A Policyowner's Rights Are Limited Under Which Beneficiary Designation

Breaking News Today

Mar 12, 2025 · 6 min read

Table of Contents

A Policyowner's Rights Are Limited Under Which Beneficiary Designation?

Choosing a beneficiary for your life insurance policy is a crucial decision. It dictates who receives the death benefit upon your passing. However, the level of control a policyowner retains over that death benefit significantly depends on the type of beneficiary designation chosen. While you have considerable flexibility in naming beneficiaries, understanding the implications of each designation is vital to ensure your wishes are carried out and to protect your assets. This article will delve into the limitations a policyowner faces under various beneficiary designations, highlighting the key distinctions and potential ramifications.

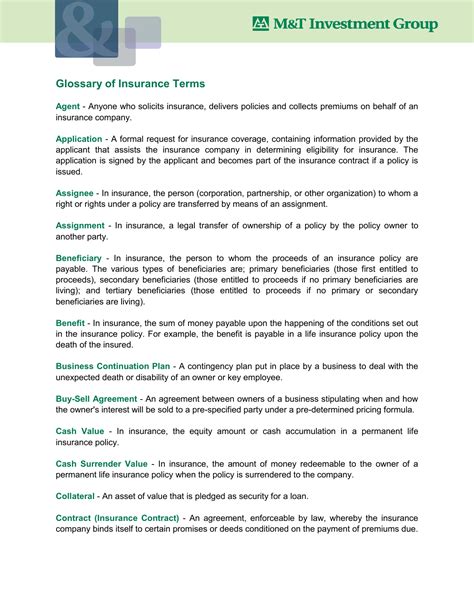

Understanding Beneficiary Designations

Before exploring the limitations, let's clarify the common types of beneficiary designations:

1. Primary Beneficiary:

This is the individual or entity who receives the death benefit first. You can name multiple primary beneficiaries, often specifying percentages for each. For instance, you might name your spouse as the primary beneficiary receiving 60% and your children as primary beneficiaries, each receiving 20%.

2. Contingent Beneficiary:

This is the individual or entity who receives the death benefit if the primary beneficiary predeceases the policyowner. This provides a backup plan to ensure the death benefit is distributed according to your wishes even if unforeseen circumstances arise. Similar to primary beneficiaries, multiple contingent beneficiaries can be named with specified percentages.

3. Revocable Beneficiary:

This designation grants the policyowner the right to change or remove the beneficiary at any time without the beneficiary's consent. This offers maximum flexibility, allowing adjustments based on changing life circumstances, such as marriage, divorce, or the birth of a child. This is the designation where a policyowner retains the most control.

4. Irrevocable Beneficiary:

This is where a policyowner's rights are most significantly limited. Once an irrevocable beneficiary is named, the policyowner generally cannot change or remove them without the beneficiary's written consent. This designation provides significant protection to the beneficiary, ensuring they receive the death benefit regardless of the policyowner's later wishes. This is the designation that dramatically reduces a policyowner's control.

Limitations on Policyowner Rights Under Irrevocable Beneficiary Designations

The core limitation under an irrevocable beneficiary designation is the loss of control over the death benefit. This has several significant implications:

1. Inability to Change or Remove the Beneficiary:

The most prominent limitation is the inability to alter the beneficiary designation without the irrevocable beneficiary's explicit agreement. This means even if the policyowner experiences a significant change in their life, such as a bitter divorce or estrangement from a child, they cannot unilaterally change the beneficiary. This restriction is designed to protect the named beneficiary's interest.

2. Restrictions on Policy Loans and Surrenders:

In many cases, naming an irrevocable beneficiary may restrict the policyowner's ability to take out policy loans or surrender the policy. Insurance companies often require the irrevocable beneficiary's consent before approving such actions, even if the policyowner seeks to use the funds for legitimate purposes. This is because the policy's value ultimately belongs to the beneficiary.

