Mrs Shields Is Covered By Original Medicare

Breaking News Today

Mar 16, 2025 · 7 min read

Table of Contents

Mrs. Shields Is Covered by Original Medicare: A Comprehensive Guide

Understanding Medicare can be a daunting task, especially when navigating the different parts and their coverage. This article will delve into the specifics of Original Medicare, focusing on Mrs. Shields' situation and exploring what her coverage encompasses. We will clarify common misconceptions and provide practical information to empower individuals like Mrs. Shields to confidently manage their healthcare.

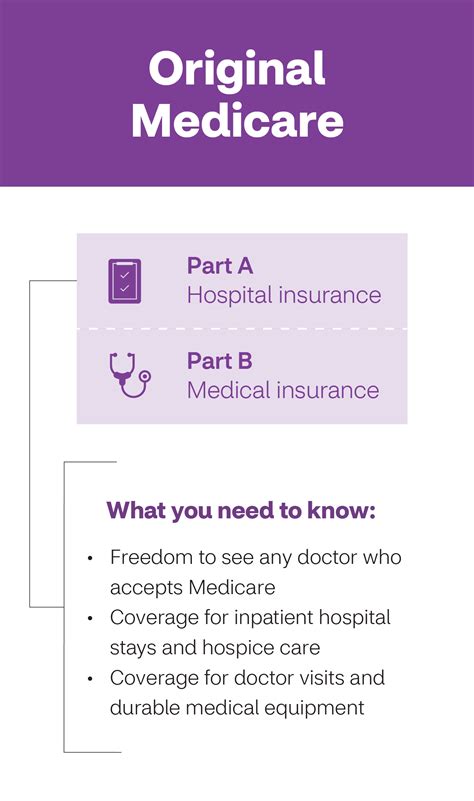

What is Original Medicare?

Original Medicare, also known as traditional Medicare, consists of Part A (Hospital Insurance) and Part B (Medical Insurance). It's a fee-for-service program, meaning you pay for each service you receive, subject to Medicare's payment rules and your cost-sharing responsibilities. Let's break down each part:

Part A: Hospital Insurance

Part A primarily covers inpatient hospital care, skilled nursing facility care, hospice care, and some types of home healthcare. For many, Part A is premium-free because they or a spouse have paid Medicare taxes while working. However, there may be deductibles and coinsurance amounts to pay for each benefit period. These costs can be substantial, underscoring the importance of understanding your coverage. For Mrs. Shields, understanding her Part A coverage means knowing exactly what costs she'll be responsible for in the event of hospitalization or related care. This includes knowing the deductible amount for a hospital stay, as well as any potential coinsurance payments.

Key Considerations for Part A:

- Deductible: This is the amount Mrs. Shields must pay out-of-pocket before Medicare begins to pay for hospital services.

- Coinsurance: After the deductible is met, Part A requires Mrs. Shields to pay a percentage of the cost of her hospital stay. The percentage and duration vary depending on the length of the stay.

- Benefit Period: A benefit period starts the day Mrs. Shields is admitted to a hospital and ends when she hasn't been in a hospital or skilled nursing facility for 60 consecutive days.

- Skilled Nursing Facility Care: Part A also helps cover a portion of the cost for skilled nursing facility care, but it's important to meet specific requirements such as needing skilled care and being admitted to the facility within a short time frame after a hospital stay.

Part B: Medical Insurance

Part B covers a wider range of services than Part A, including doctor visits, outpatient care, some preventive services, and medical equipment. However, Part B requires a monthly premium, the amount of which depends on Mrs. Shields' income. Higher income individuals pay higher premiums.

Key Considerations for Part B:

- Premium: Mrs. Shields will pay a monthly premium for Part B coverage. The premium amount is determined by her income and is adjusted annually.

- Annual Deductible: Similar to Part A, Part B also has an annual deductible that Mrs. Shields must pay before Medicare begins to cover the cost of her services.

- Coinsurance: After the deductible, Mrs. Shields will usually pay a percentage of the cost of her services. This percentage varies depending on the service.

- Preventive Services: Part B provides coverage for many preventive services like annual wellness visits, mammograms, and colonoscopies. This is a crucial aspect of maintaining good health and preventing future complications.

What Mrs. Shields Needs to Know About Her Coverage

Knowing she's covered by Original Medicare is only the first step. To effectively manage her healthcare, Mrs. Shields needs a thorough understanding of:

1. Her Specific Coverage Details

Mrs. Shields should obtain her Medicare Summary Notice (MSN) regularly. This document provides a detailed breakdown of her claims, payments, and remaining costs. By carefully reviewing her MSN, she can track her spending, identify any discrepancies, and proactively address any potential issues.

