Which Best Describes What A Subsidy Does

Breaking News Today

Mar 19, 2025 · 6 min read

Table of Contents

What Best Describes What a Subsidy Does? A Deep Dive into Government Support

Subsidies are a cornerstone of many government economic policies, impacting everything from food prices to renewable energy adoption. Understanding what a subsidy does, however, requires going beyond a simple definition. This comprehensive guide will delve into the multifaceted nature of subsidies, exploring their various forms, economic effects, both intended and unintended, and their ultimate impact on society.

Defining Subsidies: More Than Just a Handout

At its core, a subsidy is a form of government financial assistance provided to individuals or businesses to encourage specific economic activities or behaviors. This assistance can manifest in numerous ways, making a simple definition insufficient. It's not simply a "handout," as the intention often goes beyond mere charity. Instead, subsidies are strategic tools used to achieve specific policy objectives, aiming to stimulate economic growth, promote social welfare, or correct market failures.

Types of Subsidies: A Diverse Landscape

Subsidies come in many forms, each with its own mechanism and impact:

-

Direct Subsidies: These are the most straightforward form, involving direct cash payments or grants to individuals or businesses. Examples include farm subsidies providing direct payments to farmers, or grants for renewable energy projects.

-

Tax Breaks: These are indirect subsidies, reducing the tax burden on specific activities. Examples include tax credits for energy-efficient home improvements or tax deductions for charitable donations. These effectively lower the cost of the activity, incentivizing participation.

-

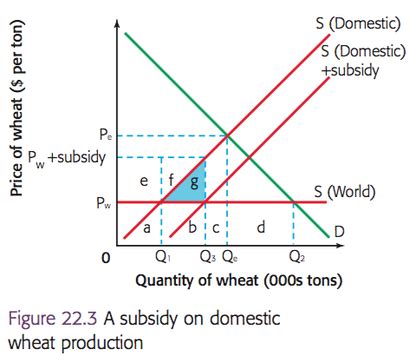

Price Supports: These involve government intervention to maintain prices above market equilibrium. This often occurs in agricultural markets where the government buys surplus production to keep prices artificially high for farmers.

-

Subsidized Loans: These offer loans at below-market interest rates, reducing borrowing costs for specific sectors or projects. This is commonly used to encourage investment in infrastructure or specific industries deemed important to the economy.

-

Government Procurement: This involves government agencies purchasing goods or services from specific businesses at prices higher than the market rate, providing a form of indirect subsidy. This is frequently used to support domestic industries or promote the use of domestically produced goods.

-

Indirect Subsidies: This is a broad category encompassing policies that indirectly lower the cost of an activity. For instance, government investment in infrastructure, like roads and railways, indirectly subsidizes businesses that rely on these systems. The reduced transportation costs constitute a hidden subsidy.

The Intended Effects of Subsidies: Achieving Policy Goals

Governments employ subsidies to achieve a range of policy objectives:

-

Correcting Market Failures: Subsidies can address situations where the free market fails to allocate resources efficiently. For example, external costs like pollution are often not factored into the market price of goods. Subsidizing cleaner technologies can incentivize their adoption and mitigate environmental damage.

-

Promoting Specific Industries: Subsidies can be crucial in nurturing nascent industries or safeguarding established ones deemed strategically important for national security or economic growth. This is particularly evident in industries like renewable energy, aerospace, and pharmaceuticals.

-

Supporting Vulnerable Populations: Subsidies can provide crucial support to low-income households or disadvantaged groups. Food subsidies and housing assistance programs are examples that directly address poverty and inequality.

-

Encouraging Innovation: Subsidies for research and development can stimulate innovation in various fields, ultimately leading to economic growth and technological advancements.

-

Improving Public Health: Subsidies can be used to promote healthier lifestyles by reducing the cost of healthy options, such as fresh produce or fitness programs.

-

Protecting the Environment: Subsidies play a crucial role in the transition to cleaner energy sources, reducing carbon emissions and mitigating climate change. Subsidies for electric vehicles and renewable energy infrastructure are prime examples.

The Unintended Consequences of Subsidies: The Hidden Costs

While subsidies can achieve positive outcomes, they also carry potential negative consequences:

-

Market Distortions: Subsidies can interfere with the efficient allocation of resources by artificially inflating demand or production in certain sectors. This can lead to misallocation of capital and hinder the growth of other, potentially more efficient, sectors.

-

Inefficiency: Subsidies can encourage inefficient production methods or practices, as businesses may not face the full cost of their operations. This can lead to resource waste and slower overall economic growth.

-

Moral Hazard: Subsidies can create a situation where businesses or individuals become overly reliant on government support, reducing their incentive to improve efficiency or innovate.

-

Rent-Seeking Behavior: Businesses may focus more on securing subsidies than on creating value, leading to lobbying and other unproductive activities.

-

Increased Government Debt: Subsidies can increase government spending and contribute to public debt, potentially crowding out other essential public services.

-

Trade Conflicts: Subsidies can lead to trade disputes as they can create an unfair advantage for domestic producers in international markets, prompting retaliatory measures from other countries.

-

Environmental Damage (despite intended benefits): While subsidies can be used to promote environmental protection, poorly designed subsidies might inadvertently lead to unintended environmental harm. For instance, subsidies for biofuels have sometimes led to deforestation and habitat loss.

Evaluating the Effectiveness of Subsidies: A Critical Perspective

Determining whether a subsidy is effective requires a thorough cost-benefit analysis, considering both its intended and unintended consequences. This necessitates:

-

Clear Objectives: Subsidies should be designed with clearly defined objectives and measurable outcomes.

-

Targeted Approach: Subsidies should be targeted to specific groups or activities to maximize their impact and minimize unintended consequences. Broad, untargeted subsidies are often inefficient and prone to waste.

-

Transparency and Accountability: The process of allocating subsidies should be transparent and accountable to ensure that funds are used efficiently and effectively.

-

Regular Evaluation: The effectiveness of subsidies should be regularly evaluated to assess their impact and make necessary adjustments.

-

Phased Rollout: Instead of immediate, large-scale implementation, phased rollouts allow for evaluation and adaptation, reducing risks associated with massive, untested policies.

-

Consideration of Alternatives: Before implementing a subsidy, exploring alternative policy mechanisms, such as tax reforms or regulatory changes, should be a priority. Sometimes, a more direct and less costly approach can achieve the same goals.

Conclusion: Subsidies - A Powerful Tool, But Requiring Careful Management

Subsidies are a powerful tool for governments to achieve a wide range of economic and social objectives. However, they are not a panacea and must be designed and implemented carefully. Understanding their various forms, potential impacts, both positive and negative, and rigorously evaluating their effectiveness is crucial for ensuring that they contribute to overall economic welfare and social progress. The key is not to eliminate subsidies entirely, but rather to use them strategically, transparently, and with a constant eye toward improving efficiency and minimizing unintended consequences. This requires a nuanced approach that considers not just the immediate benefits but also the long-term implications for the economy and society as a whole. Only then can subsidies truly serve their intended purpose and contribute to a more prosperous and equitable future.

Latest Posts

Latest Posts

-

According To The Exercise Principle Of Balance A Workout Should

Mar 20, 2025

-

Are Engaging In Small Talk And Looking For Things

Mar 20, 2025

-

3 03 Quiz Health And Life Insurance 3

Mar 20, 2025

-

The Aztecs Controlled The Most Powerful Empire In

Mar 20, 2025

-

Using The Formula You Obtained In B 11

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Which Best Describes What A Subsidy Does . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.