Who Does A Liability Insurance Policy Cover Quizlet

Breaking News Today

Mar 18, 2025 · 6 min read

Table of Contents

Who Does a Liability Insurance Policy Cover? A Comprehensive Guide

Liability insurance is a crucial aspect of risk management for individuals and businesses alike. Understanding exactly who is covered under a liability policy is essential to avoid costly mistakes and ensure adequate protection. This comprehensive guide will delve into the intricacies of liability insurance coverage, addressing common questions and scenarios. We'll explore different types of liability insurance, clarifying the scope of coverage and highlighting potential limitations. By the end, you'll have a clearer grasp of who your liability policy protects and how to maximize its benefits.

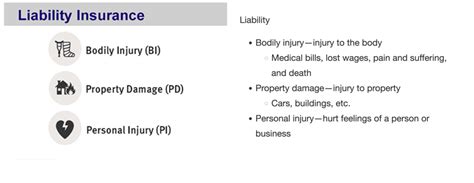

Understanding Liability Insurance Basics

Before we delve into specific coverage details, let's establish a foundational understanding of liability insurance. Essentially, liability insurance protects you from financial losses arising from claims of bodily injury or property damage caused by your negligence or the negligence of those you are responsible for. It covers the costs associated with legal defense, settlements, and judgments.

Key Terms to Understand:

- Insured: The individual or entity named on the insurance policy.

- Named Insured: The specific person or organization explicitly identified as the insured on the policy's declaration page.

- Additional Insured: Individuals or entities added to the policy beyond the named insured, granting them specific coverage.

- Claim: A formal request for compensation made by a third party due to alleged damages caused by the insured.

- Liability: Legal responsibility for causing harm or damage to another person or their property.

- Negligence: Failure to exercise the reasonable care that a prudent person would exercise in a similar situation.

Types of Liability Insurance and Coverage

Various types of liability insurance cater to different needs and circumstances. Let's examine some common ones:

1. Homeowners Insurance: This policy typically includes liability coverage for accidents occurring on your property or caused by your actions off your property. It protects you against claims arising from bodily injury or property damage to others.

Coverage Extends To:

- You and your family members: Coverage extends to the named insured, their spouse, and resident relatives.

- Guests on your property: Liability coverage applies to injuries or damages caused to guests due to your negligence.

- Pet-related incidents: Many policies cover liability arising from dog bites or other pet-related incidents, although specific exclusions and limitations might apply.

- Certain off-premises activities: Coverage often extends to accidents caused by your actions off your property, such as accidentally damaging someone's property while using tools.

2. Renters Insurance: Similar to homeowners insurance, renters insurance provides liability protection for renters. It covers accidents that occur in your rented dwelling or those caused by your actions elsewhere.

Coverage Extends To:

- You and your family members: Coverage is similar to homeowners insurance, encompassing the named insured and resident family members.

- Guests in your rented apartment/house: Liability coverage extends to injuries or damages to visitors due to your negligence.

- Pet-related incidents: Similar to homeowners insurance, liability for pet-related incidents is typically included, but with possible limitations.

3. Auto Insurance: Auto insurance is legally mandated in most jurisdictions and typically includes liability coverage to protect you in case you cause an accident.

Coverage Extends To:

- You and any authorized drivers: Coverage typically covers the named insured and other drivers authorized to operate the vehicle.

- Passengers in your vehicle: Liability coverage may extend to injuries sustained by passengers in your car, depending on specific policy provisions. However, personal injury protection (PIP) usually covers medical expenses for the insured and their passengers regardless of fault.

- Third-party property damage: Coverage applies to damages caused to another person's vehicle or property in an accident.

4. Business Liability Insurance (General Liability Insurance): Businesses need this type of liability insurance to protect against claims arising from their operations.

Coverage Extends To:

- The business owner(s) and employees: Coverage protects the business, its owners, and employees from liability claims related to business operations.

- Customers and visitors on business premises: This covers injuries or damages caused to customers or visitors due to business negligence.

- Products manufactured or sold by the business: Product liability coverage protects the business from claims arising from defective products causing harm.

- Advertising injury: This covers liability arising from false advertising or copyright infringement.

5. Professional Liability Insurance (Errors and Omissions Insurance): This specialized coverage is crucial for professionals like doctors, lawyers, and consultants, protecting them against claims of negligence or errors in their professional services.

Coverage Extends To:

- The professional and their business: The policy protects the professional against claims of negligence or errors related to their professional work.

- Clients affected by professional negligence: Claims arising from errors or omissions in professional services that cause harm or financial loss to clients are covered.

Factors Affecting Liability Coverage

Several factors can influence the scope of your liability insurance coverage:

- Policy exclusions: Policies often exclude certain types of activities or situations from coverage. Carefully review your policy's exclusions to understand what isn't covered.

- Policy limits: Liability insurance policies have limits on the amount of coverage provided. These limits can be per occurrence or per policy period.

- Deductibles: Before your insurance kicks in, you might have to pay a deductible.

- Endorsements: Endorsements are add-ons that can expand your coverage, such as adding an umbrella policy for higher liability limits.

Who is NOT Covered Under a Liability Insurance Policy?

It's equally important to understand who is not typically covered:

- Intentional acts: Most liability policies exclude coverage for intentional acts of harm or damage.

- Criminal acts: Liability insurance generally does not cover damages caused by criminal activity.

- Employees (in some cases): While business liability insurance covers employees in some instances, specific situations might not be covered. Workers' compensation insurance is generally required for employee injuries on the job.

- Individuals specifically excluded: Your policy might explicitly exclude certain individuals from coverage.

- Damage to the insured's property: Liability insurance usually covers damage to other people's property, not your own.

Maximizing Your Liability Insurance Coverage

To ensure you have adequate protection:

- Review your policy regularly: Understand your coverage, limits, and exclusions.

- Consider additional insured endorsements: If necessary, add other individuals or entities to your policy.

- Choose appropriate policy limits: Select limits that adequately protect your assets.

- Consult with an insurance professional: Discuss your specific needs and obtain expert advice.

Conclusion

Understanding who your liability insurance policy covers is critical for effective risk management. While the specifics vary depending on the type of policy and its terms, this guide provides a comprehensive overview of typical coverage and limitations. By carefully reviewing your policy and understanding the factors influencing coverage, you can ensure you have the appropriate protection against potential liability claims. Remember, consulting with an insurance professional is always advisable to tailor your coverage to your individual or business needs. Always prioritize thorough review of your policy documents and seek clarification when necessary to avoid any surprises or gaps in coverage. This proactive approach ensures you're well-protected and prepared for unforeseen circumstances.

Latest Posts

Latest Posts

-

Which Best Describes The Terrorist Planning Cycle

Mar 18, 2025

-

Cdl Combination Test Questions And Answers Pdf

Mar 18, 2025

-

Life Insurance Exam Questions And Answers Pdf

Mar 18, 2025

-

The Direct Carry Is Used To Transfer A Patient

Mar 18, 2025

-

The Emancipation Proclamation Of January 1 1863 Quizlet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Who Does A Liability Insurance Policy Cover Quizlet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.