices, their underlying causes are distinct. Demand-pull inflation arises from excessive aggregate demand, exceeding the economy's capacity to produce goods and services. This typically occurs during periods of strong economic growth and low unemployment. In contrast, cost-push inflation originates from supply-side factors, reducing the economy's capacity to produce goods and services at existing prices.

The Wage-Price Spiral: A Vicious Cycle

One critical aspect of cost-push inflation is the potential for a wage-price spiral. When prices rise due to increased production costs, workers demand higher wages to compensate for the reduced purchasing power of their earnings. Businesses, facing increased labor costs, respond by raising prices further, leading to another round of wage demands. This cycle can continue, perpetuating inflation and potentially leading to a period of sustained price increases.

Policy Responses to Cost-Push Inflation

Addressing cost-push inflation requires a nuanced approach that targets the underlying causes. Simple monetary policy tightening (raising interest rates) can be counterproductive as it can further reduce aggregate demand and exacerbate economic hardship without addressing the core issue of reduced supply. Instead, policymakers should consider measures such as:

- Supply-side policies: These aim to boost the economy's productive capacity by investing in infrastructure, education, and technology, reducing bureaucratic bottlenecks, and promoting competition.

- Targeted subsidies: Government subsidies can temporarily offset increased costs for essential goods and services, alleviating the immediate inflationary impact on consumers.

- Income policies: These involve measures such as wage and price controls, although they are often controversial and may lead to unintended consequences such as shortages or black markets.

- International cooperation: Addressing global supply chain disruptions often requires international collaboration to improve logistics, reduce trade barriers, and enhance resilience to global shocks.

Conclusion: Understanding the Nuances of Cost-Push Inflation

Cost-push inflation is a complex phenomenon with far-reaching consequences. It's driven by a variety of factors impacting the supply side of the economy, leading to increased production costs and ultimately, higher prices for consumers. Understanding the specific drivers in each scenario is crucial for implementing effective policy responses. While monetary policy has a role to play, addressing the underlying supply-side constraints and fostering economic resilience are essential for managing cost-push inflation effectively and mitigating its negative impacts on economic growth and societal well-being. Ignoring the root causes and relying solely on demand-side measures can worsen the situation, potentially leading to stagflation – a combination of slow economic growth and high inflation – a particularly challenging economic predicament. Therefore, a comprehensive and nuanced approach that tackles both supply-side and demand-side factors is crucial for navigating the complexities of cost-push inflation.

Latest Posts

Latest Posts

-

Property And Casualty Insurance Exam Questions And Answers Pdf

Mar 15, 2025

-

World History Sem A Unit 1 Post Test Ofy

Mar 15, 2025

-

Anything That Interferes With A Message And Is Usually Temporary

Mar 15, 2025

-

If Your Truck Or Bus Has Dual Parking Control Valves

Mar 15, 2025

-

Correctly Label The Anterior Muscles Of The Thigh

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Which Scenario Is An Example Of Cost Push Inflation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.