3. Impact on Estate Planning:

The death benefit from a policy with an irrevocable beneficiary is typically excluded from the policyowner's estate. This can have significant tax implications, potentially reducing estate taxes owed upon the policyowner's death. However, it also means the policyowner loses control over how this asset is distributed within their overall estate plan.

4. Limited Access to Policy Information:

While the policyowner remains responsible for paying premiums, they may face limitations in accessing certain policy information or making changes without the irrevocable beneficiary's involvement. This could lead to delays or complications, particularly in situations requiring quick action.

5. Potential for Disputes and Litigation:

The irrevocable nature of the designation can lead to conflicts and legal disputes, especially if the relationship between the policyowner and the beneficiary deteriorates. Disagreements over policy changes, loans, or surrenders can necessitate expensive legal proceedings to resolve.

Weighing the Pros and Cons of Irrevocable Beneficiary Designations

While the limitations are significant, irrevocable beneficiary designations offer compelling advantages, primarily for the beneficiary:

Advantages for the Beneficiary:

- Guaranteed Death Benefit: The death benefit is secure and protected from the policyowner's creditors or subsequent changes in their wishes.

- Financial Security: The beneficiary has a guaranteed source of income, offering significant peace of mind.

- Protection from Creditors: The death benefit is typically protected from the policyowner's creditors, even in bankruptcy situations.

Disadvantages for the Policyowner:

- Loss of Control: This is the primary drawback. The policyowner sacrifices considerable control over their assets.

- Potential for Complications: Managing the policy and making changes becomes more complex and may lead to disputes.

- Limited Access to Funds: The policyowner may lose access to funds through loans or surrenders.

Alternatives to Irrevocable Beneficiary Designations

For policyowners seeking a balance between beneficiary protection and retaining some control, several alternatives exist:

- Revocable Beneficiary with a Trust: Establishing a trust to hold the life insurance policy can offer flexibility while protecting the beneficiary's interests. The trust document dictates how the death benefit is distributed, providing a level of control for the policyowner while ensuring a secure outcome for the beneficiary.

- Carefully Chosen Revocable Beneficiary: Selecting a reliable and trustworthy individual or entity as the revocable beneficiary minimizes the risk of disputes and ensures that your wishes are likely to be respected.

- Regular Review of Beneficiaries: Periodically reviewing and updating your beneficiary designation ensures the policy reflects your current wishes and life circumstances.

Legal Considerations and Professional Advice

The legal implications surrounding beneficiary designations vary by jurisdiction. Consulting with an attorney experienced in estate planning and insurance law is crucial to ensure your chosen designation aligns with your wishes and legal requirements. An attorney can help you navigate the complexities of beneficiary designations, including tax implications and potential legal challenges.

Furthermore, consulting a financial advisor can provide valuable insights into the financial aspects of beneficiary designations and help you select the best option for your individual circumstances. They can analyze your financial situation, estate plan, and risk tolerance to recommend the most suitable strategy.

Conclusion: Informed Decision-Making is Key

Choosing a beneficiary designation is a critical component of estate planning. The level of control a policyowner retains is directly tied to the chosen designation. While irrevocable beneficiary designations provide maximum security for the beneficiary, they simultaneously limit the policyowner's control. Understanding these limitations is vital. Through careful consideration of your needs, goals, and relationships, along with professional legal and financial advice, you can make an informed decision that balances protection and control to achieve your desired outcomes. The key is to choose a designation that aligns with your personal circumstances and ensures the smooth and intended distribution of the death benefit. Remember, proactive planning and informed decisions minimize potential conflicts and protect your loved ones' financial future.

Latest Posts

Latest Posts

-

Every Transaction Requires At Least Accounts

Mar 13, 2025

-

A Full Stretching Session Should Take Between

Mar 13, 2025

-

One Advantage Of The Corporate Form Of Organization Is The

Mar 13, 2025

-

Which Business Opportunity Involves Recruiting Marketers To Join A Team

Mar 13, 2025

-

Which Statement About Reserved Powers Is Accurate

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about A Policyowner's Rights Are Limited Under Which Beneficiary Designation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.