2. Cost-Sharing Responsibilities

Understanding her deductibles, coinsurance, and copayments is crucial for budget planning. This information is readily available on her Medicare Summary Notice and also through her Medicare card. Failing to account for these cost-sharing responsibilities can lead to unexpected medical bills.

3. Medicare Supplement Insurance (Medigap)

Mrs. Shields might consider purchasing a Medigap policy. Medigap policies help cover some of the cost-sharing expenses associated with Original Medicare. This can significantly reduce the out-of-pocket expenses she may face. Different Medigap plans offer various levels of coverage, making it crucial to carefully compare plans and choose one that aligns with her needs and budget.

4. Prescription Drug Coverage

Original Medicare doesn't directly cover prescription drugs. Mrs. Shields will need to enroll in a separate Part D plan to get prescription drug coverage. Delaying enrollment in Part D can result in a penalty on her premiums later. Selecting a Part D plan requires comparing various plans and choosing one that fits her medications and budget.

5. Choosing Doctors and Hospitals

Mrs. Shields isn't limited to specific doctors or hospitals with Original Medicare. She can choose from any doctor or hospital that accepts Medicare assignment. However, verifying acceptance is crucial before receiving care to avoid unexpected billing complications.

6. Appealing a Medicare Decision

If Mrs. Shields disagrees with a Medicare decision regarding her coverage or payment, she has the right to appeal. The Medicare appeals process allows her to challenge the decision and potentially receive a different outcome. Understanding the appeal process is essential for protecting her rights.

Addressing Common Misconceptions About Original Medicare

Several misconceptions surround Original Medicare. Understanding and dispelling these misconceptions is vital for making informed healthcare decisions.

Misconception 1: Original Medicare Covers Everything

Reality: Original Medicare has gaps in coverage. While it covers a broad range of services, it doesn't cover everything. It has deductibles, coinsurance, and copayments, and it doesn't cover certain services, such as vision, hearing, and dental care. This is where Medigap and other supplemental insurance options can become helpful.

Misconception 2: Original Medicare is Too Expensive

Reality: The cost of Original Medicare can vary. Part A is often premium-free, but Part B requires a monthly premium, which is income-based. Additionally, the out-of-pocket costs for deductibles, coinsurance, and copayments can be significant. However, the affordability can be managed through careful budgeting, Medigap plans, and potentially qualifying for financial assistance programs.

Misconception 3: Original Medicare is Only for the Elderly

Reality: While Original Medicare is often associated with the elderly, it's also available to younger individuals who qualify for Social Security Disability Insurance (SSDI) or who have End-Stage Renal Disease (ESRD). These individuals can access Medicare benefits even before reaching traditional retirement age.

Misconception 4: Once Enrolled, Coverage is Automatic

Reality: Medicare enrollment requires active participation. While initial enrollment can be automatic for those who are eligible for Social Security retirement benefits, specific actions, like enrolling in Part B and Part D, need to be taken at the appropriate times. Missing these deadlines can result in penalties and delayed coverage.

Proactive Steps for Mrs. Shields

To ensure a smooth experience with Original Medicare, Mrs. Shields should take the following steps:

- Review her Medicare card and Summary Notices: This is crucial to understanding her specific coverage details and tracking her expenses.

- Consult with a Medicare advisor: A Medicare advisor can provide personalized guidance based on her specific needs and circumstances.

- Explore Medigap and Part D options: Evaluating Medigap and Part D plans can help reduce her out-of-pocket expenses and provide comprehensive coverage.

- Maintain accurate records: Keeping records of her medical expenses and interactions with Medicare is essential for resolving any discrepancies or disputes.

- Understand her rights and appeal processes: Knowing her rights and the appeal processes will empower her to advocate for herself in case of disputes or coverage denials.

Conclusion

Navigating Original Medicare can be challenging, but understanding its nuances is crucial for accessing appropriate healthcare. This comprehensive guide provides a detailed overview of Original Medicare, focusing on Mrs. Shields' situation and highlighting key aspects of her coverage. By actively managing her coverage and understanding her cost-sharing responsibilities, Mrs. Shields can ensure she receives the care she needs while minimizing financial burdens. Remember, staying informed and proactive is key to a positive Medicare experience. Seeking guidance from a Medicare advisor or reviewing the official Medicare website can offer further support and clarity.

Latest Posts

Latest Posts

-

The Revenue Recognition Principle States That Revenue

Mar 16, 2025

-

The Cognitive Behavioral Approach To Therapy Stresses

Mar 16, 2025

-

Letrs Unit 5 Session 5 Check For Understanding

Mar 16, 2025

-

This Figure Depicts The Basic Anatomy Of The

Mar 16, 2025

-

Which Is A Stroke Severity Tool That Helps Ems

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about Mrs Shields Is Covered By Original Medicare . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.