Which Statement Shows That Money Is A Store Of Value

Breaking News Today

Mar 17, 2025 · 7 min read

Table of Contents

Which Statement Shows That Money Is a Store of Value?

Money serves three primary functions in an economy: a medium of exchange, a unit of account, and a store of value. While its role as a medium of exchange (facilitating transactions) and a unit of account (providing a common measure of value) are relatively straightforward, the concept of money as a store of value is more nuanced and subject to various factors. This article delves deep into what constitutes money as a store of value, exploring various statements that demonstrate this function, the challenges to its effectiveness, and the implications for individuals and economies.

Understanding the Store of Value Function of Money

A store of value means that money, in its various forms (cash, bank deposits, etc.), can be saved and used for future purchases. Ideally, the purchasing power of this saved money remains relatively stable over time. However, this is not always the case, and the effectiveness of money as a store of value is significantly influenced by several economic variables.

Key Characteristics of a Good Store of Value:

- Stability: The value of the money should remain relatively constant, or at least predictably change, over time. High inflation erodes the purchasing power, making it a poor store of value.

- Liquidity: The ability to quickly and easily convert the asset into cash is crucial. Real estate, for example, while a store of value, is less liquid than cash.

- Safety: The asset should be secure and protected from theft or loss. Holding large amounts of cash at home lacks the safety of bank deposits.

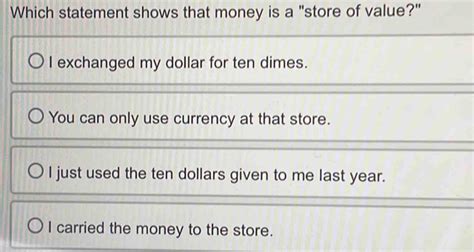

Statements Demonstrating Money as a Store of Value

Numerous scenarios illustrate money's function as a store of value. Let's analyze several statements, examining how they highlight this vital economic role.

1. "I saved $10,000 in a savings account to buy a car next year."

This statement clearly shows money acting as a store of value. The individual is deferring consumption, intentionally setting aside money today to acquire a car in the future. The savings account provides a relatively safe and liquid means of storing the value until it's needed. The success of this strategy depends on the stability of the currency and the interest rate earned (or lost to inflation). If inflation outpaces interest earned, the purchasing power of the $10,000 may decrease by the time the car is purchased.

2. "My grandmother kept her life savings in government bonds, which she later used to fund her retirement."

This exemplifies a long-term perspective on money as a store of value. Government bonds, while not technically money, are considered a safe and relatively stable store of value. Grandmother is effectively storing her purchasing power over many years, relying on the government's commitment to repay the principal plus interest. The success here relies on the stability of the government and the reliability of its bond program. If the government defaults, her savings would lose substantial value.

3. "The company invested its profits in treasury bills to ensure financial stability."

Corporations also use money as a store of value. Investing in treasury bills—short-term debt obligations issued by the government—serves as a safe and liquid way to store excess cash. This allows the company to meet future obligations, invest in expansion, or weather economic downturns without immediately needing to deploy all available funds. The choice of treasury bills highlights a preference for safety and liquidity over potentially higher returns from riskier investments.

4. "I bought gold coins as a hedge against inflation."

This statement demonstrates a concern about money's ability to maintain its purchasing power. While not money itself, gold has historically served as a store of value. Individuals who anticipate high inflation may invest in gold as a hedge because its value tends to rise during inflationary periods. This shows that the perception of money as a reliable store of value directly influences investment decisions. However, it is important to note that gold prices fluctuate, and they are not immune to market forces.

5. "We put a down payment on a house using our savings."

This represents a significant use of money as a store of value. Accumulating a down payment requires saving money over an extended period, often requiring considerable discipline and patience. The accumulated savings are used to acquire a house, a valuable asset that also serves as a store of value. However, the housing market's volatility means that the house's value isn't guaranteed to appreciate, and it is significantly less liquid than cash.

Challenges to Money as a Store of Value

While the above statements highlight the potential for money to act as a store of value, several factors can undermine its effectiveness:

1. Inflation: The Biggest Enemy

Inflation, the sustained increase in the general price level of goods and services in an economy over a period of time, is the most significant threat to money's ability to store value. As prices rise, the purchasing power of money declines. High inflation can dramatically erode the value of savings, making long-term planning difficult and discouraging saving.

2. Currency Fluctuations and Exchange Rates

For individuals and businesses engaged in international transactions, currency fluctuations pose a risk. Changes in exchange rates can impact the value of savings held in foreign currencies. A depreciation of the home currency can reduce the value of foreign-currency savings when converted back to the home currency.

3. Deflation: A Different Kind of Threat

Deflation, the opposite of inflation, also poses challenges. While lower prices might seem beneficial, deflation can discourage spending as consumers anticipate further price drops. This can lead to decreased economic activity and potentially reduce the value of assets, including money.

4. Financial Instability and Systemic Risk

Bank failures or widespread financial crises can dramatically impact the value of money held in bank accounts or other financial institutions. Loss of confidence in the banking system can lead to runs on banks, reducing the accessibility and value of savings.

5. Political and Economic Uncertainty

Political instability, economic shocks, and other unforeseen events can significantly affect the value of money. Uncertainty about the future can make it difficult to assess the risk associated with holding money and make individuals less likely to save.

Implications for Individuals and Economies

The effectiveness of money as a store of value has significant implications for both individuals and the broader economy.

For individuals, the ability to store value reliably influences:

- Saving and Investment Decisions: The perception of money as a reliable store of value shapes individuals' savings patterns and investment choices. High inflation encourages spending and discourages saving.

- Long-Term Financial Planning: The ability to store value over time is critical for long-term planning, including retirement savings, education funding, and major purchases.

- Wealth Accumulation: The effective preservation of purchasing power is crucial for accumulating wealth over time.

For economies, the store of value function of money influences:

- Economic Growth: A stable store of value encourages saving and investment, which are vital for economic growth. Uncertainty about the value of money can stifle investment and reduce economic activity.

- Price Stability: Maintaining price stability, which is essential for a healthy economy, requires managing inflation effectively. Loss of confidence in the currency's ability to retain value can lead to instability and economic turmoil.

- Monetary Policy: Central banks play a crucial role in managing inflation and ensuring the stability of the currency, thereby safeguarding its function as a store of value.

Conclusion: A Complex but Crucial Function

The statement that best shows money's function as a store of value is not a single, simple statement. It's the cumulative effect of countless individual and collective actions demonstrating the attempt to preserve purchasing power over time. While the ideal scenario is the maintenance of stable purchasing power, several factors, particularly inflation, consistently challenge this function. Understanding the complexities of money's role as a store of value is essential for individuals to make informed financial decisions and for policymakers to create a stable economic environment. The success of a nation's economy, and the financial well-being of its citizens, significantly hinges on the consistent preservation of money's capacity to store value.

Latest Posts

Latest Posts

-

Which Best Describes The Terrorist Planning Cycle

Mar 18, 2025

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Which Statement Shows That Money Is A Store Of Value . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.